The Supreme Court has upheld the constitutional validity of Sections 69 and 70 of the Goods and Services Tax Act, which grant the power to arrest and summon.

The Constitutionality of these provisions was contested on the basis that the Parliament does not have the legislative competence to legislate them.

It was claimed by the applicant that Article 246-A of the Constitution while granting legislative powers to Parliament and State Legislatures to levy and collect GST, does not authorize the breach thereof to be made criminal offences.

Directing to Entry 93 of List I to the Seventh Schedule, it was submitted that the Parliament can enact criminal provisions only for the matters in List I. It was claimed that the power to summon, arrest and prosecute is not ancillary and incidental to the authority of imposing GST and hence is beyond the legislative competence of the Parliament under Article 246-A of the Constitution.

The bench denying these claims consisting of Chief Justice of India Sanjiv Khanna, Justice MM Sundresh and Justice Bela M Trivedi ruled that the provisions are traceable to Article 246-A, which is a special provision specifying the source of power and the field of legislation for the Parliament and the State Legislature concerning GST.

“The Parliament, under Article 246-A of the Constitution, has the power to make laws regarding GST and, as a necessary corollary, enact provisions against tax evasion. Article 246-A of the Constitution is a comprehensive provision and the doctrine of pith and substance applies. The impugned provisions lay down the power to summon and arrest, powers necessary for the effective levy and collection of GST. Time and again this Court has held that while deciding the issue of legislative competence, entries should not be read in a narrow or pedantic sense but given their broadest meaning and the widest amplitude because they are intrinsic to a machinery of government,” the Court observed.

Read Also: SC Rejects Anticipatory Bail in GST Summons Case U/S 69, Grants Interim Protection

The judgment authored by CJI Sanjiv Khanna expressed:

“Thus, a penalty or prosecution mechanism for the levy and collection of GST, and for checking its evasion, is a permissible exercise of legislative power. The GST Acts, in pith and substance, pertain to Article 246-A of the Constitution, and the powers to summon, arrest and prosecute are ancillary and incidental to the power to levy and collect goods and services tax. In view of the aforesaid, the vires challenge to Sections 69 and 70 of the GST Acts must fail and is accordingly rejected.”

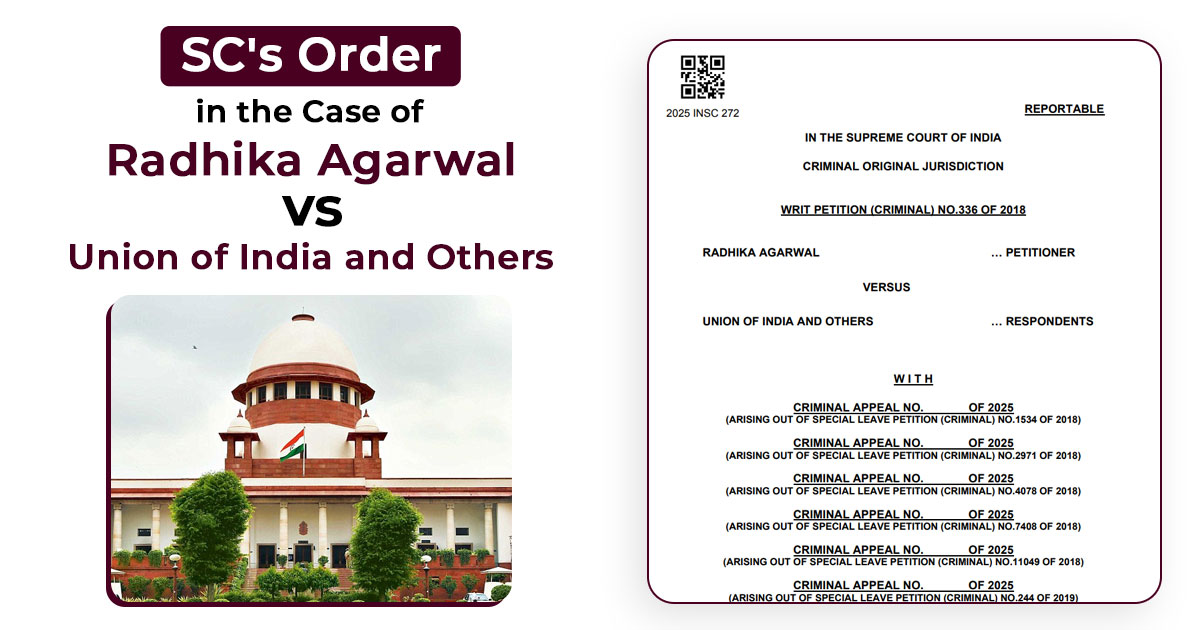

| Case Title | Radhika Agarwal vs. Union of India and Others |

| Citation | WRIT PETITION (CRIMINAL) NO.336 OF 2018 |

| Date | 27.02.2025 |

| Counsel For Petitioner | Radhika Agarwal |

| Supreme Court | Read Order |