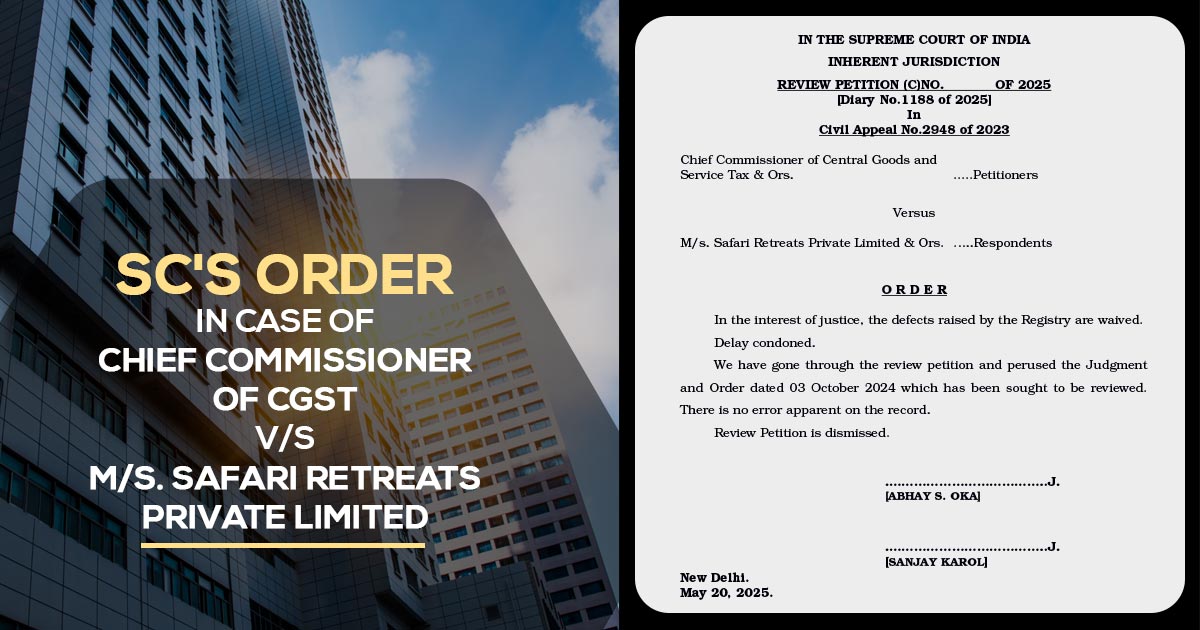

A review petition filed by the Chief Commissioner of Central Goods and Services Tax (CGST) against the 2024 ruling in the case of Safari Retreats Private Limited has been dismissed by the Supreme Court of India.

The earlier decision of the Supreme Court has been contested by the review appeal on October 3, 2024, but was rejected on the grounds of no error apparent on the record.

The case recorded under Civil Appeal No. 2948 of 2023 revolves around the ITC eligibility under the GST law for properties made for leasing purposes. The legal questions of the case were not revisited in the latest order of the court; the review petition dismissal kept the original verdict that had implications for real estate and leasing businesses under GST.

Justices Abhay S. Oka and Sanjay Karol, presiding over the review petition (Diary No. 1188/2025), marked that the raised defects of the Registry were exempted in the interest of justice, and the delay in filing the review was condoned. The bench post examining the petition and the original ruling concluded that no merit was there to authenticate a review.

The updated ruling seems to draw a legal closure to the long-running problem between the GST department and the Safari Retreats and shall be seen via the companies involved in the real estate leasing, particularly those asking for the GST ITC advantages on the expenses of construction.

The dismissal supports the significance of the finality of the Apex court rulings and restricts the avenues for reopening settled problems unless there is an error on record, legal experts recommend.

The submitted applications with the review petition, one for condonation of delay and another asking for waiver from submitting a certified copy of the impugned ruling, were also disposed of after the dismissal.

| Case Title | Chief Commissioner of CGST vs. M/s. Safari Retreats Private Limited |

| Order No. | Civil Appeal No.2948 of 2023 |

| Supreme Court Order | Read Order |