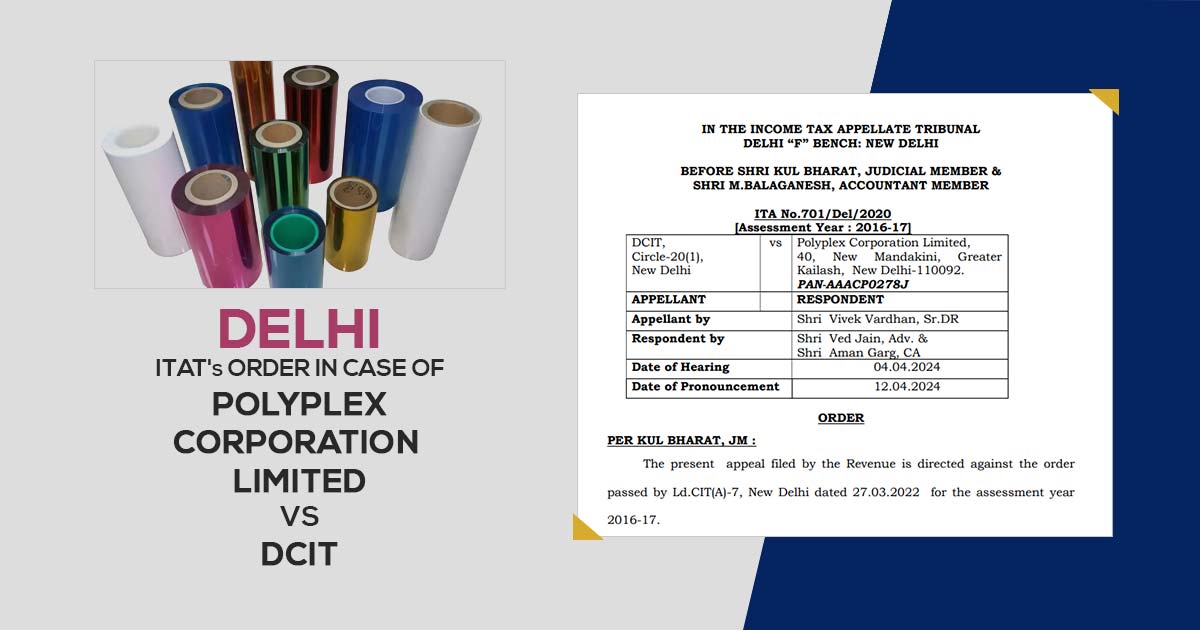

The Delhi Bench of Income Tax Appellate Tribunal (ITAT) comprising of M. Balaganesh (Accountant Member) and Anubhav Sharma (Judicial Member) has ruled that the payments made to doctors shall be covered by TDS provisions under Section 194J and not Section 192 of the Income Tax Act. Section 194J of the Income Tax Act is pertinent […]