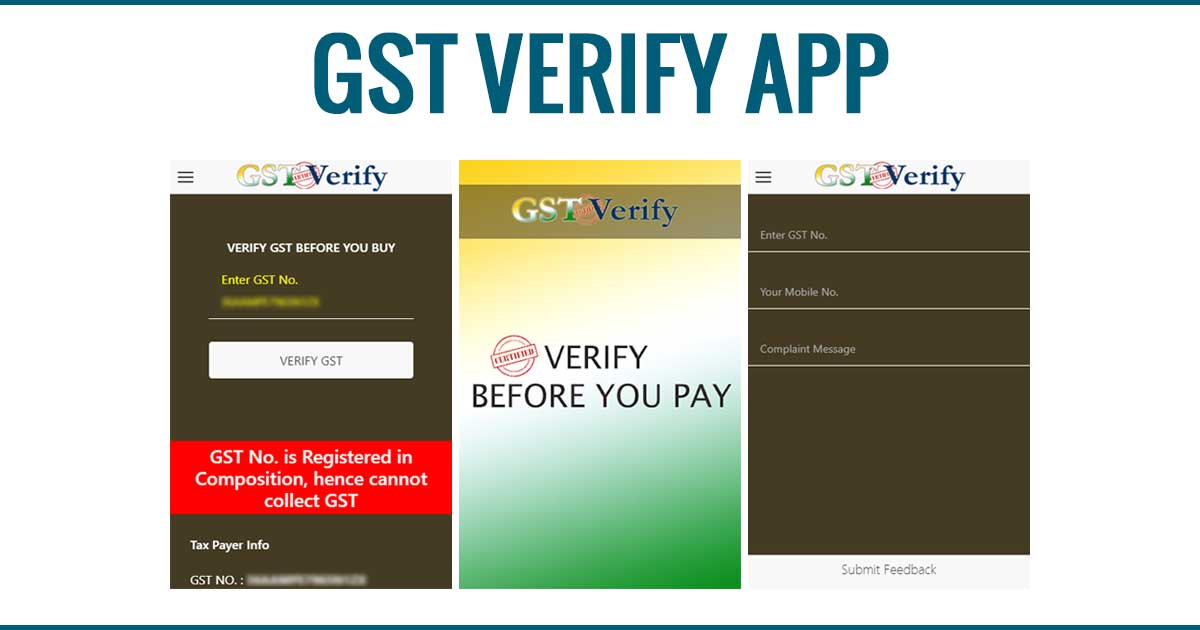

In a bid to secure the consumer interest as well as their hard earned money, B Raghu Kiran joint commissioner GST Hyderabad introduced a much-anticipated app called ‘GST Verify‘.

The app is now available on Android Play Store with the facility to cross-check whether the dealer or retailers are eligible to take GST from the customers or not.

The Central Board of Indirect Taxes and Customs (CBIC) came forward in developing this app which will further safeguard the interest of customers across India.

The app will also provide details of the retailer or company which is collecting GST on behalf of the government from the customers. The GST Verify app will also check whether the dealer or retailer is under the composition scheme or not.

The reason to check the following is that the composition scheme dealer can not collect taxes and if in case he does so, he is taking the taxes illegally.

According to an official statement “Every time you shop/eat/buy check the bill if there is any GST amount mentioned, if yes verify through this app if she/he is genuinely registered person or not, thereby you save the amount shown as tax from the fraudster if he is cheating you.”

Recommended: How to Check Genuine GST Bill Online Given by Seller?