The Delhi High Court asked the appropriate officer to expedite the refund process for a petitioner who asked the Court to direct the refund of a sum of Rs.81,79,52 u/s 54 of the Central Goods and Services Act,2017.

The applicant, AJ Flight Reservations Pvt. Ltd., represented by Advocate Vineet Bhatia, had filed a refund claim dated January 31st, 2024 but no deficiency memo was issued as of May 8th, 2024.

Provided that the legal duration of 60 days was elapsed by not processing the refund claim, The court asked for the proper officer to process and dispose of the application within 2 weeks.

As per Section 54 of the CGST Act 2017, The proper officer will issue the order under sub-section (5) within 60 days from the date of receipt of application complete in all respects.

On remarking that the applicant retains the right to ask for remedies if unsatisfied with any following order from the GST heads for the refund claim and interest, the petition was disposed of.

A division bench of Justice Sanjeev Sachdeva and Justice Ravinder Dudeja made a judgment. Advocate Gibran Naushad represents the respondent.

Division Bench of the Delhi High Court comprises Justice Vibhu Bakhru and Justice Amit Mahajan in a matter held that interest on delayed Goods and Services Tax (GST) refunds must be computed from the expiration of 60 days after the refund application, not from the appellate order date, despite the initial denial.

On 11.07.2023 the applicant challenged the order from the Additional Commissioner of the Department of Trade and Taxes, denying the claim for Rs 13,12,761 interest on refunded GST at an annual rate of 9%.

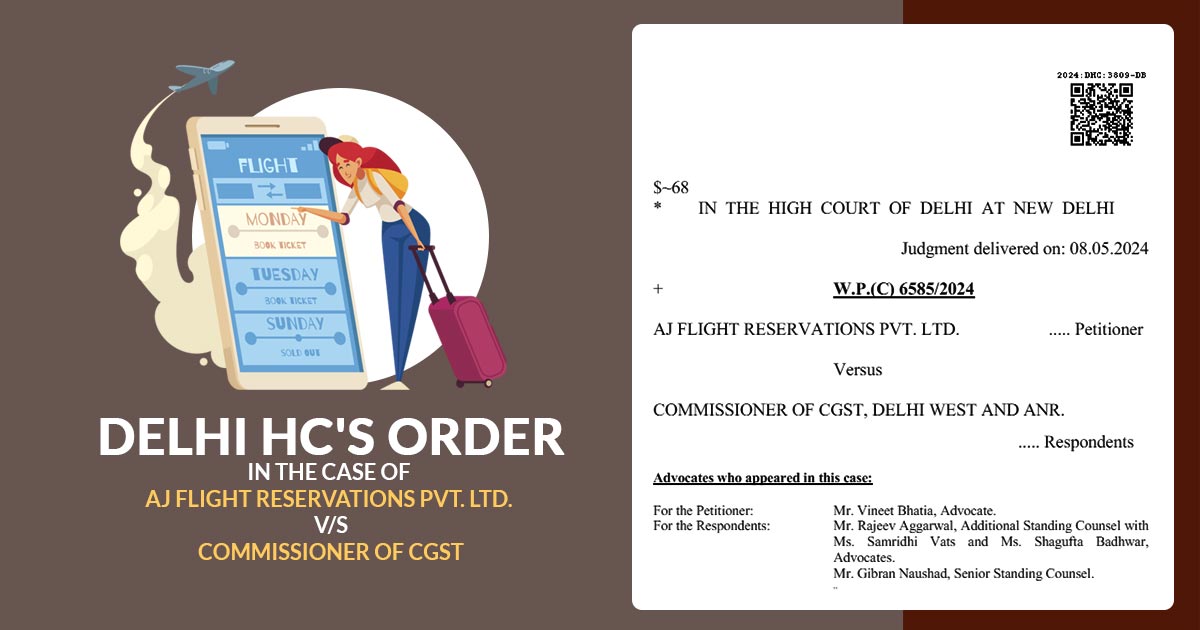

| Case Title | AJ Flight Reservations Pvt. Ltd. v/s Commissioner of CGST |

| Case No.: | W.P.(C) 6585/2024 |

| Date | 08.05.2024 |

| Counsel For Petitioner | Mr. Vineet Bhatia, Advocate |

| Counsel For Respondent | Mr Rajeev Aggarwal, Additional Standing Counsel with Ms. Samridhi Vats and Ms. Shagufta Badhwar, Advocates. Mr Gibran Naushad, Senior Standing Counsel |

| Delhi High Court | Read Order |