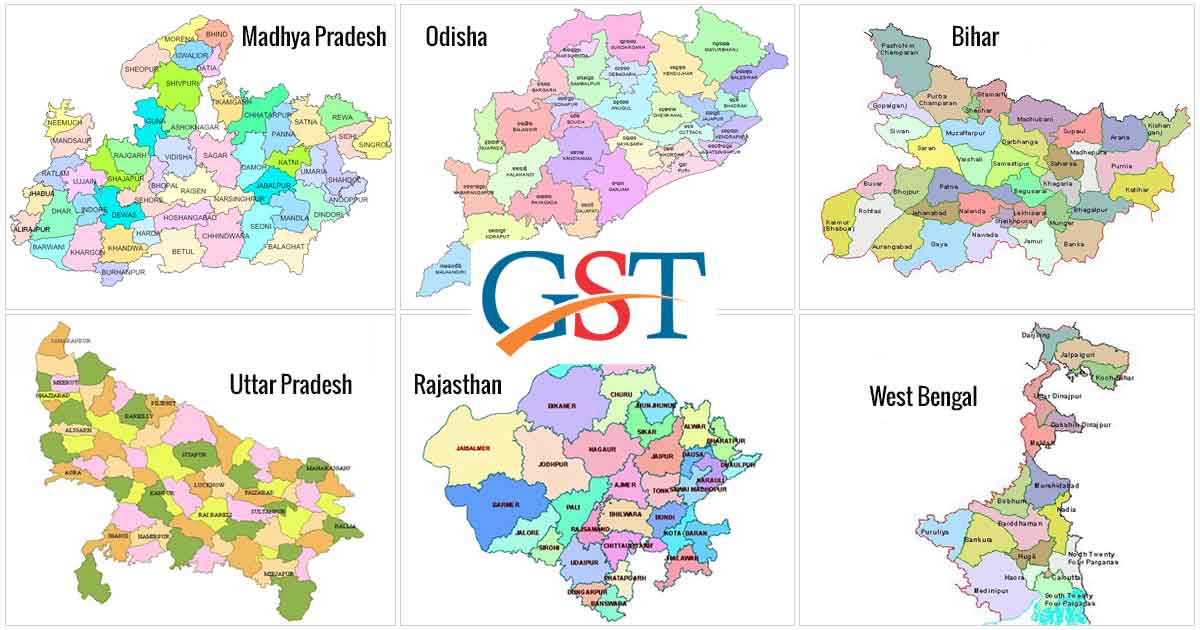

Rural states those have low per-capita income such as Madhya Pradesh, Odisha, Bihar, Uttar Pradesh, Rajasthan, and West Bengal have contributed a lot in regards to the sales of automobiles post GST. Many factors like female literacy, rise in the per capita income of the rural India have contributed in neutralising the effect of GST previously presumed in the automobile sector.

The composed sales volume of automobiles in six states in the first half of FY 2017 has performed well and expanded by 7 percent to 15 percent in several categories. From total sales volume, 23-45 percent is account for the states and also depends on the vehicle category.

Six states those have low per capita income lies in between $990 to $1,600 as compared to India’s average income around $1,800 and the states combine one-third of GDP in the nation’s total gross domestic product.

Read Also: GST Helps Oil and Automobile to Gain Momentum

GST is creating a competitive environment as neutralised rates have been applied across the country. For example, Delhi always considered as a wholesale market. The growth in the volume of sales of automobiles in low- capita income states have enhanced due to the implementation of GST, said Rakesh Srivastava, Director of Hyundai India.

Before the implementation of GST, those states producing automobiles had gained tax benefits of 3- 5 percentage points. Yadvindar Singh Guleria, Senior vice-president of Honda Motorcycle and Scooter (HMS) said,”Bihar is witnessing higher growth due to increase in the available acreage, lower migration and improving law and order”.

Female Literacy in West Bengal is one of the effective factors in the sales increase of automobiles in low- capita income states, a larger number of women and girls are purchasing scooters. Better monsoon in the past two- years, debt waivers, direct benefit transfer (DBT), are some of the factors that have encouraged the purchasing power of people in rural areas.

Recommended: Goods and Services Tax Impact on Petroleum Products in India

After the consecutive year-on-year from six months to September 2016, Rear rural wages increased by 3.3 percent in the second quarter of FY 2016. It enhanced by 4.6% in the duration of April- September, the fastest enhancement in past four years. The number of schemes has enhanced from 59 in FY year 2016 as compared to current fiscal year under DBT. So far, it has further reached to 393 in FY18.

The government is trying to cover all 534 schemes under DBT before March 2018. “The consecutive good monsoon in rural economy is translating into higher disposable income. It is having a positive effect in consumer sentiment towards the ownership of vehicles”, Srivastava said.