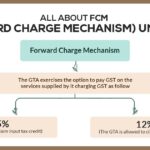

The Ministry of Finance has been approached by the Real estate developers for the subject of the impact of GST charged on the rehabilitation apartments that has developed and given back, at no cost, to existing occupants under the portion of redevelopment projects. The Confederation of Real Estate Developers’ Association of India (CREDAI) – MCHI, […]