The government has initiated the new ITR filing portal dated 7th June 2021 to enhance the efficiency of the IT portal, the effective user interface, and the more satisfying user services.

But since the start of its launch, the portal is seeing issues such as it is not able to furnish the ITR on the “New Portal, unable to do EVC (E-verify) of ITR, non-launching of the schema of ITR Forms, facing errors in the registration of PAN/TAN, unable to opt for New Tax Slab Regime in ITR, non-auto-population of 26AS data in ITR, Filing of Form 15CA and CB not enabled, getting error in the registration of Digital Signature on IT Portal, inactivation of PAN, unable to download ITR filed for current & past assessment years, unable to submit ITR in response to notice u/s.148, etc.”

Moreover, the portal computed the late filing of the fees despite the suspension of the ITR date to 30th Sept 2021. In this article, it is mentioned about the problems being faced and their resolutions have been recommended.

Is the ITR for AY 2024-25 Filing Commencing on the IT Portal 2.0?

Yes, the ITR filing has initiated the new IT portal. Form ITR 1, ITR 2, ITR 3 and ITR 4 can be furnished with dual utility offline/online mode. Some of the assessees may face the issue in specific menus but ordinarily, it is being filed now.

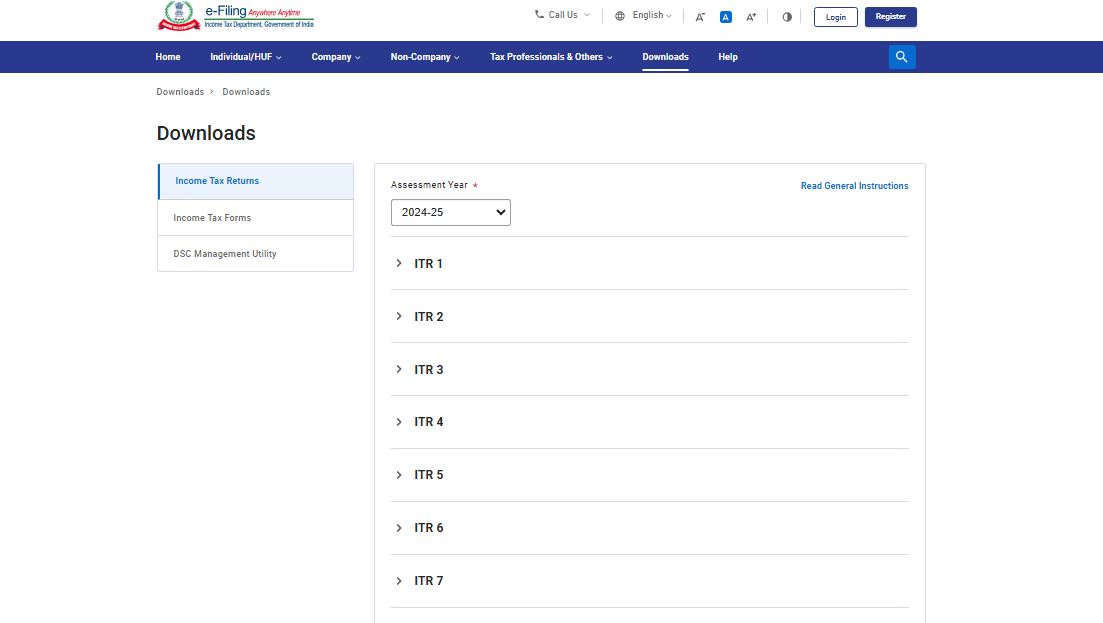

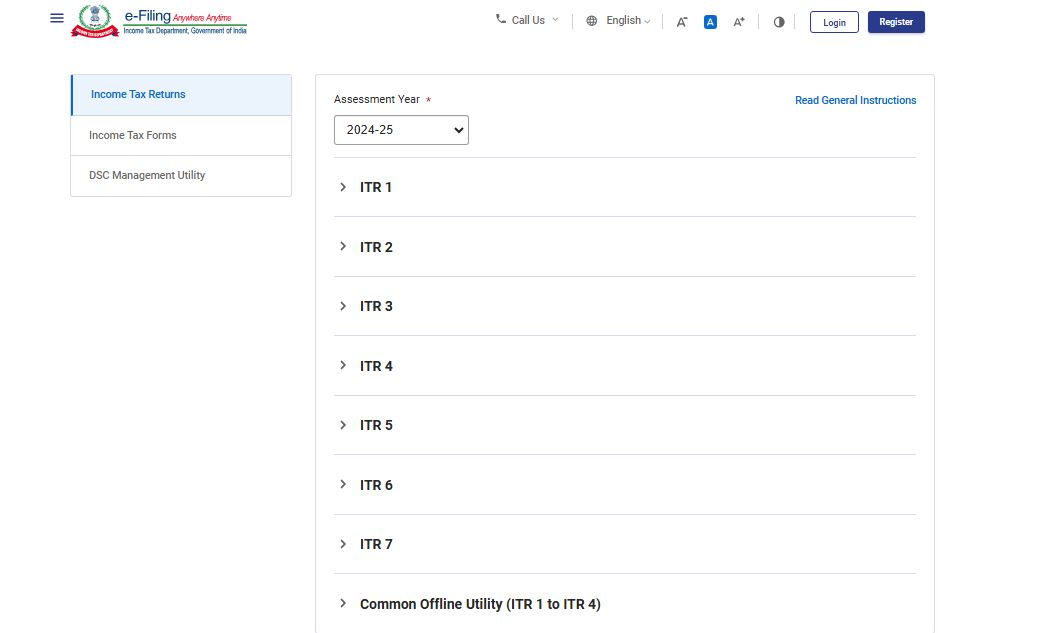

Are the ITR e-Forms i.e. ITR 1 to ITR 7 Now Available on New Portal?

According to the latest guidelines of the Income Tax Portal, Common Offline Utility has been published for ITR 1 to ITR 4, but for ITR 5 to ITR 7, this is yet to be released.

What is the Method to Choose a New Tax Slab Regime for Furnishing the ITR?

For the concern, if you are filing ITR 3 or ITR 4 you are required to e-file Form 10IE to choose the old tax slab regime because from AY 2024-25 New Tax Regime is Default Tax Regime. After furnishing the Form 10IE, we have to mention the details of 10IE in the ITR Form. The option to choose the current regime is given in ITR 1 & ITR 2 itself.

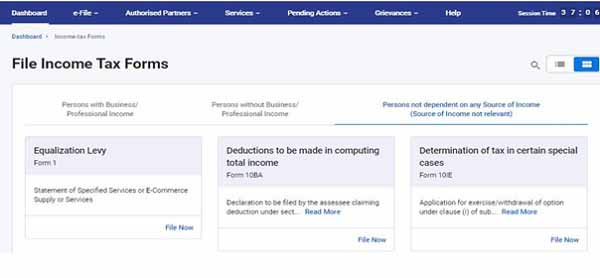

What is the Method to File Form 10 IE on the Latest IT E-filing Portal?

For the concern, you need to choose a fresh regime before furnishing the ITR 3 or ITR 4. You are required to furnish Form 10 IE by logging into the New e-filing Portal 2.0. Filing of Form 10IE has been enabled on the Portal.

- Go to e-file

- Income Tax Forms

- File Income Tax Forms

- “Persons not dependent on any source of Income (i.e. Source of Income not relevant for this form)”

- Determination of tax in certain special cases (Form 10 IE)

What is the Method to Download Java Offline or Excel Utility for Filing ITR of AY 2024-2025?

The concept of starting the separate Excel and Java offline utility for each IT return Form separately was just stopped. Now you can revise the common JSON utility which shall be released. As of now the common utility for furnishing ITR 1 to ITR 4 is to be released that is to be downloaded as:

Downloads> Income Tax Returns>AY 2024-25>Common Offline Utility (ITR 1 to ITR 4)

Not Able to E-verify the ITR After Furnishing the ITR?

Some assessees are not able to e-verify after the filing of ITR as the portal does not answer on tapping the e-verify option which is shown as compared to ITR V acknowledgement of the assessment year 2024-25. From the mentioned steps you can do the same:

- Log out of Web Portal (i.e. Don’t use ID & Password to login)

- Go to our services

- Click on e-Verify

- Fill in the details as per the menu mentioned as:

- ITR will be successfully verified Post OTP.

The Most Reliable Method to e-Verify the ITR?

For the concern, you are filing the online ITR via the income tax website. Hence before the furnishing of the ITR, the portal urged to opt for one of the mentioned options:

- E-Verify Now

- E-Verify Later

- Speed post to Bangalore

The effective method to opt for is the 1st option which is to e-verify now and execute the Aadhar OTP. It works effectively.

What is the Method to Make the Signature File to Enroll DSC on the New Tax Portal 2.0?

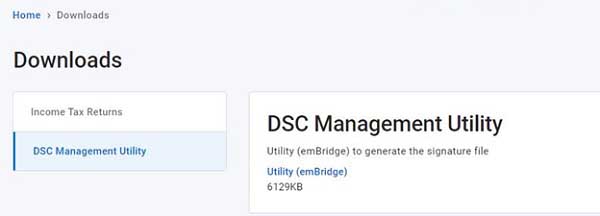

The concern for making the signature file for registering a Digital Signature Certificate (DSC) has just stopped with the latest portal. The thing is that now you can enrol in DSC by installing the latest DSC management utility, Enbridge from the IT Portal.

What is the Method to Enroll in the DSC of the Partner of the Firm or Director of the Company for Filing IT Return Form of Company/Firm?

Partner or director needs to enrol DSC in his or her profile through his credentials. For the case, if they have an authorized signatory in the Firm/Company’s IT Profile, the DSC shall automatically execute the same.

Form 26AS Information Which is Not Automatically Populated in the New IT Portal?

During the furnishing of the online ITR form, some of the assessees face the error as per the non-auto population of specific information of 26AS Form e.g. TDS, TCS, Advance Tax and Self Assessment Tax Challan details. The concern is that you can manually download form 26AS and insert the information of TDS or TCS or Tax Deposit in the ITR Form.

What is the Method to File ITR in Answer to Notice u/s 148 for AY 2021-2022?

Some assessees who receive notice u/s.148 for AY 2020-2021, which were obtained in recent times, shall not be able to furnish the ITR towards the notice. The choice to furnish ITR is enabled now in the e-Proceeding Menu> File Response.

Not Enrolled on the Upgraded & Traditional Income Tax Portal. Shall I Do it now?

Yes, one can register himself on the new portal based on their PAN details. If you previously enrolled in a traditional e-filing portal, then you are not required to re-register as traditional taxpayers get transferred to the new portal automatically with the same credentials. But for the first time registering on the tax portal will be able to use the new portal and work easily.

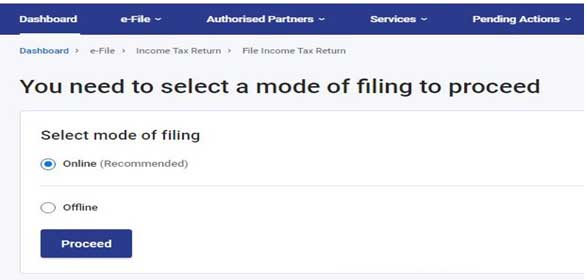

How to File ITR on New Web Portal?

Just opt for the mentioned methods to furnish the ITR:

- Immediately furnish the online ITR on the new tax portal https://www.incometax.gov.in/

- File the Income-tax return via common offline utility open on the latest income tax portal

- You can furnish the ITR via third-party vendor software or websites that enable you to file the ITR through their portal or software or generating JSON files over them & uploading it on the new official website of Income Tax.

New Portal Calculating Late Fees for Late Furnishing of ITR of AY 2024-25?

Late fees are computed by the Income Tax Portal as per the provision of Section 234F. where a person is required to file a return of income under section 139, fails to do so within the time given, then he shall pay a fee of five thousand rupees: Provided that if the total income does not exceed ₹500,000/-, the fee payable under this section shall not exceed ₹1000/-

What to Do When I File & E-verify My ITR But Have Not Obtained the Refund to Date?

Please see if the chosen bank account to receive an IT refund is pre-validated & EVC enabled on the New IT portal. It provides quick processing & credit of IT refunds to your bank account.

Reply to Complaint on New Income Tax Portal is Shown as “NA”?

Please see that your registered email ID as portal shall not correctly show the answer to the complaint but accurate communication is to be delivered through email.

My Income Tax Profile has Not Updated to 100% But I Can’t find What’s Left. Do I File ITR Without Completing the Profile to 100%?

Finishing the profile of the income tax website to 100% level assists in pre-filing the normal information during ITR filing. Towards the concern of the profile update, you were enabled to opt to file the information during the time of filing the ITR on your own.

What to Implement If There Are Various Glitches in the New Portal?

Establish a grievance at the E-filing Portal through accurate facts and screenshots of the error.