The Tamil Nadu Authority for Advance Rulings (AAR) ruled that the Goods and Services Tax (GST) is not subjected to tax on the sale of goods warehoused in third-party Free Trade Warehousing Zone (FTWZ) on an “as is where is” basis to customers who clear the same to a bonded warehouse under the Merchandise Warehouse and Withdrawal for Re-export (MOOWR) Scheme.

A company M/s. Sunwoda Electronic India (P) Ltd is importing and trading Portable Lithium System Batteries and has entered into a contract with an Original Equipment Manufacturer (OEM) to supply these batteries.

From abroad the goods were imported and stored in a third-party FTWZ in India before being sold to the OEM’s MOOWR unit located within a separate FTWZ. The OEM’s MOOWR unit clears the goods under bond on the grounds of requirement. The applicant asked for an advance ruling on the GST obligation of this sale.

Sahana and Pavan Varshiney represented the petitioner who claimed that their sale was waived from GST because of the provisions in Schedule III of the CGST Act. They asserted the transaction fell under Para 7, which waives supplies from a non-taxable territory, as an FTWZ is considered outside the customs territory under the Special Economic Zone (SEZ) Act.

They claimed that Para 8(a) of Schedule III, waiving “supply of warehoused goods before clearance for home consumption,” applied since the goods were ultimately re-exported under MOOWR.

The AAR marked that “the instant case of the applicant, where the imported goods stored in a third-party FTWZ warehouse, is being moved to the Bonded Warehouse (MOOWR) on effecting a sale to an OEM’s MOOWR unit, taxes under GST are not leviable, as the transaction gets covered under clause 8(a) of the Schedule III of the CGST Act, 2017, which reads as “Supply of warehoused goods to any person before clearance for home consumption”.

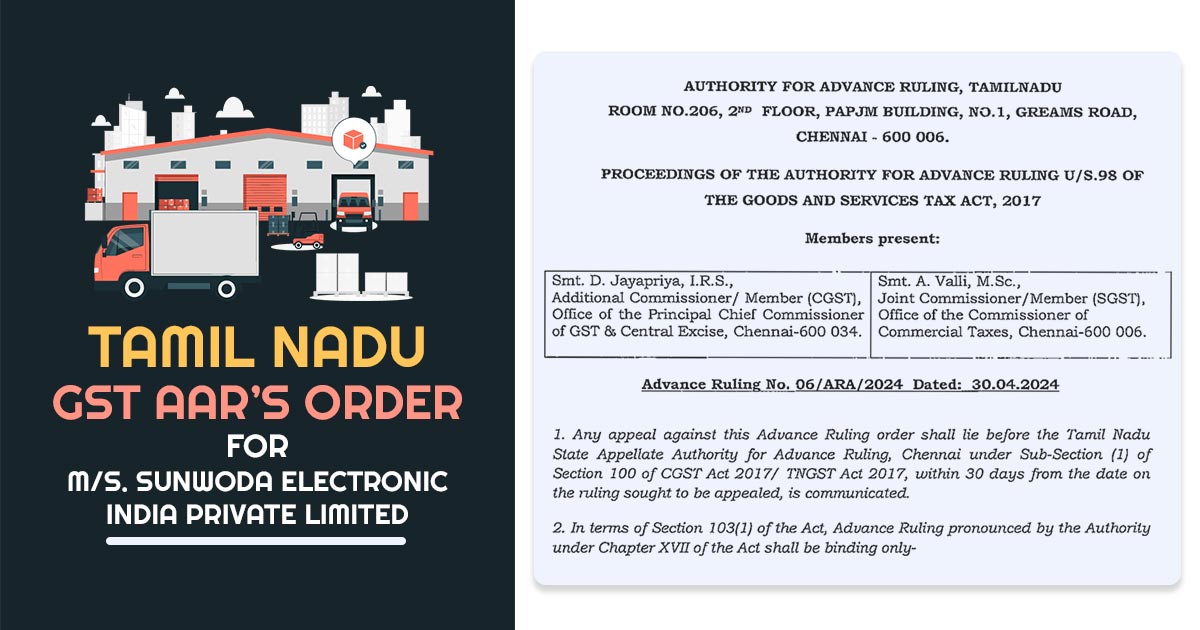

The bench, D. Jayapriya, and A. Valli held that GST is not imposed as a tax on the sale of goods warehoused in a third-party FTWZ on an ‘as is where is’ basis to customers who clear it to a bonded warehouse under the MOOWR Scheme.

| Applicant Name | M/s. Sunwoda Electronic India Private Limited |

| GSTIN Number | 33AAXCS8681F1ZN |

| Date | 30.04.2024 |

| Tamil Nadu AAR | Read Order |