In India, the rollout of the Goods and Services Tax (GST) has transformed the way businesses handle indirect taxation. GST has streamlined the tax framework while also increasing the importance of accurate reporting and timely compliance.

Sales reconciliation is one of the most critical procedures in GST compliance, as it involves matching sales data from internal records with the information reflected on the GST portal.

Manual reconciliation has become impractical with the surge in transaction volumes and frequent regulatory revisions. GST software with built-in sales reconciliation features in such a situation has become crucial for businesses of all sizes.

Sales Reconciliation in GST

Sales reconciliation is defined as the process of comparing and matching a business’s outward supply records, such as invoices, debit notes, and credit notes, with GST returns like GSTR-1 and auto-populated statements on the GST portal. All taxable sales must be reported appropriately, and the tax liability calculated in returns should align with the books of accounts.

It specifies that reconciling sales data with internal records and the GST portal ensures consistency between what is reported before the government and what is recorded internally.

Any mismatch between internal records and GST data can result in wrong tax payments, notices from tax authorities, or loss of ITC for recipients. GST software automates this matching process, shows discrepancies, and helps businesses correct them before filing returns.

Challenges of Manual Sales Reconciliation

Various small and medium enterprises rely on spreadsheets or manual reconciliation methods. The same method shows various issues-

- High risk of Human Error

- Time-consuming Data Comparison

- Difficulty in Handling Large Volumes of Invoices

- Delayed Identification of Mismatches

- Increased Possibility of Non-compliance

Manual reconciliation becomes more intricate when amendments, cancellations, or multiple GST registrations are engaged. The same errors can result in wrong reporting and unnecessary penalties.

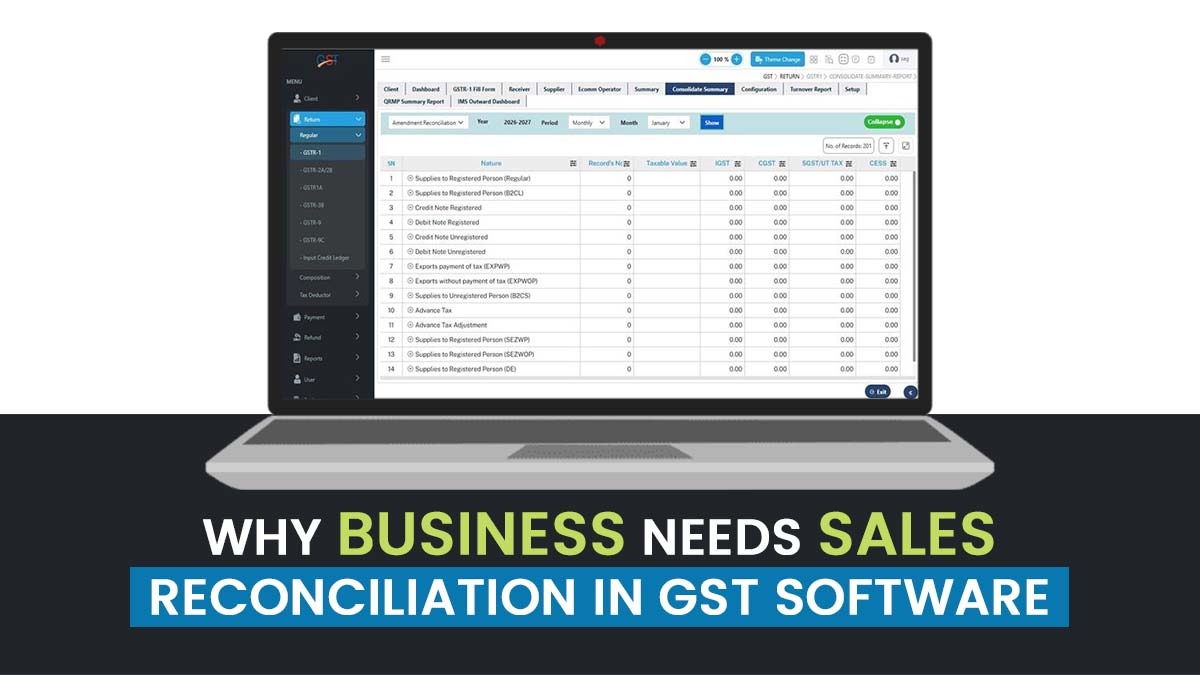

How GST Software Facilitates Sales Reconciliation

The latest GST software automates and facilitates the process of reconciliation. The same imports data from accounting systems and the GST portal, compares them, and shows the results in an easy-to-understand format.

Key features possessed:

- Automatic matching of invoices between books and GSTR-1

- Reconciling sales data with internal records and the portal on a single dashboard

- Identification of missing, duplicate, or mismatched entries

- Bulk corrections and updates

- Real-time validation of GSTIN, tax rates, and invoice details

- Detailed reconciliation reports

The same automation saves time and lowers the reliance on manual checks.

Assures Precise GST Returns

Appropriate returns support GST compliance. Sales reconciliation ensures that the outward supplies reported in GSTR-1 are complete and correct. When data is reconciled with internal records and the portal before filing, businesses can be assured that their tax liability is calculated accurately.

GST software supports fetching errors such as incorrect taxable value, wrong tax rates, or missing invoices. Addressing these issues at initial phase prevents future revisions and lowers the chance of scrutiny from tax authorities.

Prevents Notices and Penalties

Mismatches between internal records and portal data are an ordinary reason for departmental notices. Also, minor discrepancies can be directed to queries or demands.

The use of GST software for sales reconciliation allows businesses to determine and solve the mismatches. Businesses by ensuring consistency across records and returns, reduces the possibility of getting notices, late fees, or penalties.

Improves Cash Flow Management

Precise sales reconciliation shows actual tax liability. When businesses learn appropriately how much GST is to be filed, then they can prepare their cash outflows effectively.

Timely reconciliation confirms that customers obtain accurate invoice details, allowing them to claim ITC without issues. This develops trust and improves payment cycles, making cash flow better.

Saves Time and Increases Productivity

Automation significantly decreases the time required for reconciliation. Tasks that previously took hours or even days can now be completed in just minutes with GST software.

This efficiency enables finance and accounting teams to focus on higher-value activities, such as analysis, planning, and compliance strategy, instead of engaging in repetitive data matching.

Supports Audit and Compliance Readiness

GST audits mandate businesses to deliver precise records and reconciliation statements. An advanced GST software helps maintain a clear audit trail of invoices, amendments, and reconciled data.

Having structured reports readily available makes the audit process more facilitative and less stressful. Additionally, it illustrates a strong culture of compliance within the organisation.

Scales with Business Growth

With the expansion of businesses, the transaction volumes also surge. But manual processes find it difficult to maintain this growth.

GST software can manage large datasets and multiple GST registrations efficiently, scaling with business growth while ensuring compliance.

Closure: In the present GST world, sales reconciliation is important. The capability to reconcile sales with accounting books and the GST portal confirms appropriate tax payments, helps prevent notices, enhances cash flow, and strengthens compliance.

GST software with advanced sales reconciliation features equips businesses with tools for accuracy, efficiency, and compliance. Businesses can facilitate their processes and enhance financial oversight.