GSTR 2 is a tax return form that is used for filing the details of inward supplies of goods or services for taxation purpose. The form will be filled online on the GST portal after registration

Powerd By SAG INFOTECH

Notifications can be turned of anytime from browser settings

GSTR 2 is a tax return form that is used for filing the details of inward supplies of goods or services for taxation purpose. The form will be filled online on the GST portal after registration

The GST Council has released GST return forms which are duly filled up every month for the return purpose. Along the 11 return forms, there are three forms which are considered to be significant and are to be filled up every month regularly. However, the forms are equal to everyone and include all the traders and merchants alike.

If you aren’t getting your company-branded writing pads or pens, blame those shortage on the Goods and Services Tax (GST). For tax advisers also in-house finance teams, managing vendors that supply pens, writing pads, pencils, staplers, and printing paper-rolls has turned out to be a major challenge after the implementation of the single producer levy.

The new GST tax regime has also not exempted the individuals, software professionals and the freelancers, who dealt in exporting services and softwares. Under GST law, every individual involved in supplying any goods and service outside the country, is mandate to register self for GSTIN.

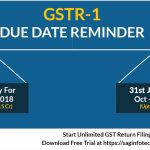

The GSTR 3B form is a return form declared by the Indian government for the return filing only for initial 6 months of GST implementation. The GSTR 3B form will be filled up for the month of July to December 2017 in the place of normal return forms – GSTR 1, 2 and 3

Food Chain Companies such as Dominos and Pizza Hut who offer freebies to consumers will suffer huge losses due to the implementation of GST as they are required to pay taxes on free items as well. Packaged products and food service provider companies have stopped their ‘buy-one-get-one-free offers’ immediately after the implementation of Goods and Services Tax (GST) from 1st July.

Now the business entities can upload their daily invoice details or account statement including sale and purchase of goods and services at the portal, as GSTN portal has started uploading invoice details.

Delhi University is set to implement the concept of Goods and Services Tax (GST) in the syllabus of all commerce programs. Students who are pursuing commerce degree programs from the Delhi University will now have to learn the concepts of GST similar like Debit and Credit. The commerce students will have to study the GST related topics in their respective programs.

According to the new notification issued by the government, now, retailers and manufacturers can sell their old inventory as per the new GST prices till September. But several industries, companies, and businesses are upset with this announcement as to why the government has not issued this notification earlier.