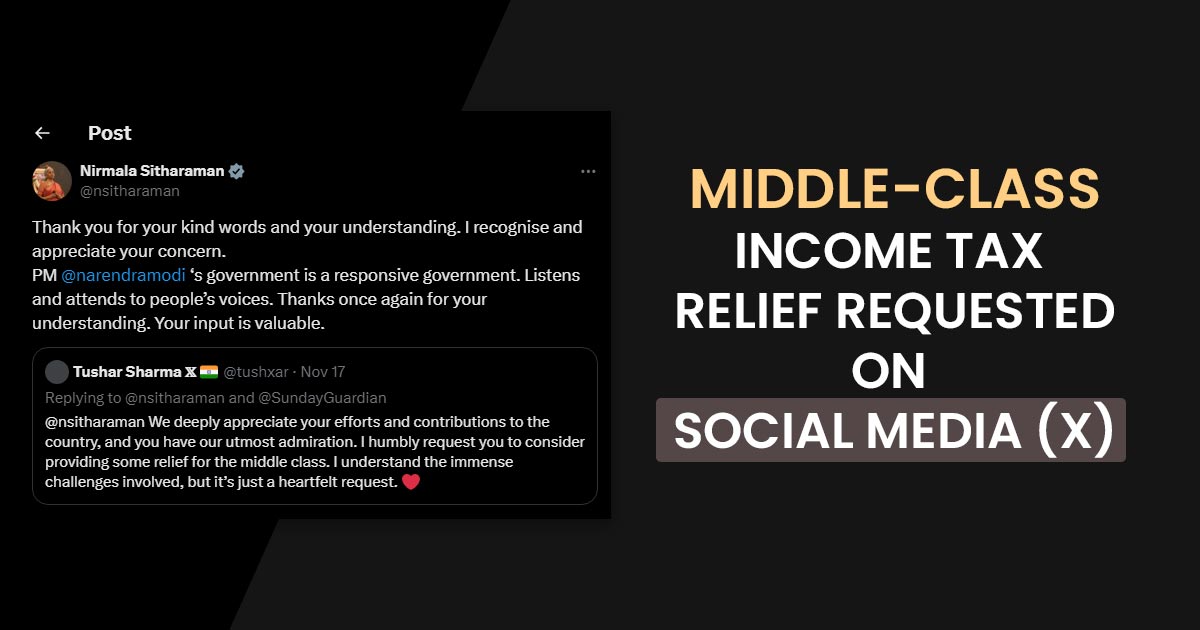

Union Finance Minister Nirmala Sitharaman addressed the user’s concern who questioned the financial pressure on the middle-class people of India. For various decades, the country has been supported by these middle-class people which contributes highly in terms of taxes and spending.

On the X platform, the user has tagged Sitharaman and requested certain relief for the same group since they suffer economic issues, particularly with loads of income tax and GST.

The concern of the user has been considered by Sitharaman and appreciated her input. She mentioned that the government has already observed the voices of the people and ensured efforts for the solution of their problems. She cited “Your input is valuable,” outlining the measures via the government to ease the middle class and assist them in coming out from these issues.

A small fraction of people in India is middle class i.e. 2% which has a significant role in the economic system of India. However, this is the part of the population on which levies such as income tax and GST on their savings and expenditures are imposed. In the middle class, taxation has been a problem of discussion from so many years. Many people are asking for the relief.

On the salaried classes, especially the middle class the Union Budget for 2024 has supported reducing the impact. For example, from Rs 50,000 to Rs 75,000 the standard deduction has been enhanced which saves an additional Rs 17500 for assessees.

Till now, as relief is concerned many people sense that there is more that can be provided at present, with the rise in the cost of living at present in the world scenario.

As per the data of 2023, it has been notified that merely 1.6% of the people of India which is nearly 2.24 crore individuals merely filed the taxes in 2022-23. But the government concentrates on the direct taxes income tax and corporate tax. Hence the indirect tax reduction provides a newer opinion on the future of the country.

The government’s answer to the middle-class perspective associated with existing initiatives asserts that the government does not overlook its efforts to reduce the issues of the middle class as the 2024 elections approach.