The applications for condonation of delay should have been regarded without being too hyper-technical and in a judicious manner, ruled by the Kerala High Court.

It was noted by the bench of Justice Gopinath P. that the delay in audit report filing in Form-10B can be 30 days, as the law merely needs that the audit report be uploaded at least a month before the deadline for filing the returns. under Section 119(2)(b) of the Income Tax Act, 1961, the Commissioner exercised his jurisdiction to condone the delay rather than taking a stringent view of the case.

U/s 12A of the Income Tax Act, 1961 the applicants and taxpayers are entities registered. For the AY 2022-23, the applicants were needed to furnish their returns by October 31, 2022, and hence the audit report in Form-10B would required to be filed on or before September 30, 2022. The filing return deadline for the AY 2022-23 was extended by the Central Board of Direct Taxes for 7 days consequently the due date to file the return for that year is November 7, 2022. Hence the due date to file the audit report in Form-10B was October 7, 2022.

The applicant does not file any audit report in Form-10B within the said time. But they filed the same on or before the filing date of the return for the AY 2022-23, which was shown, November 7, 2022. Hence the applicant filled the separate applications to the Commissioner of Income Tax (Exemption) u/s 119(2)(b), praying that the delay in filing the audit report in Form-10B be extended. The applications for condonation of delay have been rejected by the Commissioner.

The Commissioner has considered the applications for condonation of delay in a highly mechanical manner the petitioners argued. The delay was 30 days or less in each of these cases; the Commissioner ought not to have taken a stringent view and needed to have condoned the delay in filing the audit report, specifically acknowledging the fact that the income tax return (ITR) was filed within the deadline.

It was argued by the department that they were not able to keep the audit report for specific technical glitches, which could not be precise, since the audit report was made later than the date on which these issues were notified. The audit report filing was obligatory and the commissioner has regarded the contentions opted before him as condoning the delay and arrived at the conclusion that no reason to exercise the jurisdiction u/s 119(2)(b) to condone the delay in filing the audit report.

Read Also: Kerala HC Orders ITAT to Review an Appeal, Even Though It was Filed After the Deadline

While permitting the petition the court ruled that the taxpayer a public charitable trust that fulfils the condition to claim these exemptions must not refuse only on the bar of limitation, particularly when the legislature has conferred wide discretionary powers to condone the delay on the authorities.

The orders of the Commissioner of Income Tax (Exemptions), Kochi have been quashed by the court dismissing the application that the applicants have filed u/s 119(2)(b) of the Income Tax Act.

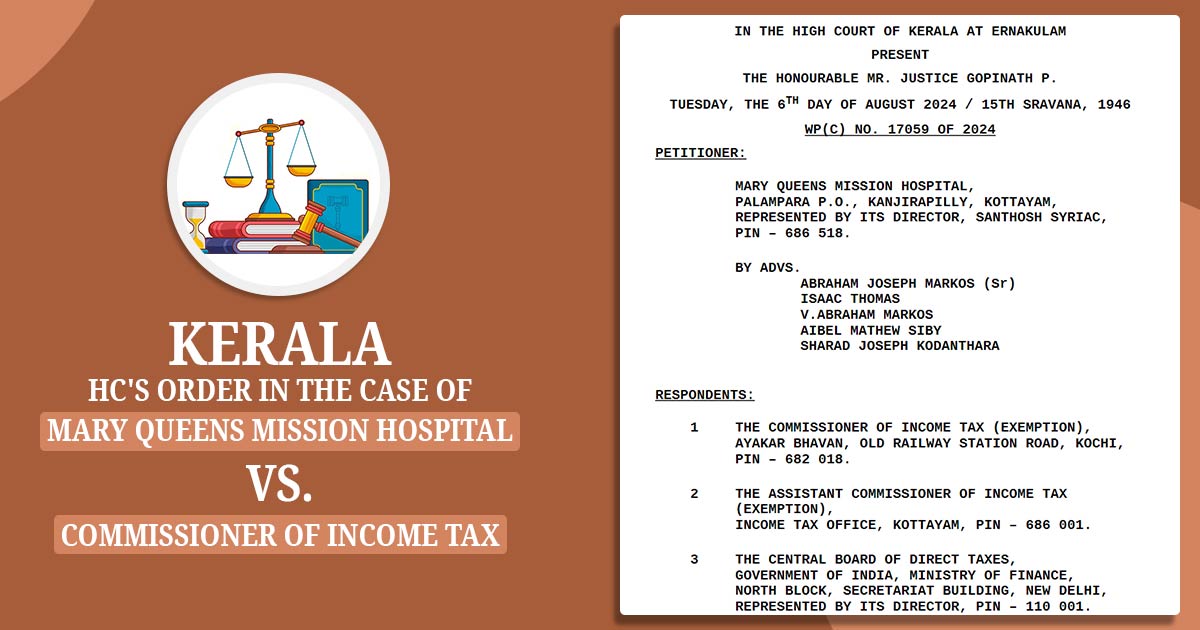

| Case Title | Mary Queens Mission Hospital Vs. The Commissioner Of Income Tax |

| Citation | WP(C) NO. 17059 OF 2024 |

| Date | 06.08.2024 |

| Counsel For Petitioner | Joseph Markos |

| Counsel For Respondent | Jose Joseph |

| Kerala High Court | Read Order |