For functions under Section 78 of the GST Act, the Assam government has designated GST officials. According to Section 78 of the Assam Goods and Service Tax Act, the liable amount is to be filed via a taxable individual in pursuance of an order passed under this Act would be paid by such person within three months from the date of service of such order; failing which, recovery proceedings would get initiated.

Given that where the proper officer regarded it suitable in the context of revenue, he might, for causes to be recorded in writing need the mentioned taxable individual to do these payments within this duration in less than 3 months as specified through him.

The Assam Government order stated as follows:

Following Clause (91) of Section 2 of the Assam Goods and Services Tax Act, 2017 (Assam Act XXVII of 2017), and subject to sub-sections (1) and (3) of Section 5 of the same Act, the Principal Commissioner of State Tax, Assam, has partially amended Office Order No. 1/2021 dated January 2, 2021.

Read Also: Assam Govt Notifies Instruction No. 13/2023 Regarding DRC 01

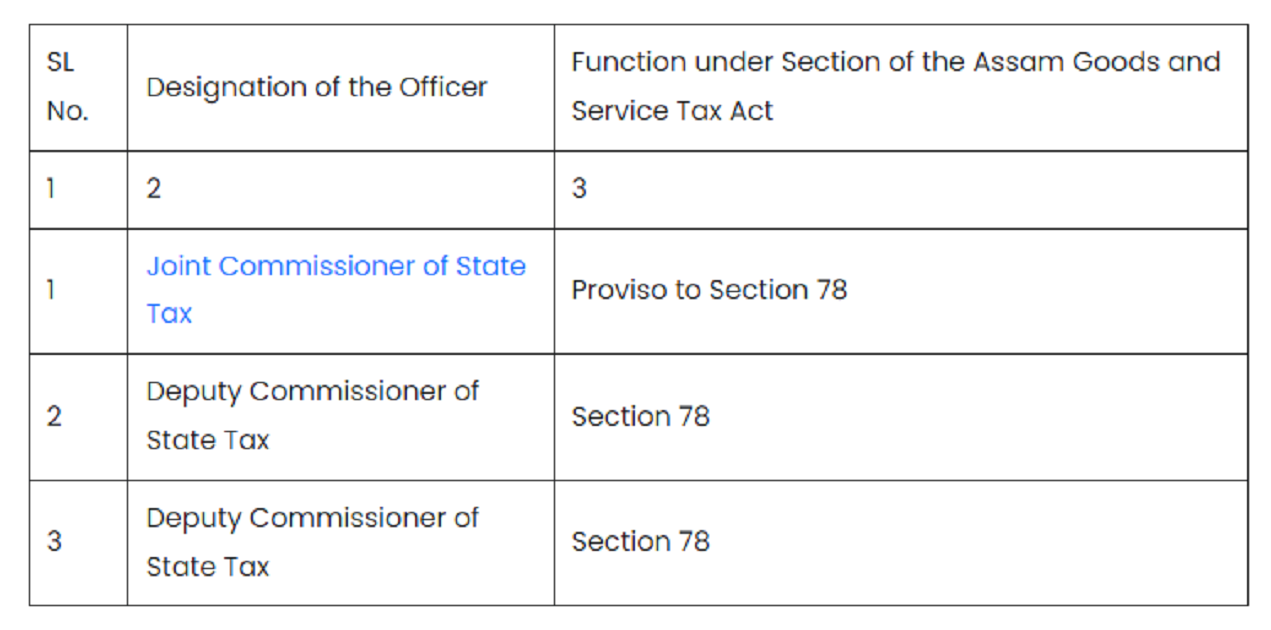

The same modification, published in the Assam Gazette, Extraordinary, No. 13, on January 5, 2021, withdraws the authority granted to the officers listed in Column (2) of the table below to practice the specific powers under the sections of the Act cited in Column (3) of the table:-