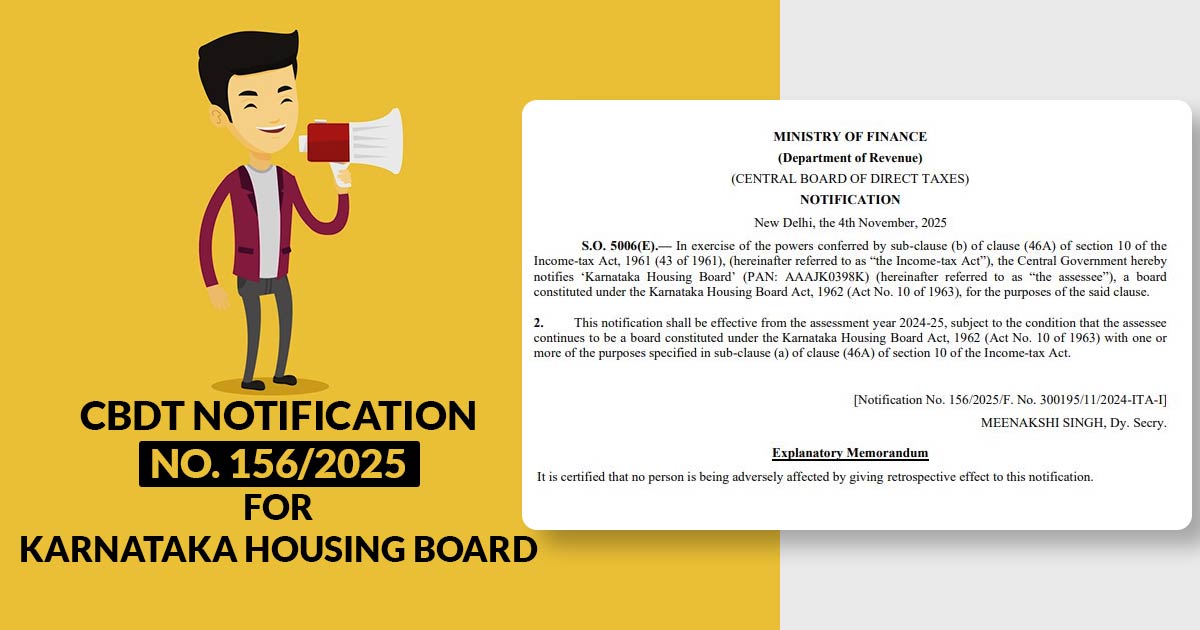

The CBDT has issued a new Notification No. 156/2025 [S.O. 5006(E)] giving income tax exemption to the Karnataka Housing Board under section 10(46A).

Meenakshi Singh, Deputy Secretary, issues the notification which cites that the Central Government, in exercise of powers provided under sub-clause (b) of clause (46A) of Section 10, has recognised the Karnataka Housing Board (PAN: AAAJK0398K) as an eligible entity for tax exemption purposes.

Also Read: CBDT Notif. 155/2025: CPC Bengaluru to Rectify and Issue Demands in Select Tax Cases

From the assessment year 2024-25 onwards, the applicability of the exemption will take place, given that the Karnataka Housing Board continues to function as a board formed under the Karnataka Housing Board Act, 1962 (Act No. 10 of 1963) and fulfills one or more purposes defined in sub-clause (a) of clause (46A) of Section 10 of the Income-tax Act.

The Explanatory Memorandum that has the notification specifies that the order is being provided with retrospective effect and authenticates that no person shall be adversely affected by this retrospective application.

The Income tax exemption to certain statutory authorities, boards, and bodies formed under a Central or State Act, has been furnished u/s 10(46A), which includes activities like housing, infrastructure development, or other public welfare objectives.

Under the Karnataka Housing Board Act, 1962, the Karnataka Housing Board (KHB) has been formed, which is a regulatory body obligated for executing housing schemes and promoting cheaper housing in the state. The board executes projects for distinct income groups, which comprise economically weaker sections, lower-income groups, and middle-income categories.

The CBDT recognition of KHB u/s 10(46A) will authorise the board to operate with greater financial flexibility, enabling it to reinvest its surpluses into affordable housing initiatives and urban development projects across Karnataka.

Read Notification