The Kerala High Court mentioned that the Joint Commissioner has jurisdiction to initiate proceedings u/s 56 of the KVAT Act against the assessment order passed under remand.

The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. noted that “when the fresh assessment order was passed consequence to the remand, the original assessment order ceased to exist in law and thereafter the only assessment order that survived for the purposes of the exercise of the power of revisions under Section 56 was the subsequent order passed by the Assessing Authority.”

In this case, the applicant is in the manufacture of unbranded food products. Under Section 67 of the Kerala Value Added Tax Act, 2003 a penalty was levied on the taxpayer.

The taxpayer contested the said order of penalty by filing a plea before the First Appellate Authority which modified the penalty. Therefore, a consequential order was passed via the Assessing Authority diminishing the penalty by an order.

The taxpayer dissatisfied with the assessment order has preferred a plea before the first appellate authority, who vide his order permitted the plea by setting aside the assessment order and asking the assessing authority to pass a fresh order.

Under the remand by the first appellate authority, a fresh assessment order was passed via the Assessing Authority lessening the tax liability of the taxpayer for the stated assessment year.

Discovering the fresh assessment order to be incorrect and prejudicial to the interest of the Revenue, the Joint Commissioner furnished a notice u/s 56(1) of the KVAT Act to the taxpayer asking him to show cause as to why the order of the Assessing Authority should not be revised.

Further Joint Commissioner passed an order validating the proposals in the notice issued to the taxpayer and enhancing the tax demand.

The taxpayer furnished that it was not open to the Joint Commissioner to begin the proceedings u/s 56 concerning the assessment order passed via the assessing authority as per the remand via the First Appellate Authority, without separately impugning the First Appellate Authority’s order that remanded the case to the Assessing Authority.

From the contention for the absence of jurisdiction in the Joint Commissioner to initiate proceedings u/s 56 against the assessment order that was passed under the remand, the bench did not agree.

The bench noted that no finding was there in the order of the first appellate authority that consequence in a continued validity of the original order of assessment, as the Assessing Authority was directed by the First Appellate Authority to pass a fresh order of assessment, the bench mentioned.

The bench in the aforesaid view has dismissed the plea.

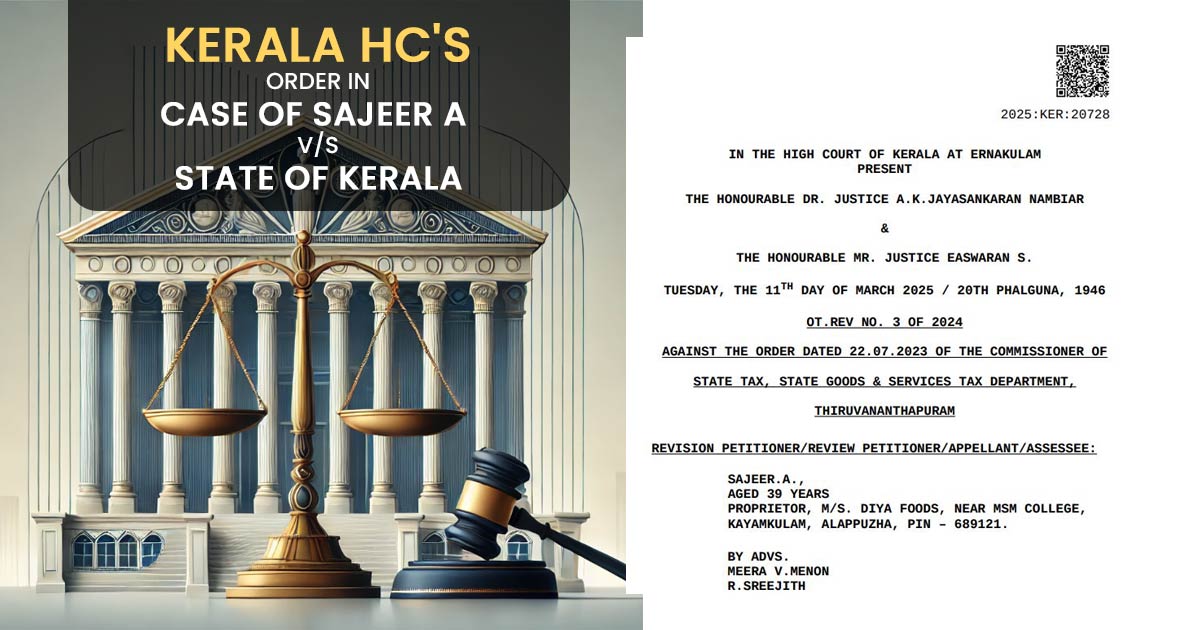

| Case Title | Sajeer A vs. State of Kerala |

| Date | 11.03.2025 |

| Counsel For Appellant | M/S. Diya Foods, near Msm College |

| Counsel For Respondent | SR GP VK Shamsudheen |

| Kerala High Court | Read Order |