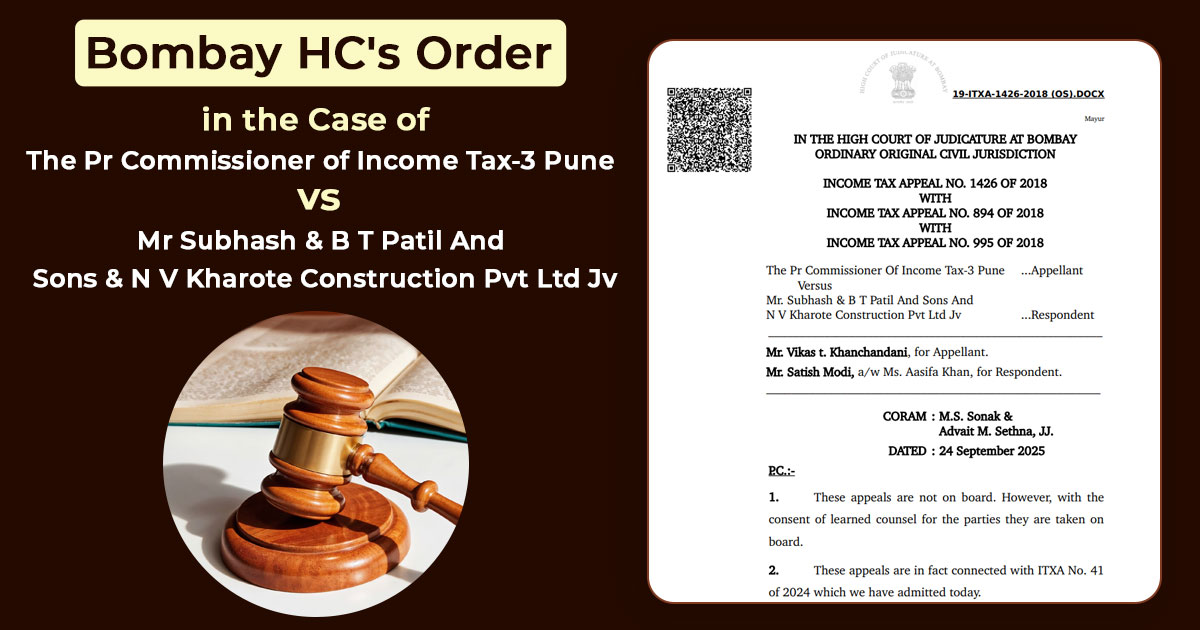

The Bombay High Court has accepted an appeal for hearing filed by the Principal Commissioner. This appeal challenges a previous decision made by the Pune ITAT, which had ruled in favour of a joint venture involving Subhash and B.T. Patil and Sons, along with N.V. Kharote Construction Pvt. Ltd.

The issue is of TDS applicability under section 194C, profit taxability in the hands of joint ventures, and disallowance u/s 40(a)(ia) of the Income Tax Act, 1961.

The case of the revenue is related to the tax treatment of contracts executed in the name of the joint venture and the subsequent allocation of work among its members. As per the revenue, these allocation is directed to subcontracting, thereby drawing TDS liabilities u/s 194C.

The ITAT held that the provisions of section 194C were not applicable in the absence of a formal contract or subcontract between the joint venture and its members.

Revenue also raised an issue that is related to the taxation of profits. It claims that profits need to be subject to tax in the hands of the joint venture itself, irrespective of whether these profits have been proposed to be taxed via the individual members.

Reliance was placed on the Supreme Court’s ruling in Ch. Achaiah (1996) in support, and the Authority for Advance Rulings decision in Geo-Consultant (AAR). ITAT had rejected the same claim and ruled that the disallowance under section 40(a)(ia) of the IT Act cannot be kept concerning payments of Rs 29.80 crore made by the joint venture.

Mr Vikas T. Khanchandani has appeared for the revenue and cited that the findings of the tribunal were opposite to the law. He claims that, as the contracts were in the joint venture’s name and the payments were credited to its account, the internal reallocation of these contracts between members, which amounts to subcontracting, thereby triggering section 194C.

He claims that profits must be required to be taxed at the joint venture level, and that the tribunal had made a mistake in permitting the disputed expenditure even after these deductions were being restricted under section 40(a)(ia).

For the respondent joint venture, Mr Satish Modi and Ms Aasifa Khan appeared. The division bench post-hearing both sides, including Justice M.S. Sonak and Justice Advait M. Sethna considered the appeal on three questions of law.

Read Also:- Bombay HC: Payments to Consultant Doctors Not Considered Salaries, Subject to TDS U/S 194J

The first is concerned with the applicability of section 194C to joint venture-member arrangements. The second is related to the profit taxability in the joint venture, irrespective of member-level taxation. The third question was whether permitting deductions was correct by the Tribunal under Section 40(a)(ia) of the Income Tax Act.

The Court tagged the appeal with other related matters, including ITXA No. 2444 of 2018, ITXA No. 163 of 2016, ITXA No. 1050 of 2013, ITXA No. 159 of 2016, and ITXA No. 161 of 2016.

The bench directed that the case be listed for final hearing on 12 November 2025. Both parties admit to furnishing a synopsis including the list of rulings they desired to rely on in advance of the hearing.

| Case Title | The Pr Commissioner of Income Tax-3 Pune V/S Mr Subhash & B T Patil And Sons & N V Kharote Construction Pvt. Ltd. JV |

| INCOME TAX APPEAL NO. | 19-ITXA-1426-2018 (OS).DOCX |

| Counsel For Appellant | Mr. Vikas t. Khanchandani |

| Counsel For Respondent | Mr. Satish Modi, a/w Ms. Aasifa Khan |

| Bombay High Court | Read Order |