The Delhi High Court, an order cancelling the GST registration of a trader with retrospective effect shall not be upheld until the Show cause notice preceding this decision shows both the reasons and the objective of the authority for the retrospective cancellation.

A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar noted that “in the absence of reasons having been assigned in the original Show cause notice (SCN) in support of a proposed retrospective cancellation as well as a failure to place the petitioner on prior notice of such an intent clearly invalidates the impugned action.”

The Court was dealing with the case of a Limited Liability Partnership whose GST registration was cancelled under 29 of the Central Goods and Service Tax Act, 2017, with retrospective effect from 09 November 2017.

The applicant approached the HC in its writ jurisdiction after the dismissal of its plea via the Additional Commissioner of GST.

The HC at the outset marked that neither the SCN nor the final order alluded to any material based on which the authority made the view that Section 29(2)(e) of the GST Act was breached.

The provision allows the GST registration cancellation if obtained via fraud, wilful misstatement or suppression of facts. The documents did not even display the objective of the proposed retrospective cancellation of the applicant’s GST registration.

The High Court, in this backdrop, has set aside the impugned order. It mentioned Riddhi Siddhi Enterprises vs. Commissioner of Goods and Services Tax (CGST), South Delhi & Anr. (2024), where a coordinate bench of the High Court had held that mere conferral of power to cancel GST registration with retrospective effect u/s 29 of the Goods and Services Tax Act 2017 would not explain a revocation.

It was ruled that “The order under Section 29(2) must itself reflect the reasons which may have weighed upon the respondents to cancel registration with retrospective effect. Given the deleterious consequences which would ensue and accompany a retroactive cancellation makes it is all the more vital that the order be reasoned and demonstrative of due application of mind.”

The petition was permitted with liberty to the department to move against the applicant merely after duly apprising it of the material based on which that view u/s 29(2)(e) is constituted.

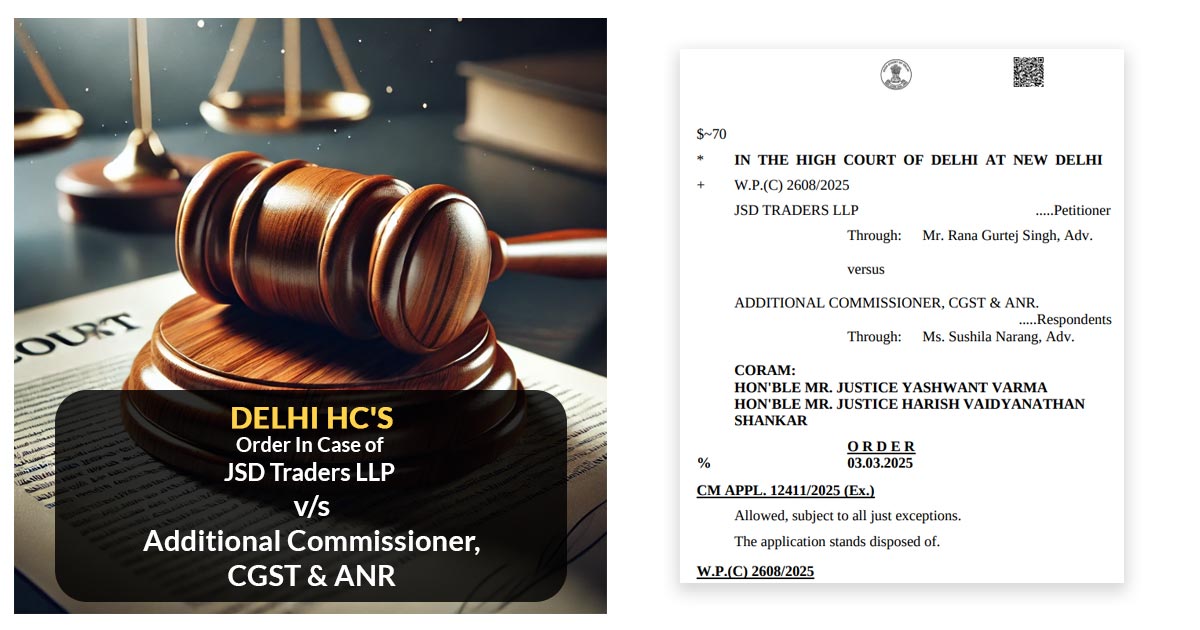

| Case Title | JSD Traders LLP vs. Additional Commissioner, CGST & ANR |

| Citation | W.P.(C) 2608/2025 |

| Date | 03.03.2025 |

| Counsel For Appellant | Mr. Rana Gurtej Singh, Adv. |

| Counsel For Respondent | Ms. Sushila Narang, Adv. |

| Delhi High Court | Read Order |