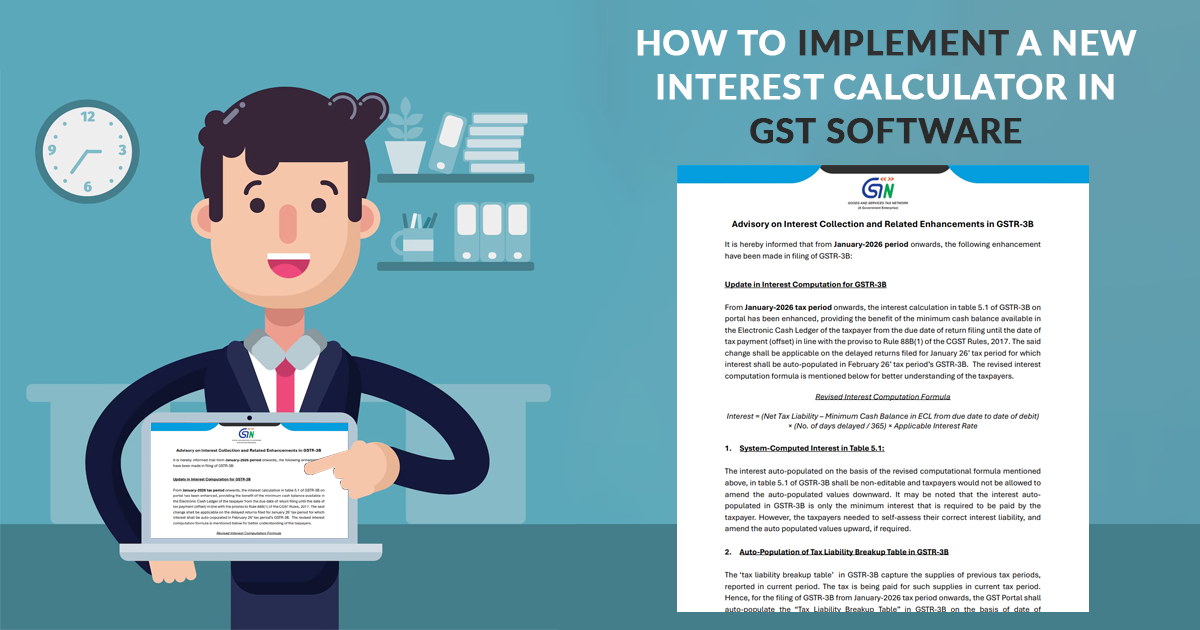

GSTN has issued an important advisory on interest computation and related enhancements in GSTR-3B, effective from the January 2026 tax period onwards.

A new interest computation procedure has been rolled out under the same revisions that permit the auto-population of tax liability breakdowns, enhance the sequence for using input tax credits (ITC), and provide for the collection of interest through GSTR-10 for cancelled registrations.

To follow the updated GST portal needs and perfectly support taxpayers, GST software providers should upgrade their systems to include the new interest calculator and the related enhancements. The blog illustrates the method by which GST software can execute such revisions as per the advisory.

Comprehending the Revised Interest Calculation

The GST portal w.e.f January 2026 shall calculate interest on Table 5.1 of GSTR-3B via an improved formula. The new method shall consider the minimum cash balance available in the Electronic Cash Ledger (ECL) from the last date of return filing until the actual tax payment date.

Formula for Revised Interest

Interest = (Net Tax Liability – Minimum Cash Balance in ECL from due date to date of debit)

× (Number of days delayed / 365)

× Applicable Interest Rate

Major elements consist of:

- Net Tax Liability: Total tax payable for the return period

- Minimum Cash Balance in ECL: The lowest balance available in the electronic cash ledger during the delay period

- Number of Days Delayed: Days between the due date and the actual payment date

- Applicable Interest Rate: Rate stipulated under the GST law

GST software should implement the same formula so that interest can be computed as per the portal logic.

Implementing System Computed interest in Table 5.1

From the Advisory:

- The interest auto-populated in Table 5.1 will be non-editable downward

- If the self-assessment of taxpayers shows a higher liability, they can increase the value

- The auto-computed interest shows only the minimum interest payable

Software Implementation Approach

- Auto-calculate interest using the revised formula

- Lock the calculated value from downward editing

- Allow upward modification with appropriate warning or confirmation

- Display a note remarking that the auto-computed interest is suggestive and represents the minimum payable amount

This guarantees alignment with the GST portal’s behaviour and helps to prevent under-reporting.

Adding Auto-Population of Tax Liability Breakup Table

The advisory rolls out auto-population of the Tax Liability Breakup Table in GSTR-3B, capturing:

- Supplies of previous tax periods

- Reported in current GSTR-1 / GSTR-1A / IFF

- Where tax is being paid in the current GSTR-3B

This table assists in accurately calculating interest for liabilities related to previous periods.

In what way should GST software manage this

- Determine invoice/document dates from return data

- Map previous-period supplies paid in the current return

- Auto-generate a breakup showing period-wise tax liability

- Permit users to view and revise upward if needed

This table should be accessible via:

GSTR-3B → Table 6.1 (Payment of Tax) → Tax Liability Breakup

Supporting the Suggestive Nature of Auto-Populated Values

GSTN mentions that:

- Auto-populated values are suggestive

- Taxpayers can edit them upward based on their records

Software Design Proposal

- Furnish editable fields with upward-only validation

- Add audit trail logs for modifications

- Show contextual assistance specifying that users should self-assess their accurate obligation

The same balances automation with user responsibility.

Update in Table 6.1 Cross-Utilisation of ITC

From January 2026:

Once IGST ITC is fully exhausted, taxpayers can use:

- CGST ITC

- SGST ITC

In any sequence for payment of IGST liability.

Implementation in GST Software

- Edit the ITC usage engine to permit a flexible sequence after IGST ITC exhaustion.

- Display the utilisation flow in the payment summary

- Validate as per the GST portal logic

The same enhances taxpayer flexibility and facilitates the processing of payments.

Interest collection via GSTR-10

For cancelled taxpayers:

- If the last applicable GSTR-3B is submitted late

- Interest on this delay shall be collected via the Final Return (GSTR-10)

Software amendments need

- Detect cancelled registration status

- Check the delay in the last GSTR-3B filing

- Auto-compute applicable interest

- Reflect the interest in the GSTR-10 preparation module

The same ensures that the appropriate recovery of interest even after cancellation.

Testing and Compliance Validation

Before Deployment:

- Compare software-generated interest with GST portal results

- Test multiple scenarios: Late filing, partial cash balance, multi-period liabilities

- Ensure UI restrictions show portal rules

To adhere to compliance, regular updates and validations are crucial.

Closure: The January 2026 GSTN advisory illustrates a substantial advancement in achieving more accurate and transparent interest calculations.

By including a revised formula, system-computed interest, a detailed breakdown of tax liabilities, flexible usage of Input Tax Credit (ITC), and GSTR-10 interest collection, an advanced GST compliance filing software can seamlessly align with the enhancements made to the portal.

These modifications will help taxpayers accurately calculate interest, minimise disputes, and streamline compliance with GSTR-3B in the evolving GST ecosystem.