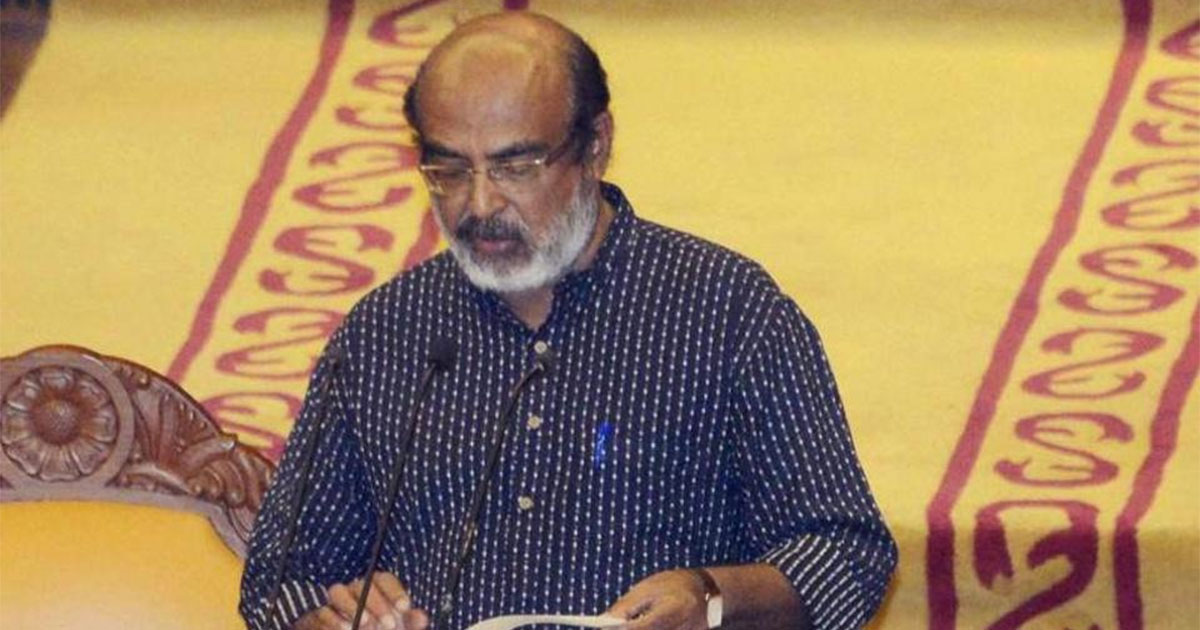

Kerala Finance Minister T M Thomas Issac has clearly given some gestures regarding the increasing smoke of problems and issues related to fundamental disputes recently. The minister assured that there are no major effects on the council operational counterpart and also no discontentment arose due to the mismatched decisions of various ages indulging in the meet. Mr. Thomas Isaac said in a statement in between the question hour of the house, “There were no fundamental disputes in GST council.” The next meeting of the council, to be held in Srinagar, would take the decision to fit different goods and services into the four approved slabs of 5, 12,18 and 28 per cent tax rates for Goods and Service Tax (GST).”

Apart from clearing and sorting out any misunderstanding on the name of GST council, the finance minister also mentioned some common issues and their pending decisions. He told that the decision regarding the tax rate of gold have been decided until now as the council is busy over various other issues ranking higher and significant than the gold taxation issue. Apart from this the minister also disclosed an approx amount of 55 thousand crores which is needed to suffice the losses to the states after the GST being implemented and in the name of compensation revenue.

The major point to be noticed here is that the head of the finance department furnished that the tax evaders will not be taken easy and a hard decision will be taken for those who will do harm the economy with their own illegal way. Also, he told that the department will take care of the traders who are in the prone list of harassment for the transactions.