The Delhi High Court has ruled that claiming Input Tax Credit (ITC) under the Goods and Services Tax (GST) system in a dishonest way, especially when there hasn’t been any real supply of goods or services, goes against the very purpose of the ITC program. This practice not only undermines the system but also compromises its integrity.

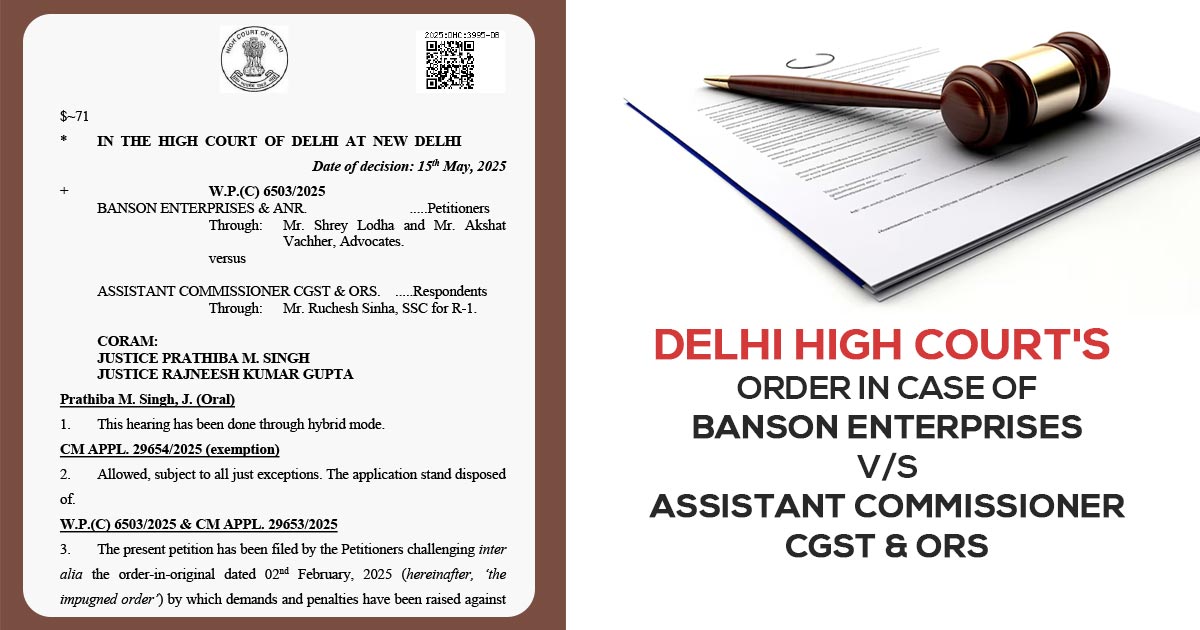

Banson Enterprises submitted the petition contesting an order-in-original dated February 2, 2025, which levied demands and penalties as per the findings that the applicant had issued goods-less invoices to ease incorrect GST ITC claims.

It was alleged by the department that the applicant had taken the ITC of more than Rs. 1.85 crores via invoices not supported by the genuine supply. The supply of goods less invoices of taxable value 45,04,500/- to one M/s Saraswati Printers during the Central Excise period, i.e., from 30th June, 2016 to 21st March, 2017, is admitted by the applicant no.2.

The court discovered no merit in the claims for practising applicants’ extraordinary writ jurisdiction, even after it contends for the procedural lapses under rule 142 of the CGST Rules, like the absence of appropriate authorization to issue the Show cause notice, lack of pre-consultation, and the issuance of a consolidated notice for multiple years.

The court referred to Mukesh Kumar Garg vs. Union of India and cited the seriousness of these ITC frauds, remarking that authorising these practices can cause “a massive dent in the GST regime.”

The bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta, section 16 of the CGST Act, which provides for ITC, is made to assist fair business transactions and does not get misapplied for financial gain via false or non-existent supply chains.

The High Court, while delivering judgment, cited that “The nature of the allegation against the Petitioner in the present case, as is clear from the SCN as also the impugned order, is that the Petitioner, in collusion with other entities has taken substantial benefit of ITC without sale of any goods or services. This strikes at the root of the Input Tax Credit facility, which is recognised in the GST regime.”

In the previous tax regime, it was admitted by the applicant’s own director that it had issued the invoices without movement of goods, which depletes their case, the court said.

The HC concludes that there is no breach of natural justice, as the applicant has been furnished with an appropriate chance to answer and be heard. Under Article 226, the petition was dismissed with the opportunity granted to the applicant to submit a plea to the GST appellate authority u/s 107 of the CGST Act. Based on merits, the appeal will be adjudicated and will not be dismissed based on limitation.

| Case Title | Banson Enterprises vs. Assistant Commissioner CGST & ORS |

| Citation | W.P.(C) 6503/2025 |

| Counsel For Appellant | Mr. Shrey Lodha and Mr. Akshat Vachher, Advocates |

| Counsel For Respondent | Mr. Ruchesh Sinha, SSC for R-1 |

| Delhi High Court | Read Order |