What Do You Mean By TDS Form 24G?

Form 24G is an important document used by government officials to report the money that has been withheld for taxes. This includes taxes taken from salaries, payments to non-salaried individuals, and even from non-residents. With Form 24G, all of these tax details can be reported in one place, making it easier to keep track of the amounts collected.

Important Deadline for Submitting Form 24G

The deadline for submitting Form 24G depends on the month in which it is prepared. If you complete the form in March, it must be submitted by 30th April. For forms prepared in any month from April to February, the deadline is within 15 days from the end of the month in which the tax was deducted.

For example, if tax was deducted in May, the form must be submitted by the 16th of May.

Purpose of Filing Form 24G

Generally, TDS is deposited in cash through a challan, but Government Departments have to deposit TDS through Book Adjustment.

For this purpose, the PAO/DTO/CDDO files Form 24G with the TIN authorities. After filing, a Book Identification Number (BIN) is generated, which must be quoted by DDOs in their quarterly TDS/TCS statements (Form 24Q, 26Q, 27Q, and 27EQ).

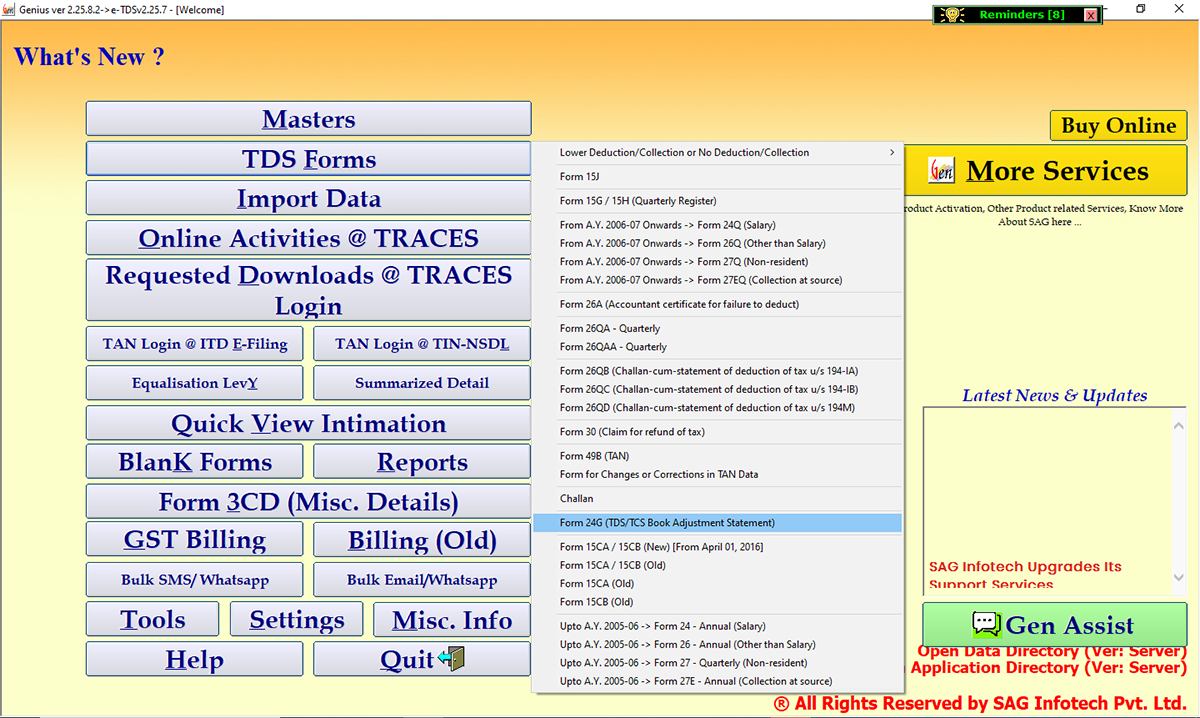

Process to E-File Form 24G through Gen TDS Software

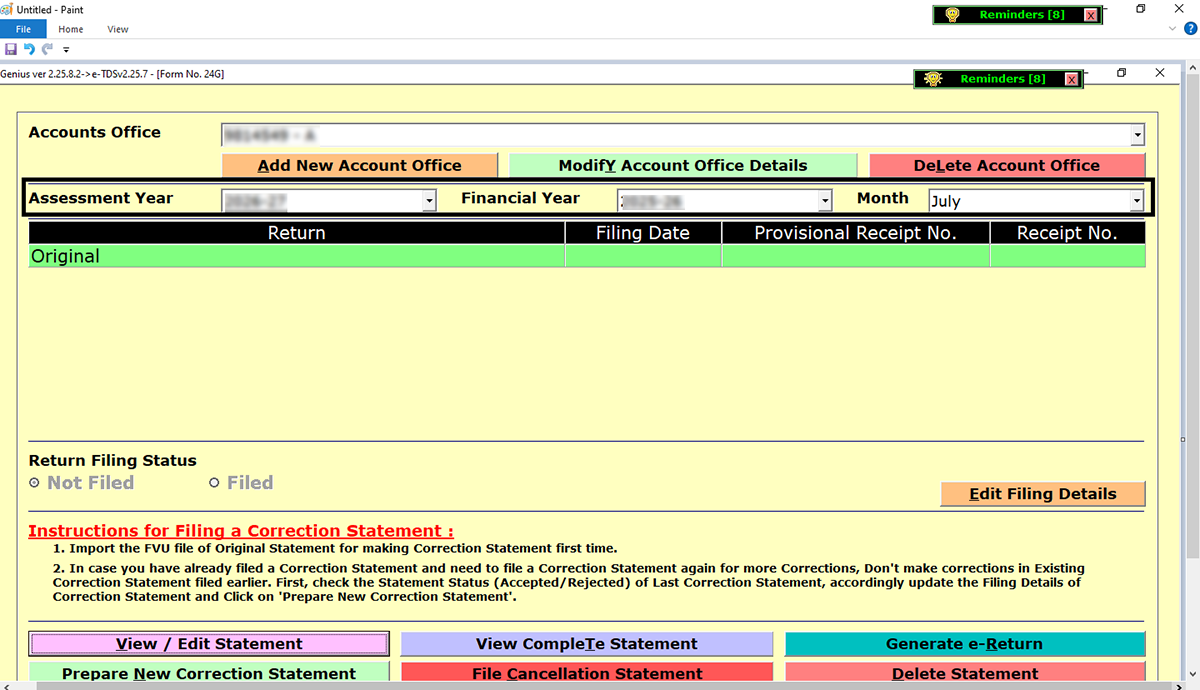

Step 1: First, install the full version of Gen TDS software on your PC, and then select Form 24G.

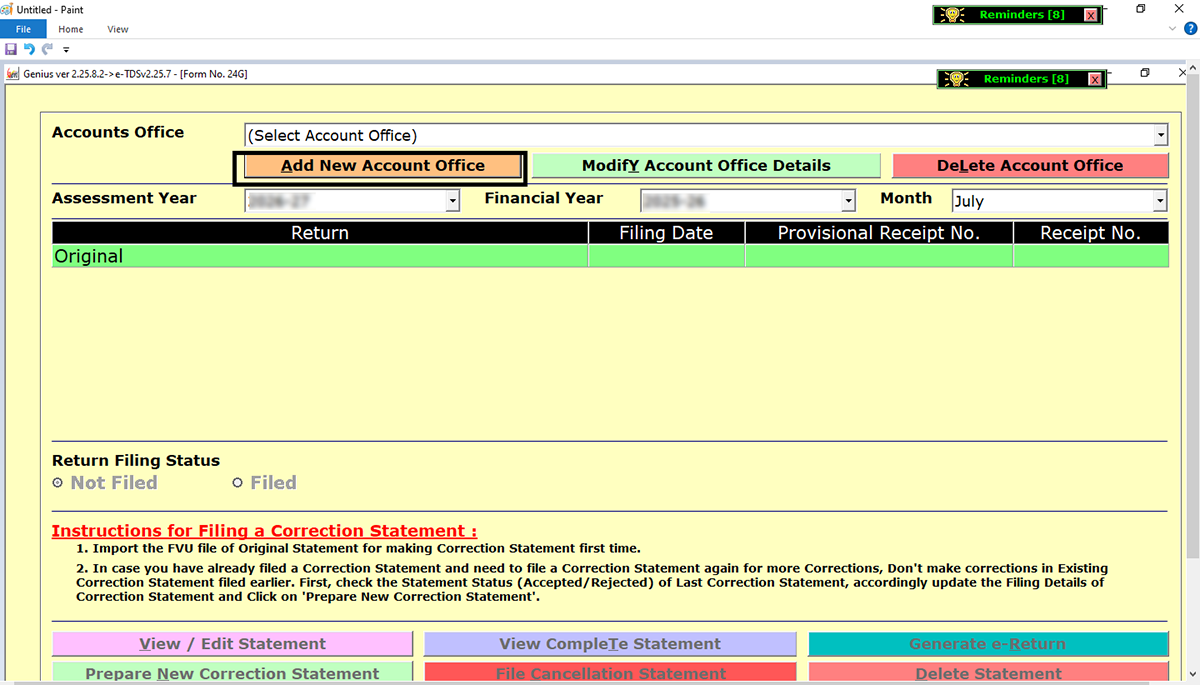

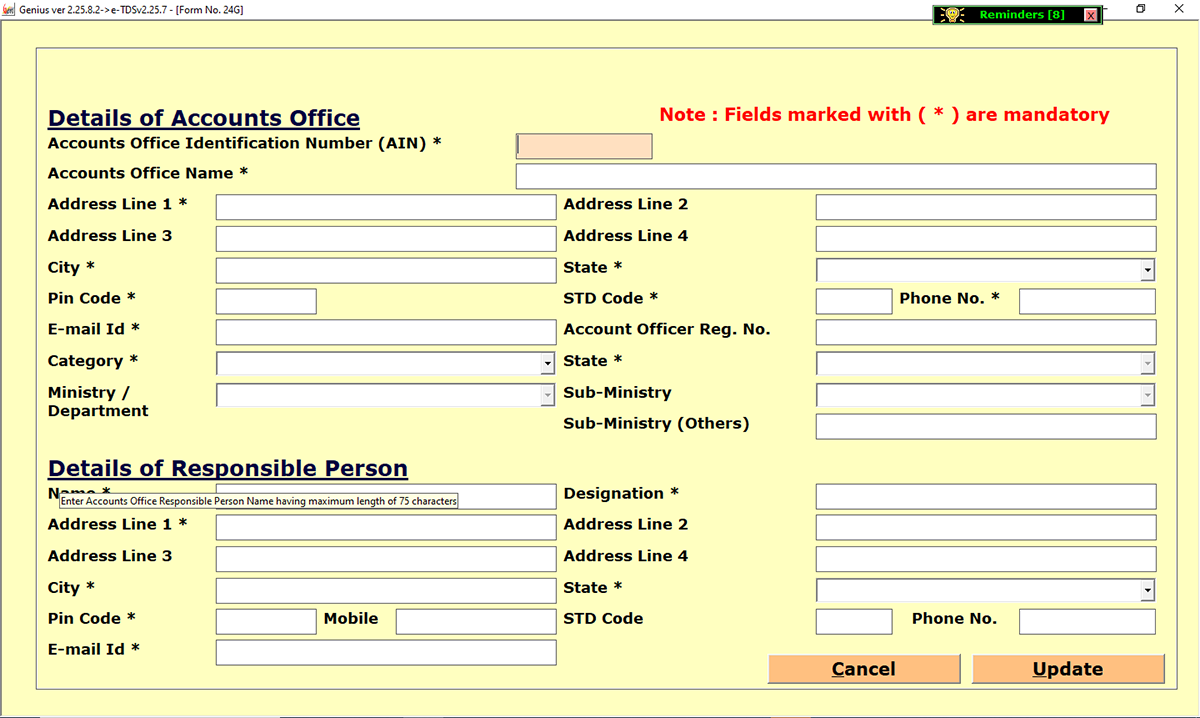

Step 2: Then prepare, modify or delete the Account Office Details that are responsible for filing Form-24G.

Step 3: Fill complete details and then click on update.

Step 4: Select the Assessment Year, Financial Year and Month.

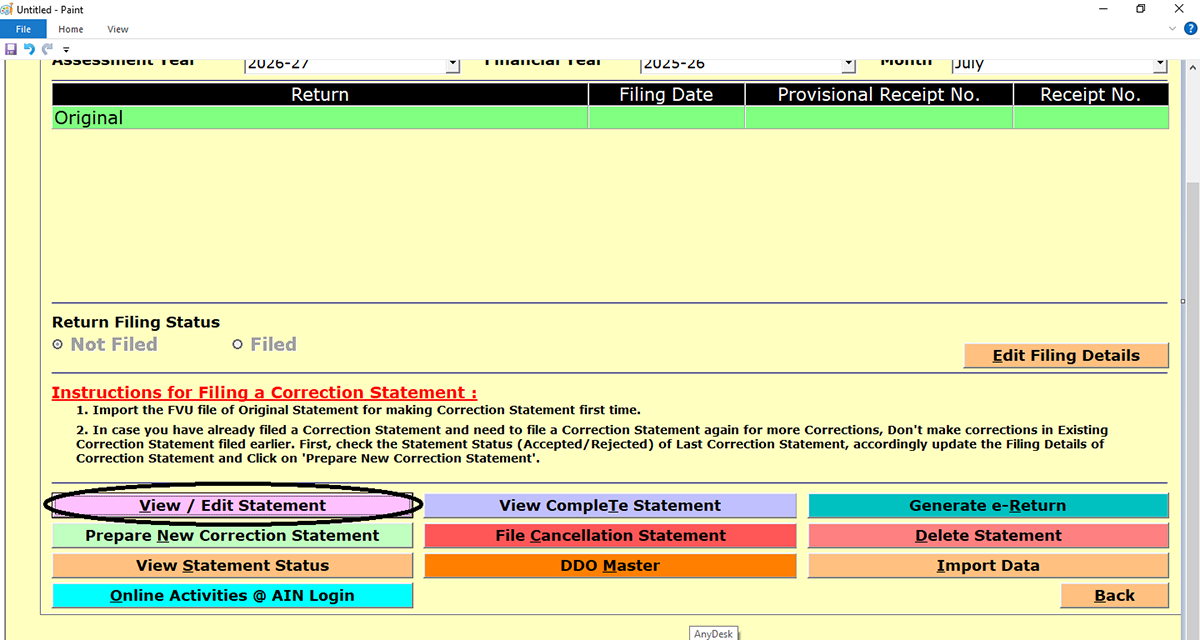

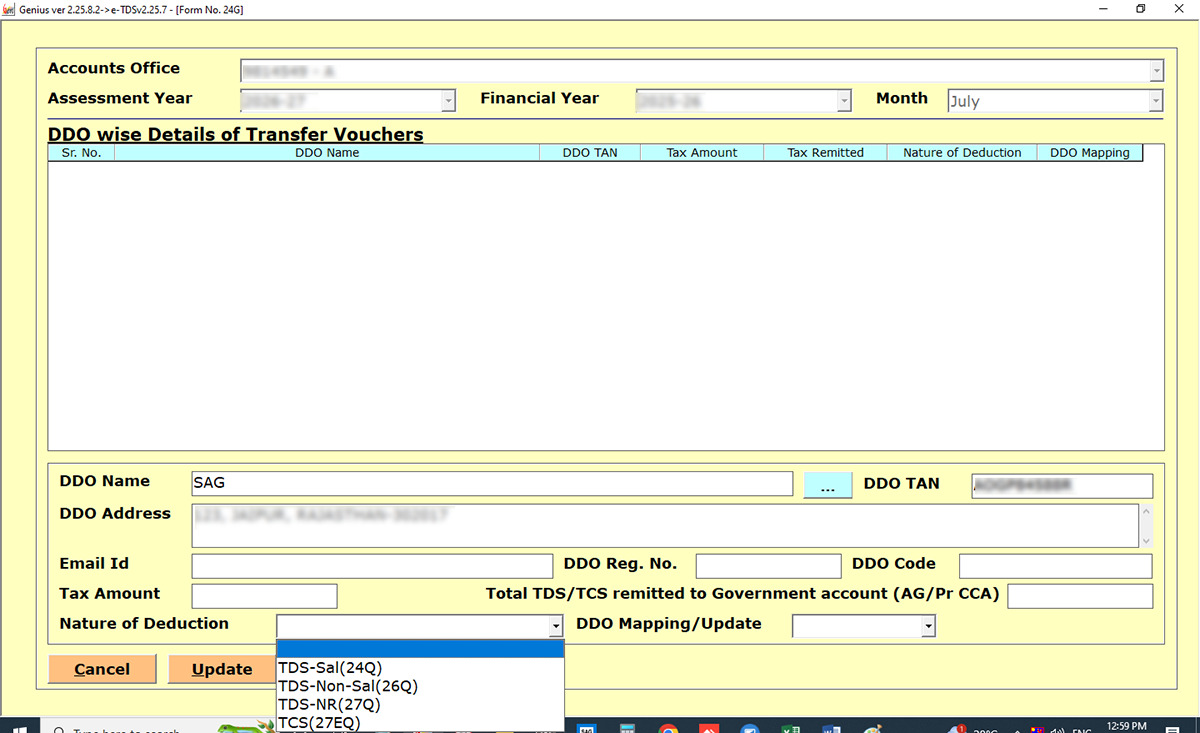

Step 5: Then select View / Edit Statement.

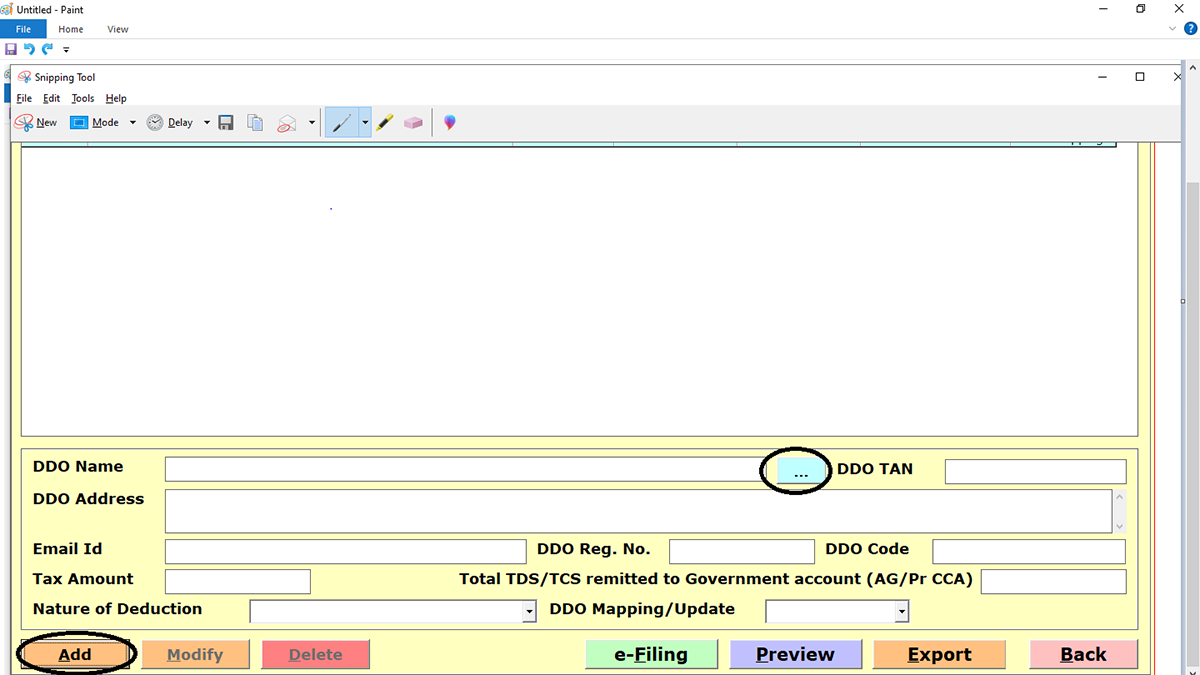

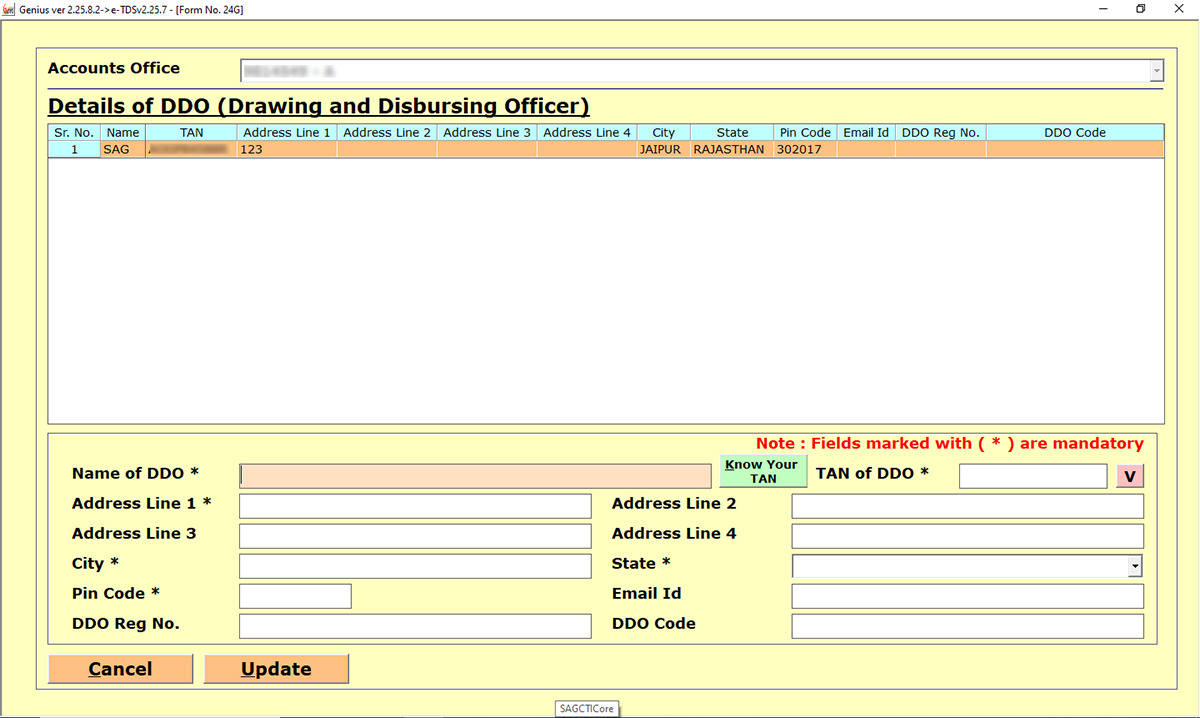

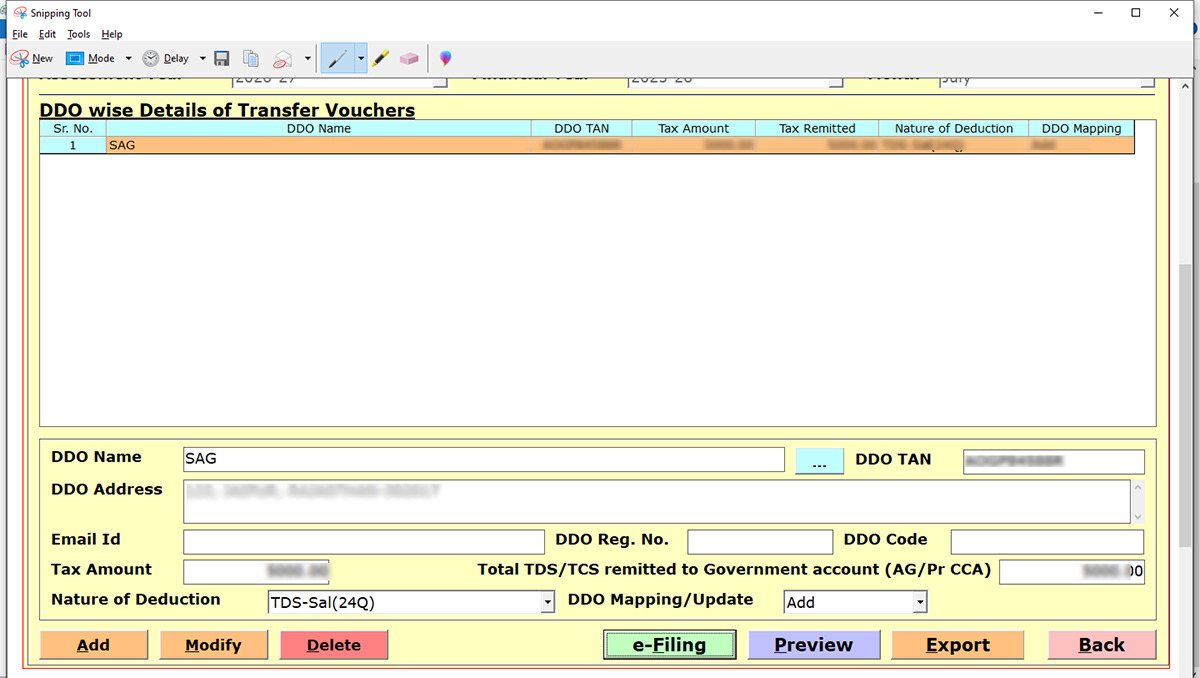

Step 6: Now add the DDO Name and details.

Step 7: After updating, fill in the Voucher Details.

Step 8: Then, proceed to e-Filing -> then validate -> then save it.

Step 9: At last, convert it into an FUV file, save this and submit it to the NSDL Centre to file it.