An excise or excise duty is the indirect tax, which is paid on the sale of a particular good. The reason behind why they are called indirect tax because the government does not apply the tax straight forward. There is an intermediary, which is either the merchant or the producer who pays the tax to the government. Prices for the goods, which the buyer pays to the merchant will then be increased up to recover the tax. To complete the process, a manufacturer has to file the excise duty return. As per a new approach, he can file the return online. The process is termed as E-filing of Excise Tax Returns. In our country, the government has made an automation of central excise and service tax (ACES). It gives the producer an ease to pay their tax online.

Before filing the form, go through the various returns under the excise control. They will give you the idea about the types of forms of returns.

Excise e filing Procedure

There are two simple steps via, which the assessees can file the statutory returns of central excise online.

Step 1: The Registration Process

For filing your excise return electronically, the first and the foremost thing you have to do is to get registered with ACES. ACES stands for automation of central excise and service tax. Central Board of Excise and Custom (CBEC) is the central national agency, which is responsible for administering customs, central excise, service tax and narcotics in India. When visiting the ACES website, you will find a central excise button on the top. If you are a new user, then click this button and fill the form to get the user name and password. You will get the same on your email id. When completing the registration process, you can login and fill the A-1, A-2, A-3, non assessee and non declaration form.

After that, you will get your registration approved by the commissioner when receiving a Registration Letter (RC) just like any vehicle’s RC. The process takes at least 15 days of time and within the same period you will receive it on your mail as well as on your mentioned address via post. There will be a 15-digit RC number in which the first 10 digits are of your PAN card number, 11-12 digits will contain excise manufacture number and the rest ones are system generated alphanumeric characters.

Step 2: Online Filing of the Form

Filling the excise returns form is pretty much easy when you complete your registration process and approve it. You have to login your ACES account with the user name and password you were provided with while performing step 1. Choose RET instead of REG, which you can see in the main menu. All the details will be available on the form. You just have to fill it properly and submit it. This will be your paid excise duty challan and you are done with your e-filing of excise tax.

Benefits of e filing of Excise

- Physical interaction with department will be minimized.

- No paperwork.

- Saves time.

- E-filing of excise returns.

- E-filing of all documents like registration applications, online returns and offline versions of ER1 to ER8.

- E-filing of claims, permissions and intimations.

- View, file and track status of your online filed documents.

- Immediate E-acknowledgement of documents via unique identification number.

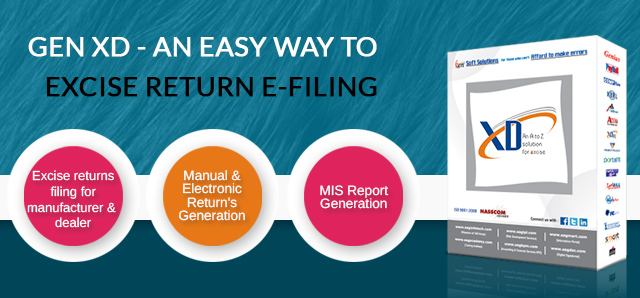

Software for Filing Excisse Return Online for Dealers and Manufacturers – GEN XD

it’s helpfull.