Simple Definition of the Form 15CA

Form 15CA declares that a tax has been deducted from the payment made to an NRI. Instead of leaving the NRI taxpayers to file and pay income tax papers, this helps the Indian government collect tax efficiently at the time of the remittance.

Different Components of Form 15CA

Part A – This form must be filed when the remittance amount exceeds INR 5 lakhs in a calendar year and the remittance is taxable.

Part B – Form B should be filled out if the cumulative remittance exceeds INR 5 lakh and when an order has been obtained from an assessing officer (AO) under section 195(2) or 195(3)/ 197 Under I-T Act.

Part C – Form 15CB must be filed only when the total remittance in the financial year exceeds INR 5 lakh and an accountant’s certificate has been obtained in Form 15CB.

Part D – If the remittances are not taxable, Part D of the form must be completed. Form 15CA and 15CB are not required for remittances to NRIs that do not require RBI approval.

Basic Meaning of the Form 15CB

Chartered accountants are required to upload the form 15CB certificate along with form 15CA if more than INR 5 lakh in remittances are made in a financial year. In addition to mentioning payment details, the CA will disclose the purpose of the remittance and the rate of TDS.

Required Documents for e-filing of Forms 15CA & 15CB

| Information about the Remitter | Information of the Remittee | Information about the Remittance | Bank Information of the Remitter |

|---|---|---|---|

|

|

|

|

Why Select Gen TDS Software for e-Filing of 15CA and 15CB Forms?

Gen TDS software is the most reliable and flexible software designed exclusively for filing TDS or TCS returns online as per the requirements of TRACES and the CPC portal, in India. In addition to pre-determining TDS amounts, preparing TDS returns, and calculating interest and penalties, along with late filing fees, you can also utilize this innovative tool.

According to the Tax Information Network website, it is an authorized TDS return filing software. Also, it was authorized by the Indian government to list TDS filing software during the financial year 2012-13. Through this TDS software, you are able to directly log in to TRACES CPC and NSDL, so you don’t have to generate the User ID every time. Other user-friendly information such as all TAN/PAN AO codes, India PIN codes, ISD codes, service tax ranges, TIN FCs MICR & IFSC codes, bank BSR codes etc. also come enabled with the Gen TDS software.

The software easily generates TDS return Forms 24Q, 26Q, 27Q, and 27EQ along with e-filing and printing features. The company has opened a free trial window for those taxpayers who want to test the Gen TDS/TCS returns filing software version.

Step-by-Step Process of e-Filing 15CA and 15CB Forms Using Gen TDS Software

The following steps will help you understand how to e-file 15CA and 15CB Forms by Gen TDS Software:

Case 1: Form 15CA

Step 1:- First Install Gen TDS Return Filing Software on your laptop and PC.

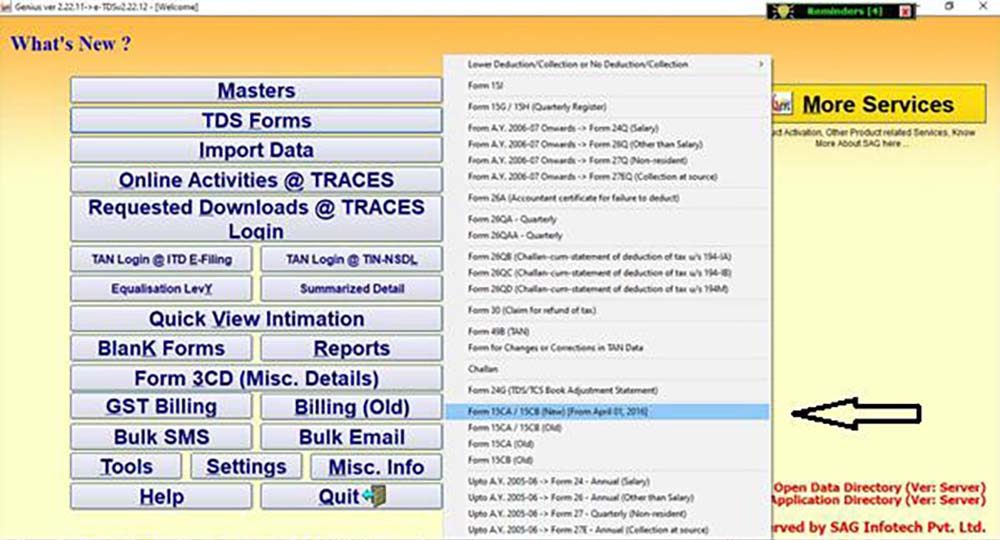

Step 2:- After that Click⏩on the TDS forms option and then select the 15CA Forms which you want to file.

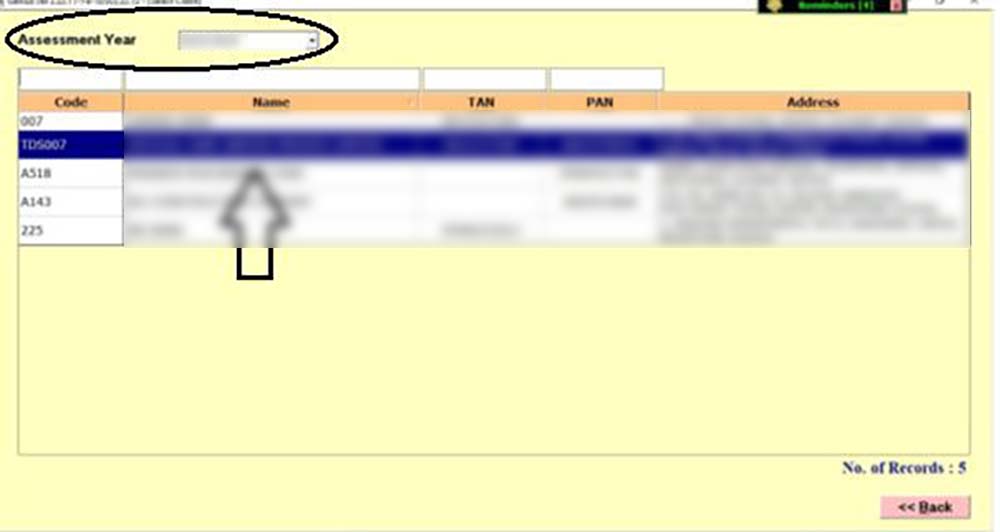

Step 3:- Select the Client and Assessment Year.

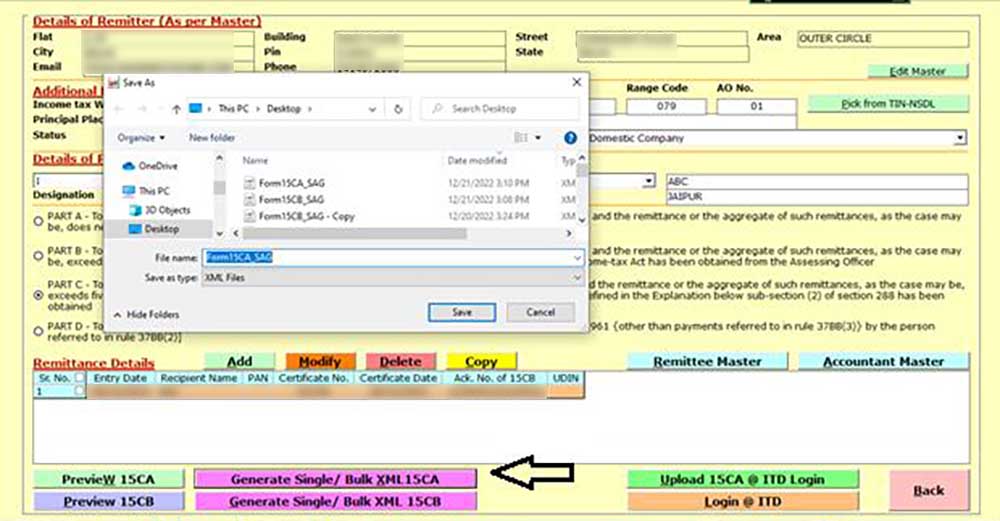

Step 4:- Click ⏩ on Generate XML 15CA and Save the XML Generated.

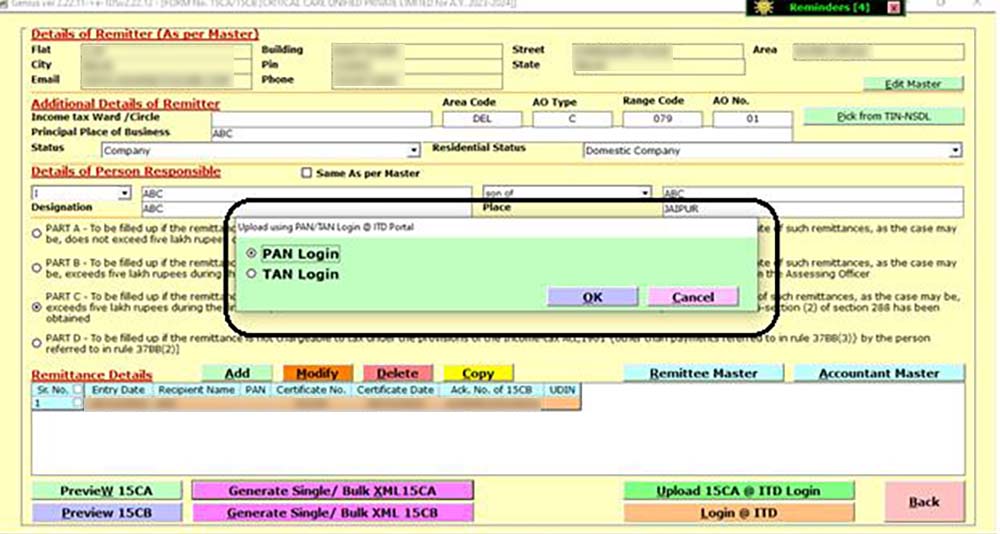

Step 5:- Now Select the Option Through Which You Want to Upload the Form i.e. Whether Through PAN Login or Through TAN Login.

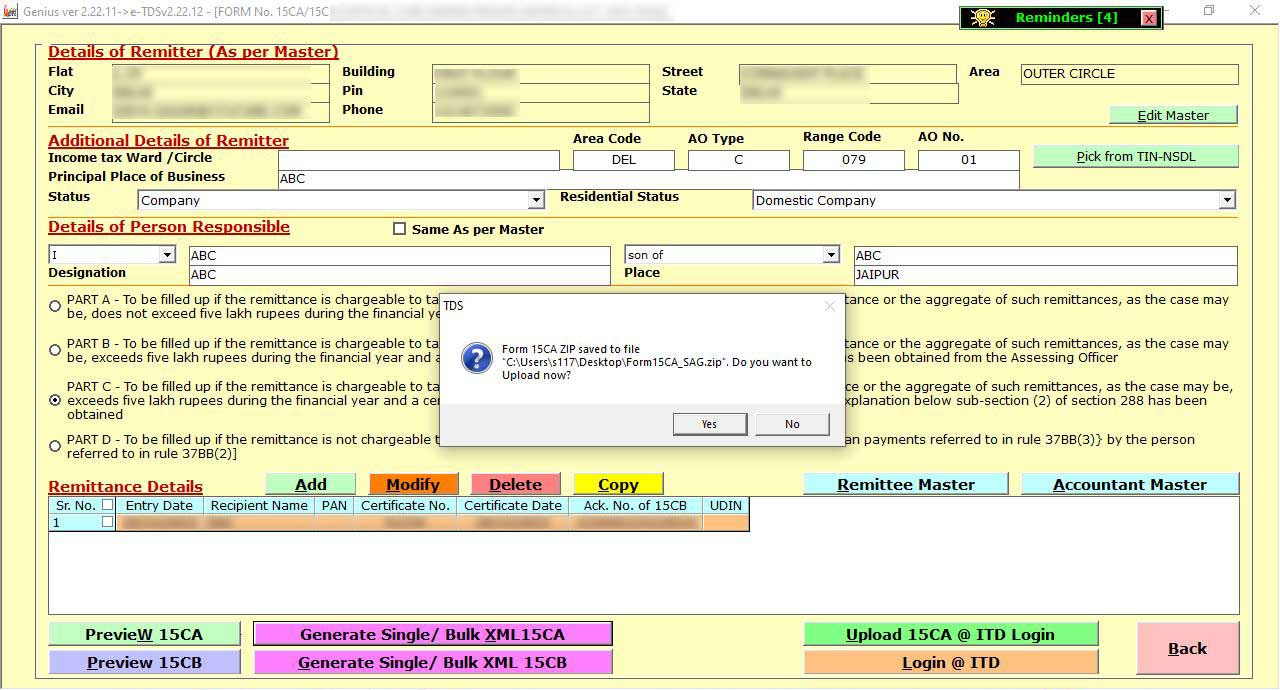

Step 6:- After that Generate the XML and Upload It.

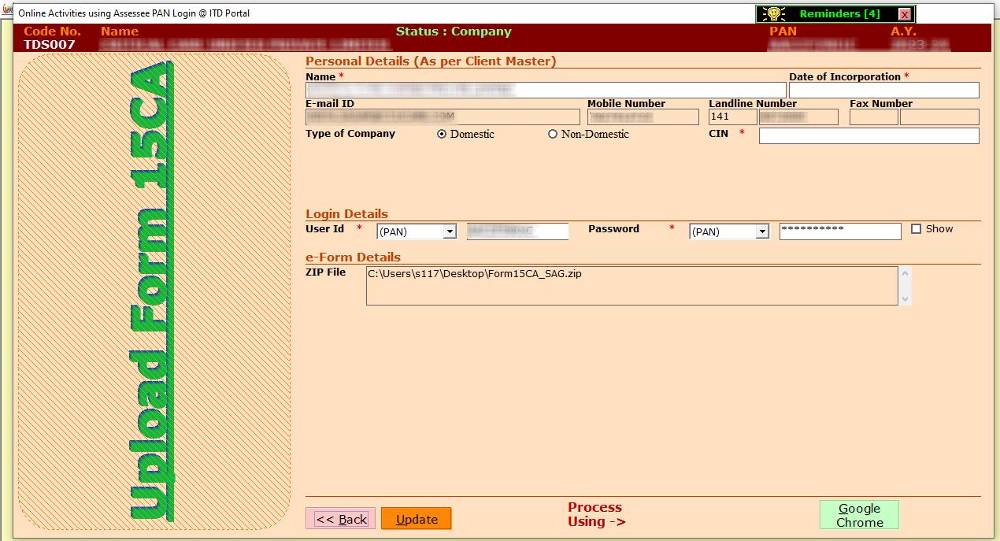

Step 7:- After Saving the XML You Can Upload It Using the Google Chrome Option.

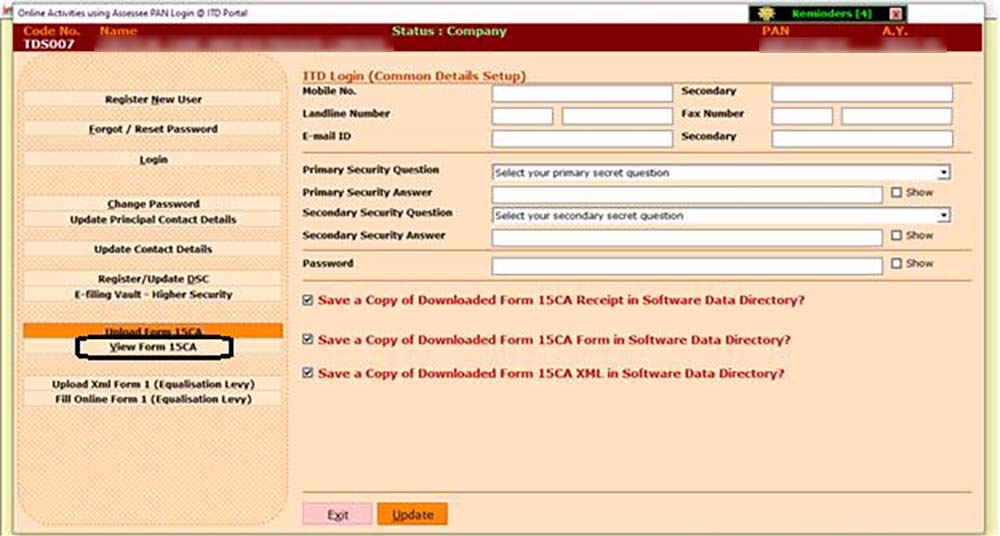

Step 8:- After Uploading the Form You Can View It Through the Option View Form 15CA.

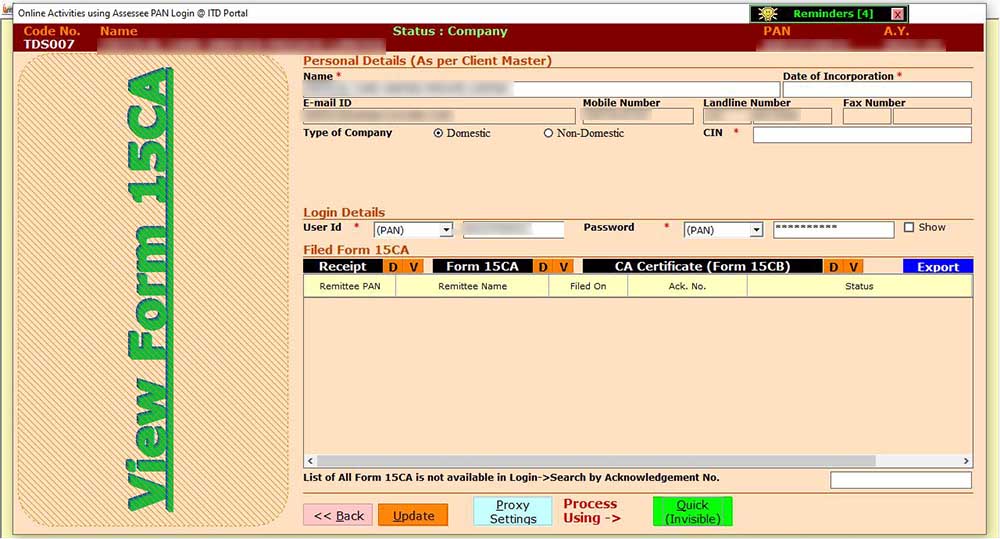

Step 9:- After clicking ⏩ on view forms this window will appear from where you can view the forms.

Case 2: Form 15CB

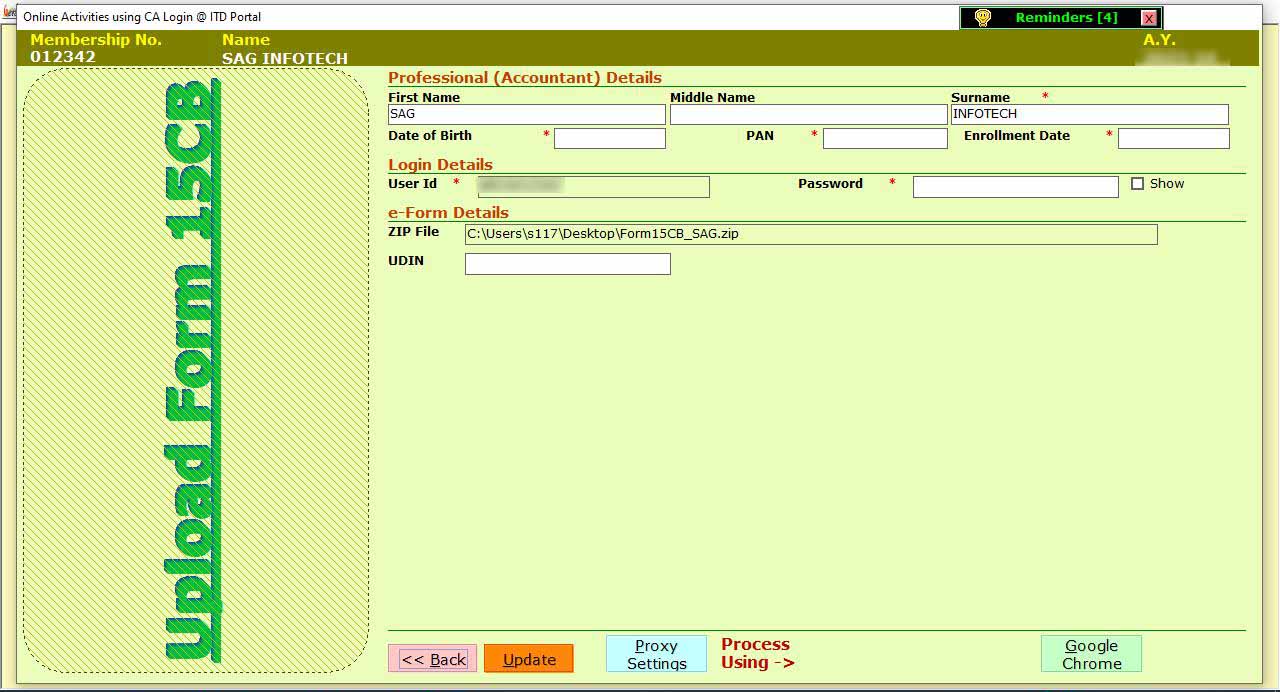

Step 1:- Install Gen TDS Software and then select the form 15CB which you want to e-file.

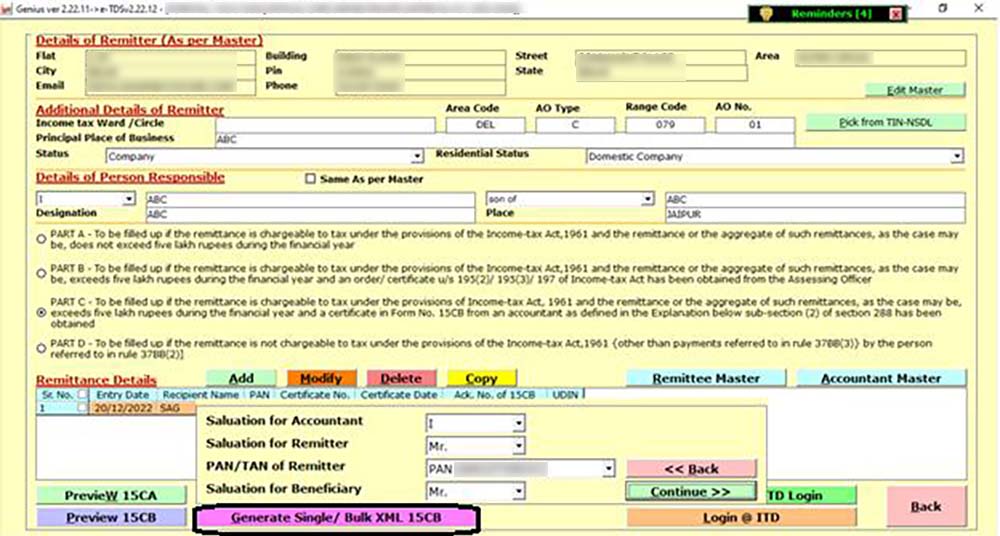

Step 2:- Now fill in the details as required to fill Form 15CB and click ⏩ on Generate Single or Bulk XML 15CB as Shown in the Image Below.

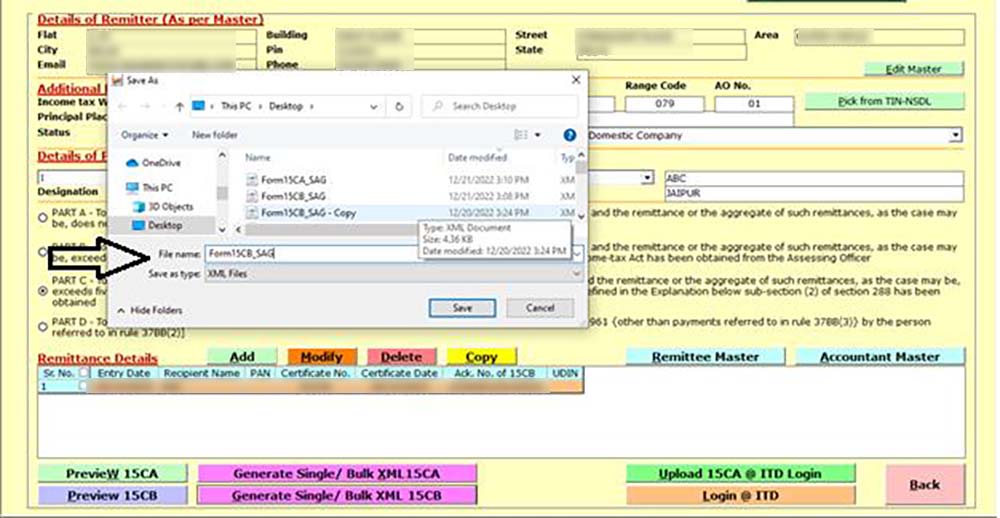

Step 3:- Save the XML File of Form 15CB.

Step 4:- After Saving the XML You Can Upload It Using the Google Chrome Option.

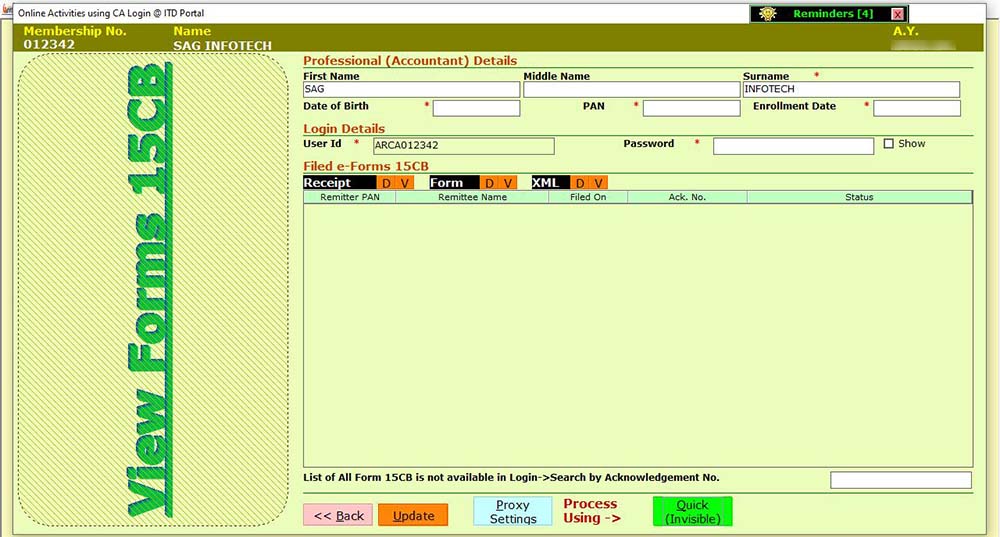

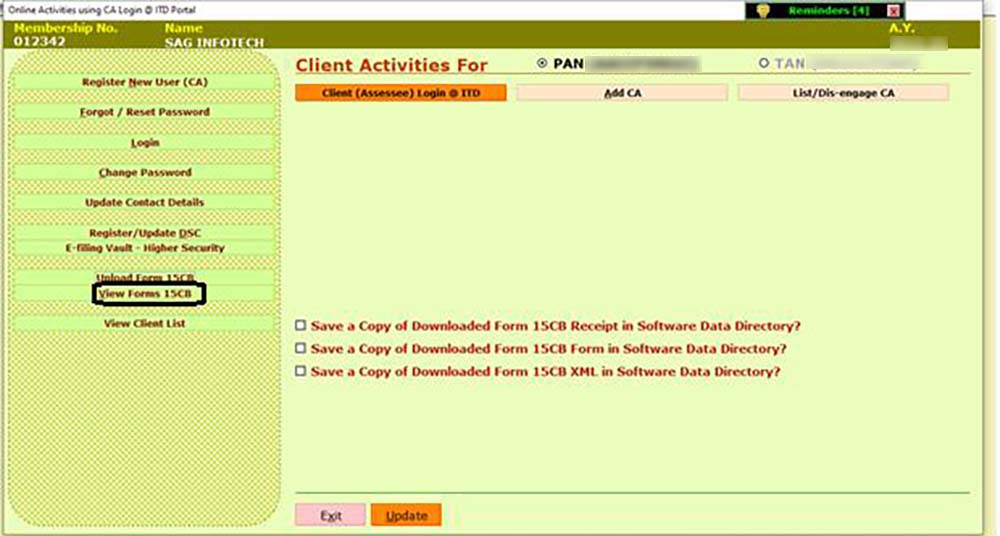

Step 5:- When you Upload the Form You Can View It Through the Option ⏩ View Form 15CB.

Step 6:- After Clicking ⏩ on View Forms This Window Will Appear from Where You Can View the Forms.