The Madras High Court has asked the State Tax Officer (STO) to re-adjudicate a demand order issued to the applicant for not regarding the Goods and Services Tax GST annual return in Form GSTR-9 filed dated 30.09.2020 for the assessment period 2018-19.

Tvl Sri Sakthi Steel filed the writ petition contesting a GST demand order issued against them dated February 28, 2023. The applicant claimed that the order, which originated from proceedings started by a SCN on December 13, 2022, failed to regard their annual return filed for the 2018-19 assessment period.

As per the petition, the applicant was not knowledgeable about such proceedings. The department uploaded the Show Cause Notice and the impugned order on the GST portal, without any additional communication.

Read Also: Best Strategies to Handle GST SCN with Basic Reply Format

The applicant’s counsel N.Chandirasekar, referred to the yearly return in Form GSTR 9 and claimed that such a return was filed dated 30.09.2020 concerning the assessment duration 2018-19. He pointed out that despite filing this return, the impugned order stated that the annual return had not been filed.

K. Vasanthamala, representing the respondents, considered that the impugned order was preceded via an intimation, after the show cause notice and a personal hearing notice.

The applicant put on record the annual return in Form GSTR 9, remarked by Justice Senthilkumar Ramamoorthy. A late fee has been levied by the impugned order on the applicant for failing to file the yearly return for the assessment period 2018-19.

It was revealed by the single bench that the order was being issued without regarding the yearly return filed via the applicant. The same needs a reconsideration of the matter.

The impugned order has been set aside by the Madras High Court, and the case was remanded for reconsideration. The respondent was asked to furnish the applicant a reasonable chance to be heard, along with the personal hearing, and hence issue a fresh order within 3 months from the date of receipt of a copy of the order.

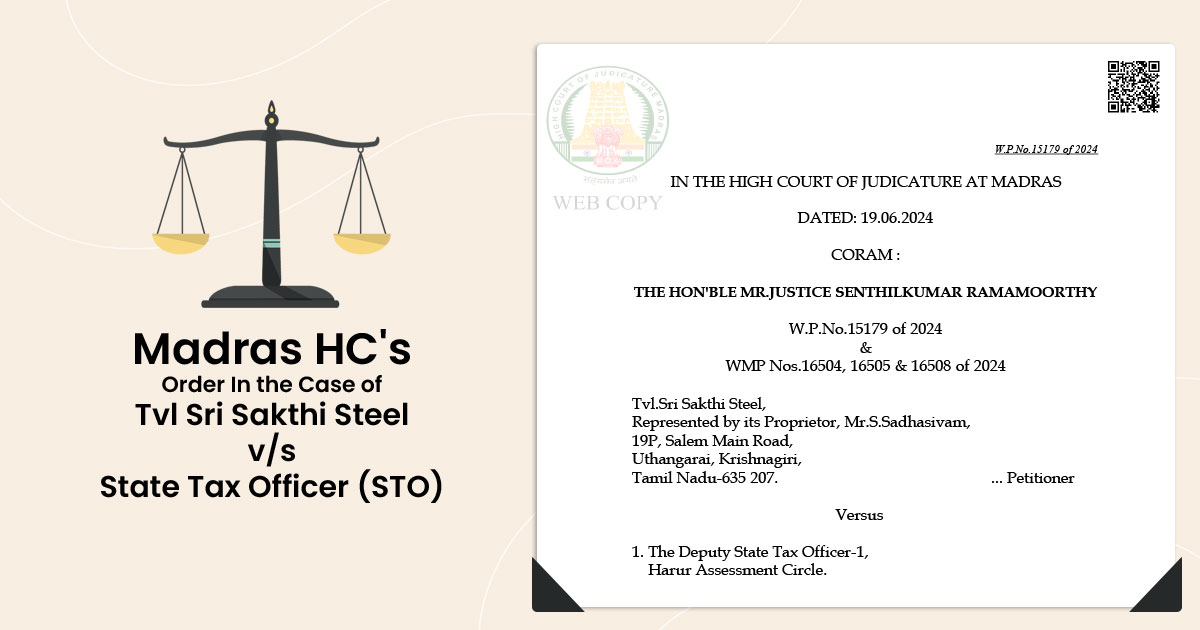

| Case Title | Tvl.Sri Sakthi Steel V/S Deputy State Tax Officer |

| Case No.: | W.P.No.15179 of 2024 |

| Date | 19.06.2024 |

| Counsel For Appellant | Mr. N.Chandirasekar |

| Counsel For Respondent | Mrs.K.Vasanthamala Govt. Advocate for R1 |

| Madras High Court | Read Order |