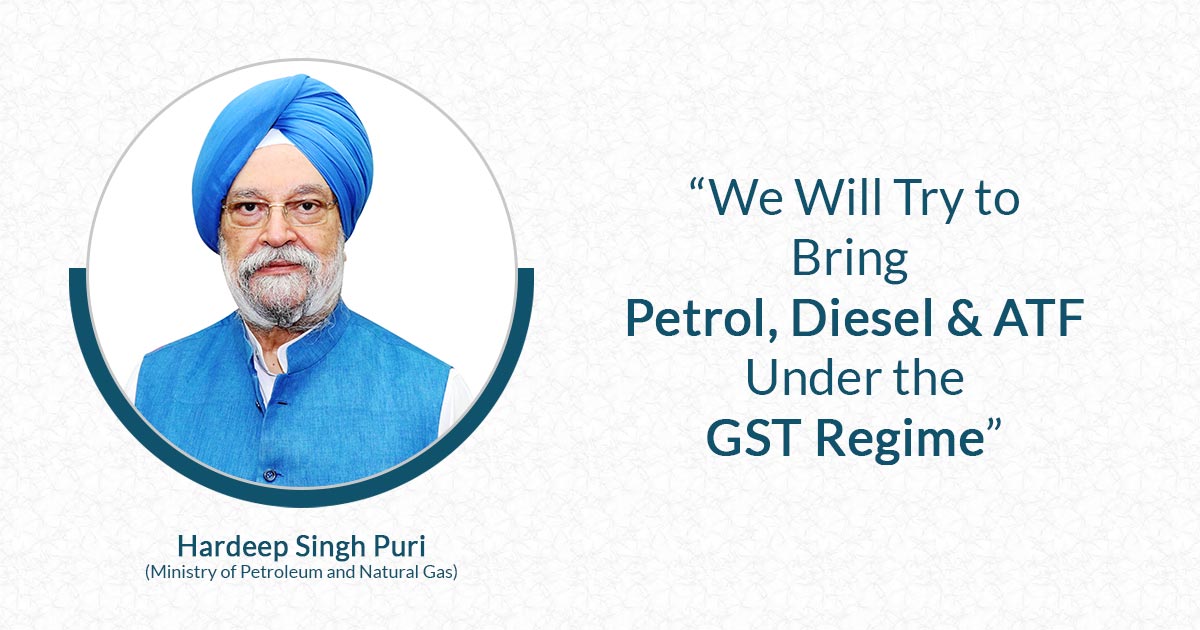

The Ministry of Petroleum and Natural Gas (MoPNG) will work on bringing petrol, diesel, and ATF under the goods and services tax (GST), Oil Minister Hardeep Singh Puri cited.

Questioned regarding charging GST on these fuels, Puri stated, “We will try. The Minister of State (Suressh Gopi) and I will both work on it.”

The MoPNG to impose a GST on petrol, diesel, and aviation turbine fuel (ATF), needs to suggest the Finance Ministry which in turn will present it in the meeting of the GST council.

Currently, crude oil, petrol (MS), diesel (HSD), ATF, and natural gas are part of GST. The GST Council under Subsection 5 of Section 12 of the 101st Constitutional Amendment Act, shall recommend the date on which the tax needs to be charged on such products. It needs to be decided by the GST council which date it wishes to impose the same.

Currently, the Centre imposes excise duty on auto fuels, while the States levy value-added tax (VAT) and sales tax.

Imposing GST on the two auto fuels and crude oil has been a demand for a longer time since the same shall draw down their costs, providing an advantage to the common man. Every political party has advocated for the identical thing at some point.

Read Also: GST Impact on Oil and Gas Sector in India

No attainment of the consensus at the same point is there at the GST council. This is because the Centre and States will take a hit concerning the tax revenue.

In FY24 (provisional), the total contribution of the petroleum sector to the government exchequer stood at around ₹7.51-lakh crore, of which the centre’s share was ₹4.32-lakh crore and the State’s at ₹3.18-lakh crore. In FY23, the contribution stood at around ₹7.48-lakh crore, with the Centre getting ₹4.28-lakh crore and States receiving ₹3.20-lakh crore.

The other problem is that the highest tax rate under GST could be 50% along with cess. But the tax rate on petrol and diesel is more than 60%. Currently, the present tax rate on diesel is 50.76%. The same is computed by taking the base cost in Delhi as of March 16, 2024, which is the revision deadline. The tax on petrol or motor spirit was 63.4% as of March 16.

The same is against the principle of revenue neutral rate (RNR).

OMC Disinvestment

The government shall not divest its stake in oil marketing companies (OMCs), the Oil Minister quoted. After the government scrapped the divestment of Bharat Petroleum Corporation (BPCL) in early June 2022, the same has arrived.

On the question of crude oil supply deals with Russia for the long term, Puri added that the Ministry had conversations on long-term deals and is sure that both private and public sector companies will have long-term deals if they discover them economically feasible.