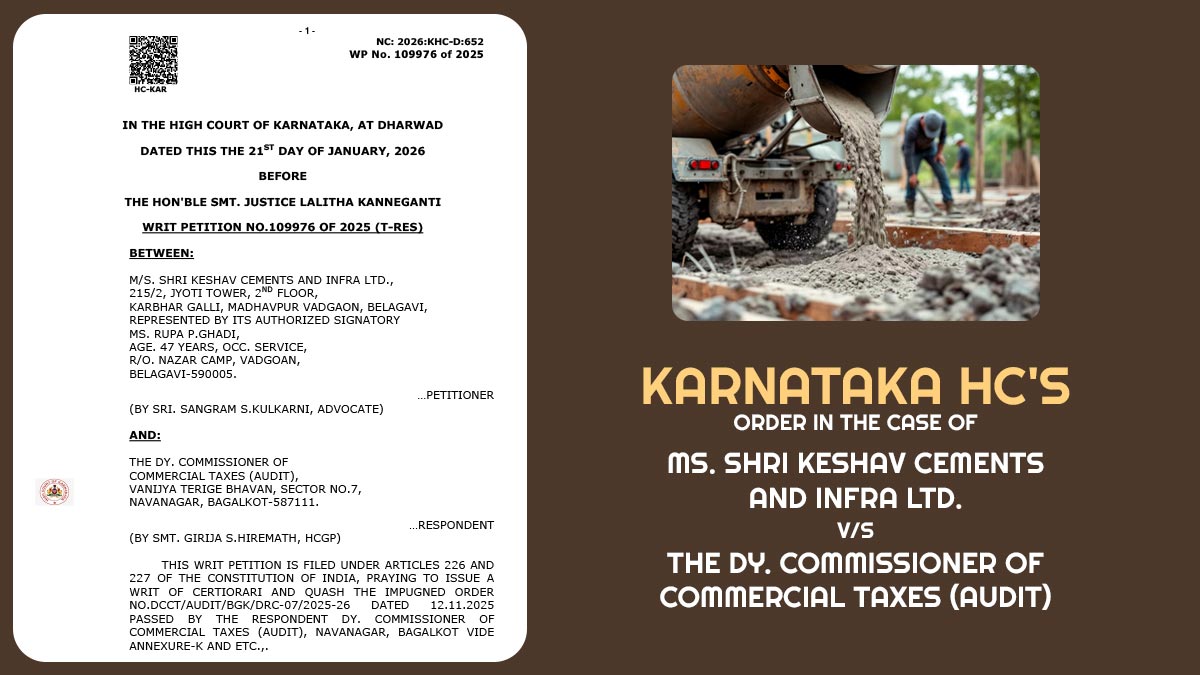

The Karnataka High Court, specifically the Dharwad Bench, has overturned a GST demand order that exceeded Rs 7.23 crore. The court found that the tax department did not follow the necessary procedure of giving a personal hearing to the affected party before issuing an unfavourable decision.

The bench of Justice Lalitha Kanneganti said that Section 75(4) of the GST Act states that a chance of hearing will be allotted where a request is obtained. The applicant did not provide a chance for a personal hearing.

The applicant is a public limited company registered under the Karnataka Goods and Services Tax Act, 2017, engaged in cement manufacturing and generating electricity through solar power for its own consumption.

The company had set up solar power plants of 20 MW and later 10 MW capacity at Bisarahalli village in Koppal district, as per the approvals granted by the Government of Karnataka. The company, concerning its tax position, had approached the Authority for Advance Rulings (AAR) under the CGST/KGST Act on the eligibility of ITC on capital goods and input services used for the erection, installation, and commissioning of the solar power plant.

AAR ruled in favour of the taxpayer, holding that the ITC was considerable as the electricity generated was captively consumed in its cement manufacturing units. The applicant put reliance on the advance ruling, and it continued to take the ITC and submitted the regular GST returns.

The Deputy Commissioner of Commercial Taxes (Audit), Bagalkot, in an audit performed for the duration April 2021 to March 2022, raised objections alleging ineligibility on ITC on distinct heads, including solar plant equipment, insurance and financial services, works contract services, construction activities, and vehicle repairs. After that, a series of communications along with an audit observation letter, intimation under Section 73(5), and a show cause notice under Section 73(1) of the GST Act are included.

Detailed responses are provided at each phase, disputing the allegations and requesting withdrawal of proceedings. But, the audit authority passed an order dated 12 November 2025 without allotting any chance of a personal hearing, disallowing the ITC, and raising a tax demand of 7,23,74,871 along with applicable interest and penalty.

The applicant was dissatisfied with the same and therefore approached the HC. The matter before the Court was whether the GST department can pass an adverse order disallowing the Input tax credit (ITC) without allotting a personal hearing, even after the express obligate u/s 75(4) of the GST Act.

The petitioner argued that while an appellate remedy u/s 107 of the GST Act was available, it was not an effective option given the circumstances of the case. This was because the advance ruling authority that had made the earlier decision held a higher position than the appellate authority. The HC ruled that Section 75(4) of the GST Act requires a hearing to be granted when an adverse decision is anticipated.

The Court noted that it was undisputed that the petitioner had not been afforded a personal hearing before the impugned order was issued. Regarding the maintainability of the writ petition, the Court accepted the claim of the applicant that the existence of an alternative statutory remedy does not prevent the exercise of writ jurisdiction in cases where there is a clear breach of the principles of natural justice. Furthermore, the Court stated that, in light of the unique facts of this case, the appellate remedy could not be considered effective or sufficient.

The GST demand order has been set aside by the HC on 12 November 2025, remanded the case back to the audit authority for fresh consideration, and asked the authority to pass a fresh order merely after providing a chance of personal hearing before the applicant, as obligated u/s 75(4) of the GST Act.

| Case Title | MS. Shri Keshav Cements And Infra Ltd. vs. The Dy. Commissioner Of Commercial Taxes (Audit) |

| Case No. | WRIT PETITION NO.109976 OF 2025 (T-RES) |

| For Petitioner | Sangram S.Kulkarni |

| For Respondent | Girija S.Hiremath |

| Karnataka High Court | Read Order |