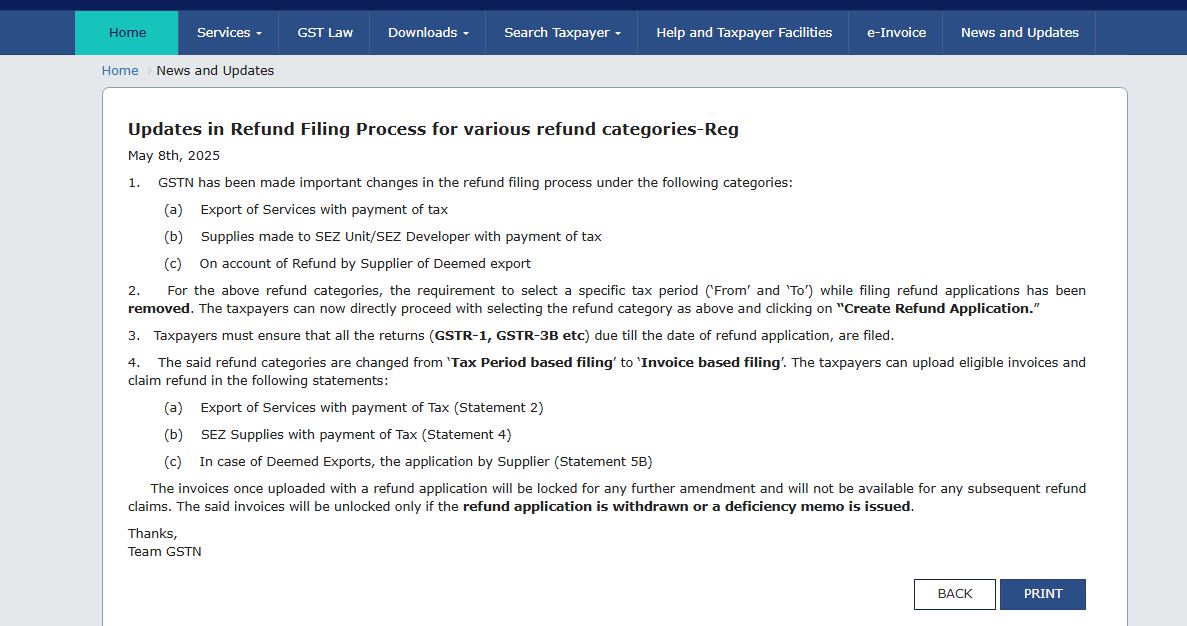

GSTN has announced an important update in several areas to make easy GST refund filing process easier in the following categories-

- Supplies made to SEZ Unit/SEZ Developer with payment of tax

- Export of Services with payment of tax

- GST Refund by Supplier of Deemed Exports

Key Highlights

Here are the major key highlights of the GST refund filing process in different categories:-

Tax Compliance Pre-filing

All pertinent GST returns (GSTR-1, GSTR-3B, etc.) are to be filed up to the refund application date.

Reduction of Tax Period Selection

While filing refund applications below these categories, the taxpayers are no longer required to choose the particular tax period (From and To). Directly, they can choose the refund category and tap on “Create Refund Application” to proceed.

Move to Invoice-Based Filing

From a tax period-based filing system to an invoice-based filing system, these GST refund categories have shifted. The taxpayers could upload the eligible invoices in the respective statements as follows-

- Export of Services with payment of tax → Statement 2

- SEZ Supplies with payment of tax → Statement 4

- Deemed Exports (application by supplier) → Statement 5B

Important Points of GST Refund

After uploading the invoices with the refund application, they shall be locked and unavailable for revisions or subsequent refund claims. If the refund application is withdrawn or a deficiency memo is furnished, then they will be unlocked.