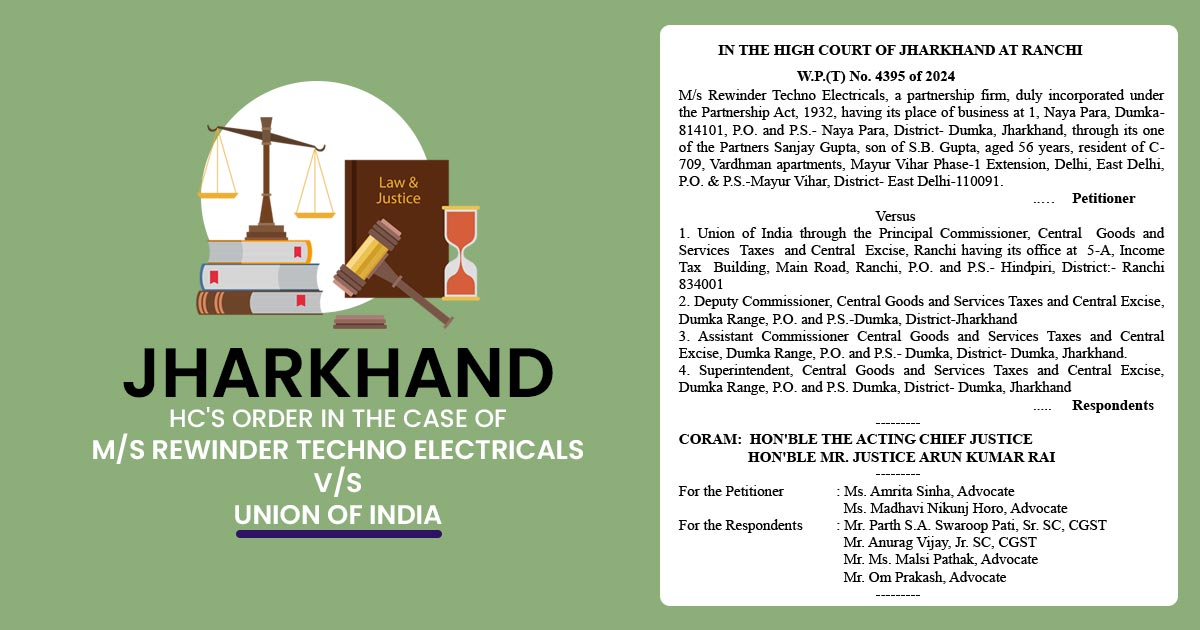

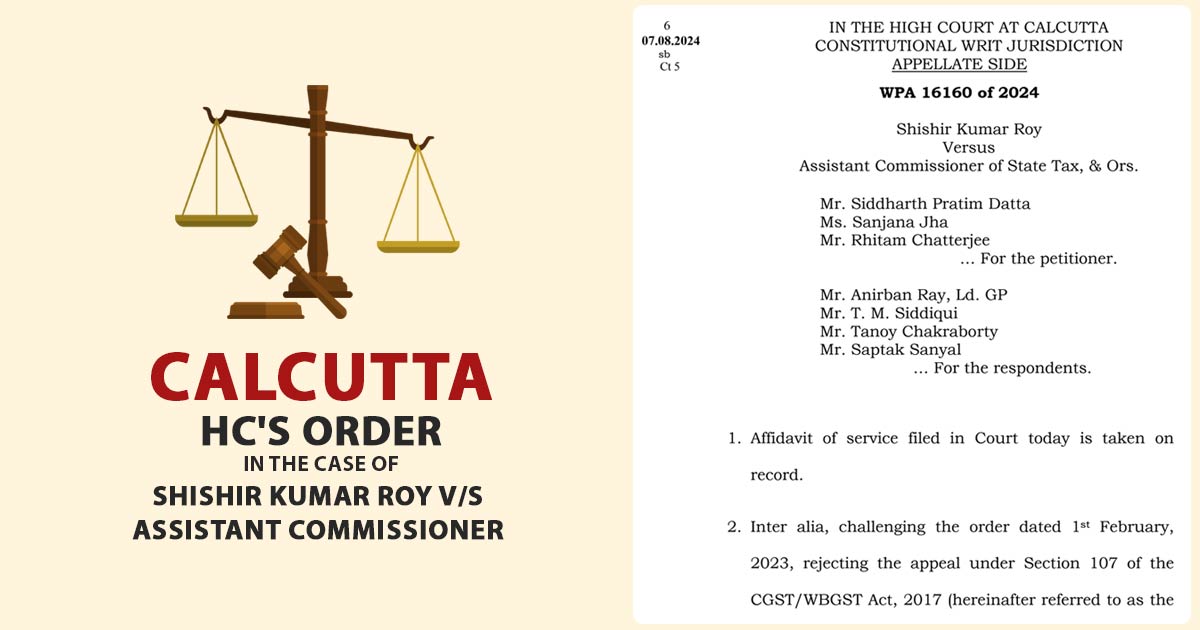

Various laws such as Cheque payment, LPG Cylinder prices, GST to UPI Transaction payment which will produce an effect on the common people will be going to get modified from January 1. Small Businesses GST-Registered The trades of Rs 5 cr turnover will need to furnish the returns for only 4 GST sales or GSTR-3B […]