In June 2019, the GST refund application was originally furnished and has remained unprocessed, as the department claimed that a deficiency memo had been issued. However, it was later determined that this could not be monitored.

The High Court of Delhi has instructed the Goods and Services Tax (GST) Department to process a refund amounting to ₹10.65 lakh, along with the applicable statutory interest. The court emphasised that there were no valid reasons for withholding this claim.

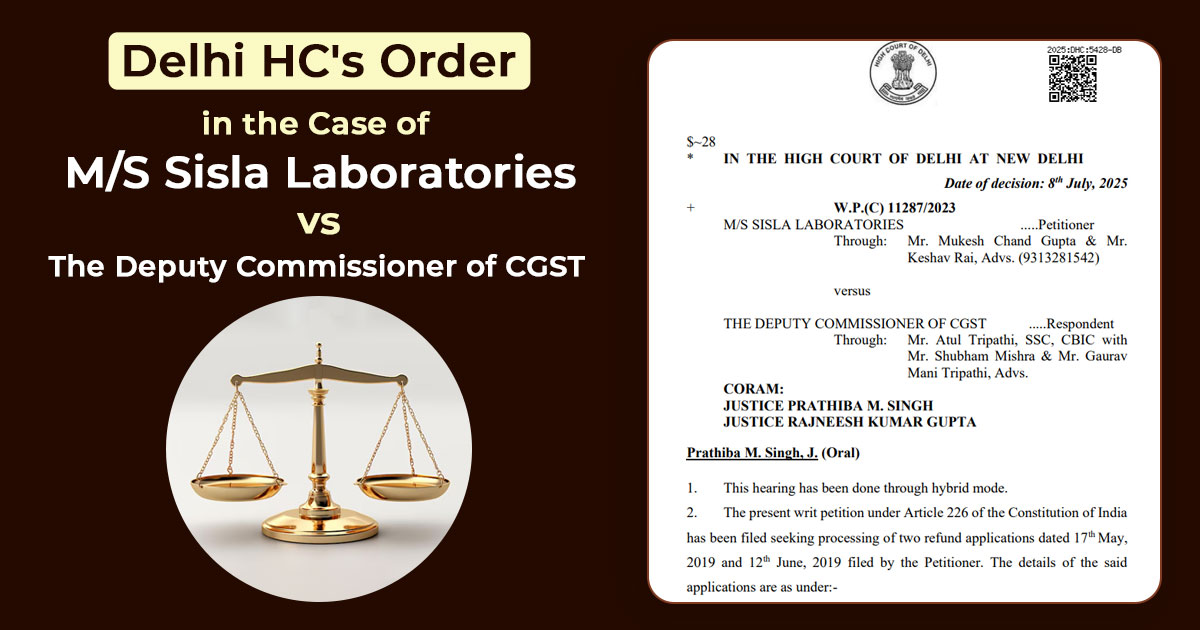

The applicant, Sisla Laboratories, has submitted a writ petition asking to process the two GST refund applications furnished in May and June 2019 for the periods July 2017-March 2018 and June 2018-March 2019. The refunds of ₹9.59 lakh and ₹10.65 lakh were not processed, even after a reminder was sent in 2023, which directed the present petition.

The petitioner’s counsel highlighted that the Department provided information via an additional affidavit indicating that the initial refund application submitted in May 2019 was rejected following a show cause notice and an order issued in 2019. However, it was noted that these relevant documents were not uploaded to the portal, leaving the petitioner unaware of the rejection.

Concerning the second application submitted in June 2019, he cited that the department asserted that the records cannot be monitored, but a deficiency memo has been issued.

The counsel of the department mentioned that the applicant had filed the needed documents for the first application only in October 2023, and the delay was due to the failure of applicant. For the second application, he considered that the department cannot monitor the deficiency memo.

Justice Prathiba M.Singh and Justice Rajneesh Kumar Gupta cited that the refund applications u/s 54 of the CGST Act must be submitted within 2 years from the pertinent date and should comprise the supporting documents till the refund amount is less than Rs 2 lakh.

On finding any deficiency, it must be reported via Form GST RFD-03, and that period shall be excluded from the 2-year limit. After resolving the deficiencies, the refund was processed or rejected accordingly.

The department for the first refund application said that it had issued a SCN and rejection order in 2019. But the applicant mentioned that these were never uploaded on the portal, and no hearing was given.

The court mentioned that the applicant learn about the rejection in February 2025. It permits the applicant to submit an appeal u/s 107 of the CGST Act within 1 month, and seeks that the appeal must be heard on merits without being dismissed as time-barred.

The department for the second application on 12th June 2019 mentioned that a deficiency memo was furnished, though it cannot be traced. The needed documents were filed in October 2023 by the applicant, though the refund was not processed.

Delhi High Court, no reason to keep the refund was there in the absence of a traceable deficiency memo. The department has been told to process the refund, including a regulatory interest, within 2 months and dispose of the petition.

| Case Title | M/S Sisla Laboratories Vs. The Deputy Commissioner of CGST |

| Case No. | W.P.(C) 11287/2023 |

| For Petitioner | Mr. Mukesh Chand Gupta & Mr. Keshav Rai |

| For Respondent | Mr. Atul Tripathi, Mr. Shubham Mishra & Mr. Gaurav Mani Tripathi |

| Delhi High Court | Read Order |

I want to know ITax slab for the FY-1995-96 &1996-97 along with surcharge applicable.pl send it on my email.0