In the context of developments reshaping GST legislation, the Calcutta High Court has denied the state department the authority to proceed with a penalty notice issued under Section 122 of the CGST/WBGST Act, 2017, without prior approval from the court. The order was issued in connection with an investigation conducted under Section 35(6), which pertains to unaccounted supplies of goods or services.

The legality of the notice has been challenged by the applicant, claiming that the statutes do not allow the issuance of a penalty under section 122 after an investigation. It was furnished that as per the CGST structure, before levying any penalty, the officers should first compute and establish the tax obligation under section 73 (for non-fraud cases) or Section 74 (for fraud or suppression). No satisfaction note was recorded u/s 67, a regulatory provision for performing an investigation or confiscating goods.

As the seized goods were obligated for confiscation and hidden books of accounts were recovered in the investigation, the revenue has kept the penalty notice valid.

It is furnished that the goods were supplied before the Ministry of Defence, the High Court asked the applicant to file 20% of the disputed tax as a precondition for the release of the goods. The court, notice issuance u/s 122 was questionable legally, and the proper means of action must have been through Section 73 and 74 proceedings.

For further hearing, the case has been posted for July 2025. The case specifies the significance of due process in GST legislation.

The High Court of Calcutta

The Calcutta High Court, before imposing penalties, the tax authorities should follow the proper regulatory procedures. After a search, a penalty notice has been imposed by the GST department u/s 122; however, the court said that when unaccounted goods or services are discovered, then the law requires the officers to determine the actual obligation under section 73 or 74. The penalties will only be imposed after that.

In this case GST search and seizure operation might get affected. It specifies the significance of the following due process and not utilising the penalty provisions as a shortcut.

Implications of the Ruling

The interim order and observations of the court can have far-reaching effects for both tax administrators and businesses:

Effect on continuous and future analyses: Now, the departments again need to think of their standard operating process to ensure that penalty notices are not issued prematurely. Businesses in the existing cases may contest the penalty notices that overlook the assessment phases.

Standardising approach across jurisdictions: Inconsistencies are cited under the case in how distinct GST field officers interpret and apply the provisions like Sections 35(6), 67, 73, 74, and 122. The authorities can be forced to choose a uniform, codified enforcement procedure under a clear judicial interpretation.

Read Also: GSTN New Simple Option for Searching GST e-Invoice/IRN

Improves rights of taxpayers: If carried in the final orders, then the ruling can make the legal safeguards stronger for taxpayers in investigation procedures, particularly relevant for confiscation of goods and levying of penalties.

Curbing incidental enforcement: By implementing the sequence of assessment before penalty imposition, as per the ruling, averts the misuse of the penalty provisions. The chances where businesses encounter financial struggle can diminish due to the premature or excessive penalties.

The same can set a precedent for courts in India to analyse the identical disputes, which makes the same a potentially watershed moment for GST administration jurisprudence.

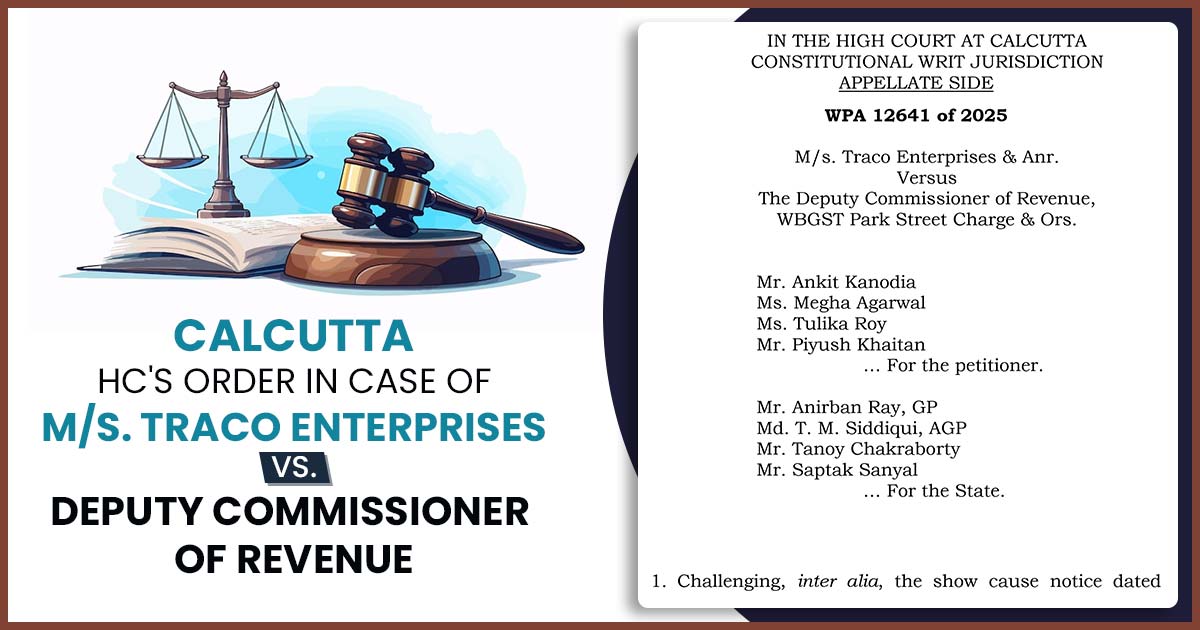

| Case Title | M/s. Traco Enterprises vs. Deputy Commissioner of Revenue |

| Case No. | WPA 12641 of 2025 |

| For Petitioner | Mr. Ankit Kanodia, Ms. Megha Agarwal, Ms. Tulika Roy, Mr. Piyush Khaitan |

| For Respondent | Mr. Anirban Ray, Md. T. M. Siddiqui, Mr. Tanoy Chakraborty, Mr. Saptak Sanyal |

| Calcutta High Court | Read Order |