Rajasthan’s Authority for Advance Ruling (RAAR) carried that Goods & Services Tax (GST) on corporations from overseas group entity liable to get paid merely one time, not periodically. Experts cited that the ruling is in line with the circular, for the entire duration of the guarantee it has the challenge of filing the full tax.

It is crucial to pay the GST under the reverse charge mechanism (RCM) at one time and not periodically for the guarantee has been furnished only once and is valid for a particular duration of time without any periodical renewal (until the final settlement date of loan contract with Bank/Financial Institution), RAAR expressed in a recent ruling.

For the concern, the AAR discovered section 13(3) of GST rules as crucial to finding the time of supply. It can express that where no consideration is charged for CG by the service supplier (overseas pertinent party in the same case) the time of supply will be the date of entry in the books of account of the service receiver that is an Indian subsidiary and only for one time the GST obligation is mandated to get paid at the time of supply under RCM.

As per that it specified that the question of GST return filing periodically would not emerge since GST is needed to get filed at one time of import of service, also it expresses the concern on the value of supply.

The same advance ruling complies with the Circular that has been issued previously where the GST is required to be paid only once during the issuance of a corporate guarantee. To pay full tax upfront for the entire duration of the guarantee is a challenge for the industry i.e. if the corporate guarantee is for 5 years then embracing the valuation rule, tax shall be required to get filed at 5%.

If the guarantee is withdrawn during the tenure of 5 years, after the upfront payment of tax, the same shall become challenging. There is an 18% GST levied on the parent company’s corporate guarantee to its subsidiary for a bank, the GST council suggested dated October 7, 2023.

In a notification, CBIC on October 27, 2023, cited that the value of supply of services via a supplier to a receiver who is a related person through the way of furnishing a corporate guarantee to any banking company or financial institution on behalf of the mentioned receiver, would be considered to be 1% of the amount of guarantee proposed, or the actual consideration, whichever is higher.

It directed that if the corporate guarantee were Rs 100 crore, then Rs 18 lakh shall be the obligation of GST. The amendment will be futuristic and the same would have no bearing on transactions implemented before October 26, 2023, therefore preserving the tax risk related to the past transactions.

Last October after the GST council meeting it was mentioned that no consideration is been filed via the company to the director in any form, directly or indirectly for furnishing a personal guarantee to the bank/financial institutions on their behalf, the open market value of the mentioned transaction/supply might be considered as zero.

The same is referred that no GST will be there if a director furnishes a personal guarantee for a loan via a bank or any financial institution to their own company.

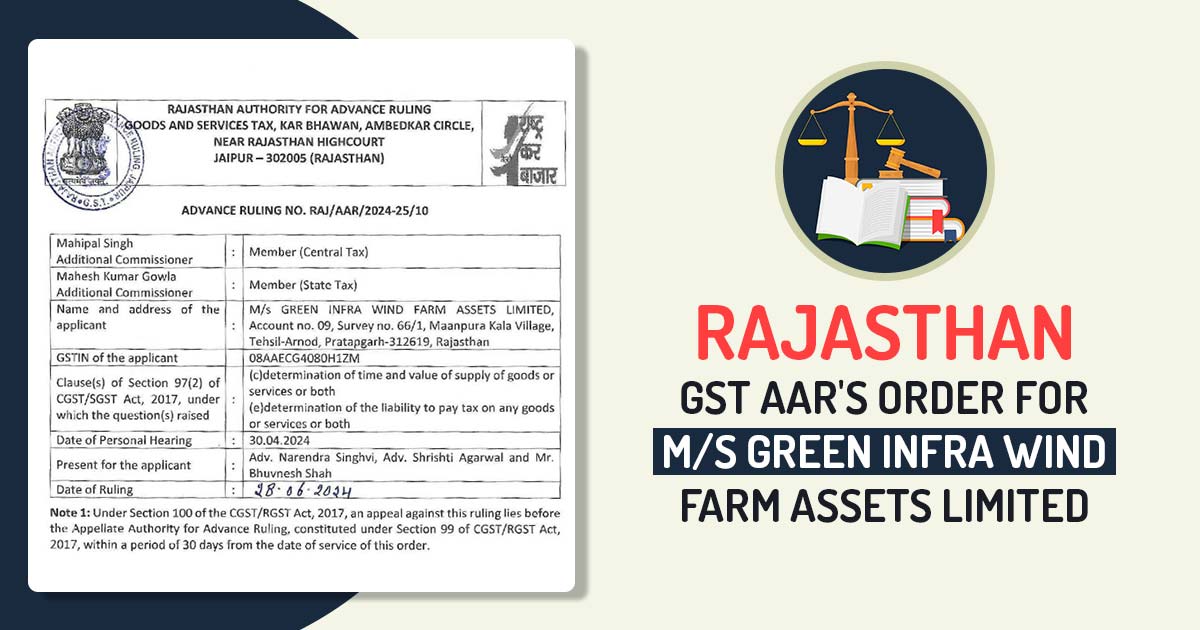

| Name of Applicant | M/s Green Infra Wind Farm Assets Limited |

| Advance Ruling No. | RAJ/AAR/2024-25/10 |

| Date | 02.07.2024 |

| GSTIN of Appellant | 08AAECG4080H1ZM |

| Present of Appellant | Narender Singhvi, Shrishi Agarwal, Bhuvnesh Shah |

| Rajasthan GST AAR | Read Order |