The West Bengal Bench of Authority for Advance Ruling (AAR), GST cannot be imposed on Comprehensive Water Supply Planning Services.

In this case, the petitioner is Shyama Chatterjee, who has the business under the name Setech India. The petitioner had been granted contracts from various local bodies/municipalities to conduct design, surveys, estimate, sketch, and prepare comprehensive plans for their water supply schemes.

The petitioner had approached the Authority for Advance Ruling (AAR) towards whether the above-mentioned services furnished by the petitioner counted beneath the pure services and would be waived from Goods and Service Tax (GST).

Hence the problem in the matter is that if the services furnished via the petitioner are applicable for the waiving from GST and if the services furnished via the petitioner are pertinent to the functions assigned to the panchayat under Article 243G or a municipality under Article 243W of the Indian Constitution.

It was furnished by the petitioner to the AAR that the services furnished through him for the survey, design, drawing, estimate, and preparation of detailed reports concerning water supply schemes in rural or municipal areas don’t concern any kind of supply of goods.

Read Also: Work Concluded Under Jal Jeevan Mission by GoI Before 2022 is GST Exempt

It was remarked by the bench that while directing to the 11th and 12th Schedule of the Indian Constitution, the operations entrusted to a panchayat or municipality comprise operations such as drinking water or water supply for domestic, industrial, and commercial purposes.

Also, the bench noted that the services of the applicant for surveying, estimating, drawing, designing, and preparing complete plans for the water supply projects would counted under the eleventh and/or Twelfth Schedule concerning functions entrusted to a panchayat under Article 243G and/or to a municipality under article 243W of the Indian Constitution.

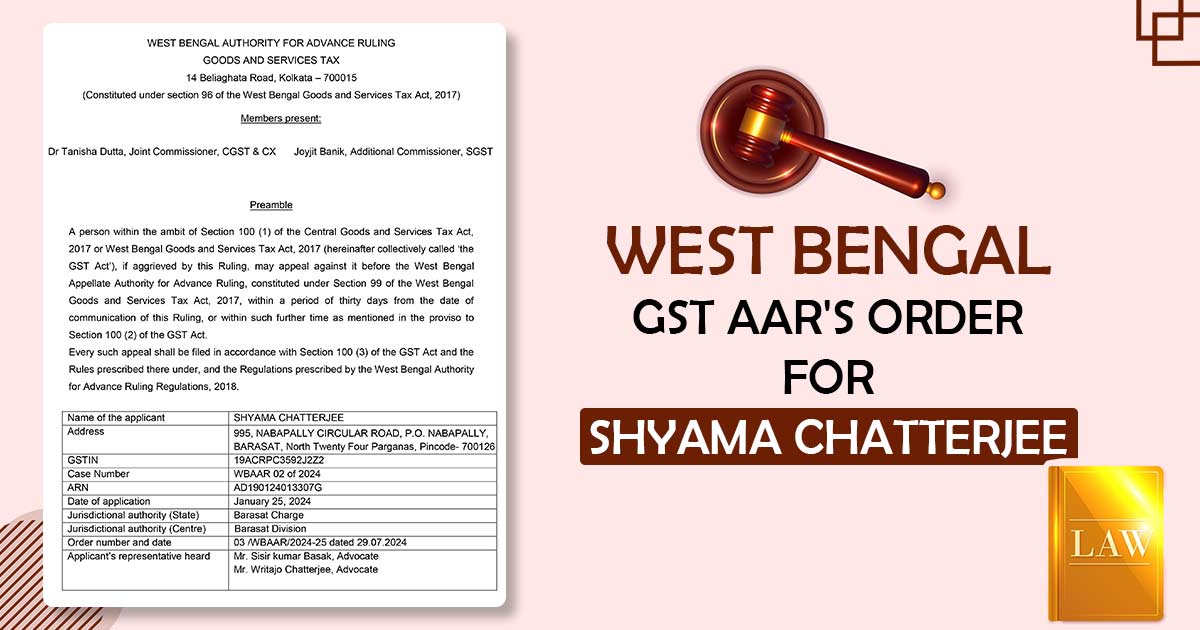

The bench, Dr Tanisha Dutta ( Joint Commissioner, CGST & CX ) and Joyjit Banik ( Additional Commissioner) ruled that the petitioner is not included in paying taxes on supplies made for the estimate, drawing, design, survey, and preparation of a complete plan pertinent to water supply schemes to the state government and the local authorities.

| Name of Applicant | Shyama Chatterjee |

| Case Number | WBAAR 02 of 2024 |

| GSTIN | 19ACRPC3592J2Z2 |

| Date | 29.07.2024 |

| Applicant Representative | Mr. Sisir Kumar Basak, Mr. Writajo Chatterjee |

| West Bengal GST AAR | Read Order |