The Delhi High Court noted that a GST demand raised against a taxpayer regarding availing of ITC and the utilisation case prima facie includes a double demand.

The applicant has been furnished with the freedom by a division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta to approach the Appellate Authority against such demand, and exempt predeposit qua the demand of ineligible GST ITC.

It said that, “On a prima facie view, it appears that there would be duplication of two demands as demand qua reversal of availed ITC and demand qua utilisation of ITC would be the same thing. But both have been separately demanded in the impugned order.”

The applicant is engaged in running a sweetmeat shop and a restaurant. It had contested an order raising demand of an ineligible ITC of Rs 11,47,55,615/- used for releasing outward tax liability for the financial year 2017-18 to 2022-23 and Rs 14,94,27,762/- ineligible ITC for the FY 2017-18, among other grounds.

The demand reason for the department is that the restaurant does not allow taking GST input tax credit (ITC), as the GST imposed on restaurants is just 5%.

Applicant, a double demand has been raised by the department initially by using the ITC taken and secondly by not permitting the ITC which has been taken.

Read Also: No Fresh GST ITC Demand Without GSTN Verification if Reversal Done Before SCN

Confirming the High Court allowed the applicant to file an appeal against the demand without making a pre-deposit qua demand for ineligible ITC of Rs 11,47,55,615.

“If any deposits have already been made by the Petitioner, adjustment thereof shall be given qua the pre-deposit,” it added and disposed of the matter.

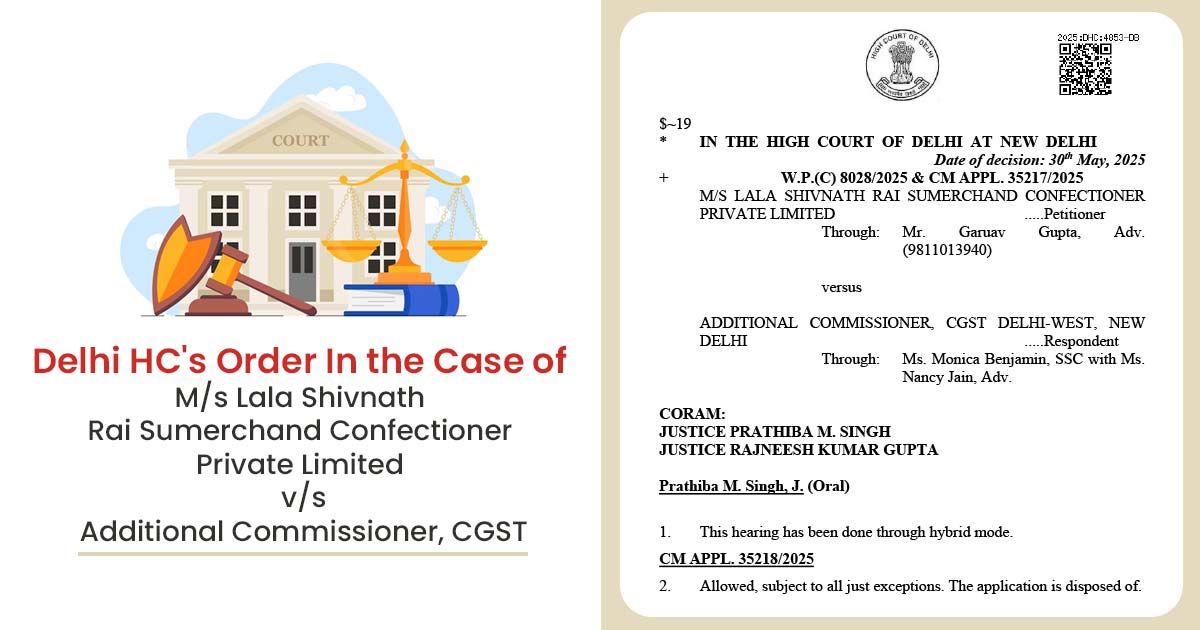

| Case Title | M/s Lala Shivnath Rai Sumerchand Confectioner Private Limited vs. Additional Commissioner, CGST |

| Case No. | W.P.(C) 8028/2025 |

| For Petitioner | Mr. Garuav Gupta |

| For Respondent | Ms. Monica Benjamin, Ms. Nancy Jain |

| Delhi High Court | Read Order |