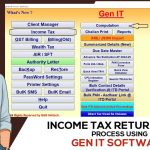

An income tax return is a document submitted by individuals or companies to declare their income, including salary, HRA, allowances, deductions, and total turnover, to the Tax Department. There are seven different types of tax return forms available on the portal, each applicable based on the taxpayer’s category. Taxpayers can use either the government utility […]