It was carried by the Kerala High Court that the initiation of an inquiry or the summons issuance u/s 70 of the CGST Act could not be regarded to be the initiation of proceedings for the objective of section 6(2)(b) of the CGST Act.

The Bench of Justice Gopinath P. noted that the term ‘initiation of any proceedings’ is a reference to the issuance of a notice under the provisions of the CGST/SGST Acts and the initiation of an inquiry or the issuance of summons u/s 70 of the CGST/SGST Acts cannot be considered to be initiation of proceedings for Section 6(2)(b) of the CGST/SGST Acts.

Section 70 of the Central Goods and Services Tax Act, 2017 specifies the law for the power of the officer to summon any individual before them to furnish the proof in the form of documents for any case.

Separate initiation of proceedings on the same subject matter by the proper officer under the C.G.S.T is been restricted by Section 6(2)(b) of the Central Goods and Services Tax Act, 2017. When on the same subject matter the proceedings by the proper officer under the state act have been started whereas Section 70 of the C.G.S.T Act.

The proper officer in the same case under the Central Goods and Services Tax Act, 2017 started an inquiry for not filing the GST and asked for the production of specific records, it was followed by issued summons u/s 70 of the CGST act. Therefore, the state authority started proceedings u/s 74 read with Section 122(1) of the CGST/SGST Acts.

It was argued by the taxpayer/applicant that the proceedings started via the state authority are non-sustainable u/s 6 of the CGST/SGST Acts. As per them once the proceedings are started via one authority then they should be concluded via that authority.

The assessee argues that since the Central Authority began proceedings in 2018 such as issuing summons and recording statements only it had the authority to issue a show cause notice (SCN) under Section 74, and not the State Authority.

It is been referred from the department to the matter of GK Trading Company v. Union of India and others and furnished that the term ‘initiation of proceedings’ in Section 6 needs to be interpreted as the start of the proceedings via the issuance of the notice and any inquiry or summons furnished for the inquiry could not be considered to be the start of the proceedings.

After referring to Section 6(2) of the CGST Act, the bench noted that proper officer under the state goods and services tax act or union territory goods and services tax act has started any proceedings on a subject matter, there will be no proceedings that would be initiated via the proper officer under the CGST act on the identical subject matter.

The bench disagreeing with the taxpayer’s contentions remarked “The term ‘initiation of any proceedings’ is no doubt a reference to the issuance of a notice under the provisions of the CGST/SGST Acts and the initiation of an inquiry or the issuance of summons under Section 70 of the CGST/SGST Acts cannot be deemed to be initiation of proceedings for the purpose of Section 6(2)(b) of the CGST/SGST Acts.”

The bench directed to the case of G.K Trading Company v. Union of India and others [AIRONLINE 2020 ALL 2678] where it was ruled that “………The word “inquiry” in Section 70 has a special connotation and a specific purpose to summon any person whose attendance may be considered necessary by the proper officer either to give evidence or to produce a document or any other thing. It cannot be intermixed with some statutory steps which may precede or may ensue upon the making of the inquiry or conclusion of the inquiry. The process of inquiry under Section 70 is specific and unified by the very purpose for which provisions of Chapter XIV of the Act confer power upon the proper officer to hold an inquiry. The word “inquiry” in Section 70 is not synonymous with the word “proceedings”, in Section 6(2)(b) of the U.P.G.S.T. Act/ C.G.S.T. Act.”

Read Also: Karnataka HC: ‘Self-ascertainment’ Recovery Under GST Section 74 Violates Article 265

Form Overview

The circular does not seem to be in tune with the clear definition of the legal provisions of Section 6(2)(b) as elaborated by the Allahabad High Court in G.K Trading Company v. Union of India and others, the bench cited.

The bench in the aforementioned provision dismissed the petition.

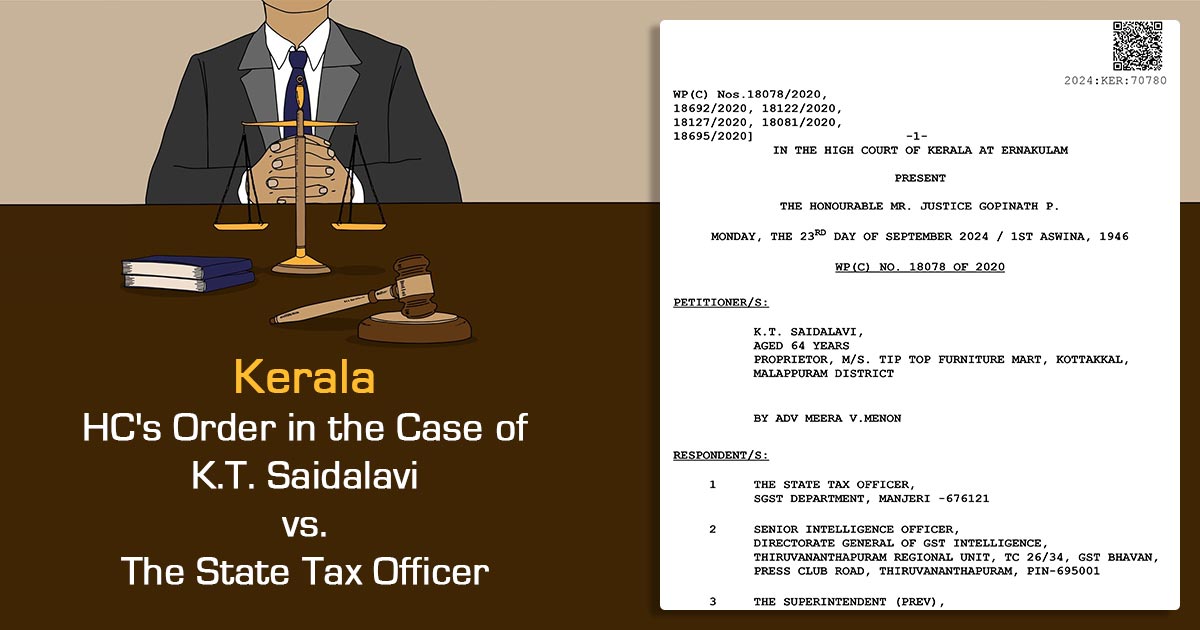

| Case Title | K.T. Saidalavi vs. The State Tax Officer |

| Citation | WP(C) NO. 18078 OF 2020 |

| Date | 23.09.2024 |

| Counsel For Petitioner | Meera V. Menon |

| Counsel For Respondent | Smt. Sheela Devi, Shri. Jagath. N. |

| Kerala High Court | Read Order |