It was cited by the Bombay High Court that the rejection of the refund order has passed without hearing the chance that breaches rule 92(3) of CGST Rules, 2017 and principles of natural justice.

The Bench of Justices M. S. Sonak and Jitendra Jain marked that “……in any event, proviso to Rule 92(3) of the CGST Rules, 2017, contemplates reasonable opportunity to be heard, implying that such hearing should be after the assessee files the reply within the time prescribed in the show cause notice.”

Rule 92(3) of the CGST Rules, 2017 furnishes that no application for the refund will be rejected without furnishing the petitioner a chance of being heard.

A SCN has been received by the taxpayer/applicant granting 15 days to elaborate why their refund application must not get rejected. The taxpayer in answer to that has furnished a response dated 16.04.2024 which was uploaded to the website of the department. The rejection of the refund orders was uploaded thereafter dated 25.04.2024. Such orders did not cite any personal hearing as mandated under Rule 92(3) of the CGST Rules, 2017.

A petition has been submitted by the taxpayer to the Bombay High Court contesting the refund rejection orders published on the website of the department dated 25.04.2024.

It was marked under the bench that the SCN furnished before the taxpayer furnishes the taxpayer 15 days to answer. As per that, they do not answer by 17.04.2024. Hence it is not understandable how a hearing was allegedly given dated 08.04.2024.

It was refused by the taxpayer that any hearing was ever provided. The Show cause notice (SCN) indeed mentioned that the date and time of the hearing shall be intimated before the taxpayer. For such intimation, no clear proof is there.

The bench then cited that in any case proviso to Rule 92(3) of the CGST Rules, 2017, concerns the reasonable chance to be heard which implies that these hearings must be after the taxpayer furnishes the response within the said time in the SCN.

“the impugned refund rejection orders are in breach of the requirements of Rule 92(3) of the CGST Rules, 2017 and the principles of natural justice and fair play” added the bench.

Read Also: Bombay HC Quashes Rejection Order for Voluntary GST Cancellation Due to Lack of Stated Reasons

The bench in the aforesaid view has quashes the refund rejection order and remanded the matter to the department to reconsider the refund application of the taxpayer rendering the department to furnish the taxpayer a fair hearing.

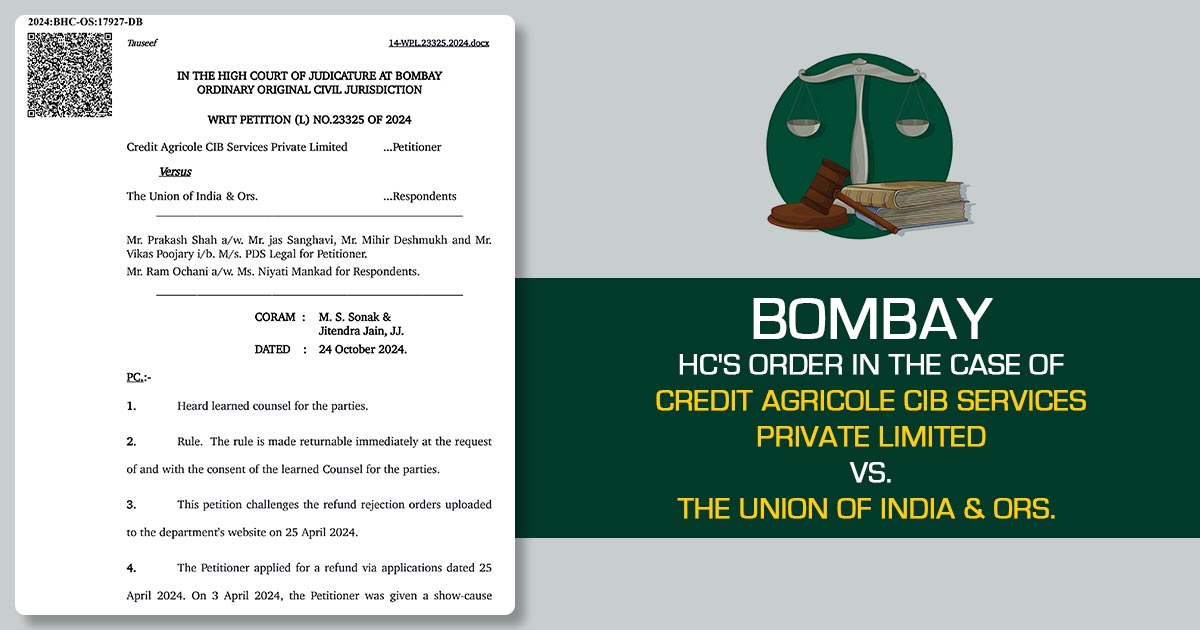

| Case Title | Credit Agricole CIB Services Private Limited vs. The Union of India & Ors |

| Citation | WRIT PETITION (L) NO.23325 OF 2024 |

| Date | 24.10.2024 |

| For Petitioner | Mr. Prakash Shah, Mr. jas Sanghavi, Mr. Mihir Deshmukh and Mr.Vikas Poojary |

| For Respondents | Mr. Ram Ochani, Ms. Niyati Mankad |

| Bombay High Court | Read Order |