The assessment order has been set aside by the Pune Bench of Income Tax Appellate Tribunal ( ITAT ) which was computed under the new regime quoting that the return was submitted under the new regime and requirements u/s 115 BAC not fully satisfied.

The taxpayer Akshay Nitin Malu is an individual who is in the business of manufacturing cloth looms. The taxpayer has chosen for the new tax regime u/s 115 BAC and thus filed form 10 IE dated 18.07.2022 which is a requirement u/s 115 BAC of the Income Tax Act.

The taxpayer acknowledged that the new regime shall not be effective for him and therefore furnished an ITR under the old regime. The central processing centre (CPC) computed the income under the new regime based on things the taxpayer chose under the new regime under Form 10IE.

The taxpayer dissatisfied with the CPC order has furnished a plea to the Commissioner of Income Tax (appeals) [CIT(A)]. It was carried by the CIT(A) that the provision u/s 115 does not furnish for the withdrawal of the practised option for the identical year. It was noted by the CIT(A) that the provisions furnish an option of withdrawal merely for the forthcoming year to the year practising the option.

Hence CIT(A) carried the CPC order and dismissed the taxpayer’s plea. According to the order of CIT(A), the taxpayer was unsatisfied and filed a plea with the ITAT.

The taxpayer’s counsel claimed that the taxpayer submitted the return in the old tax regime and further submitted that the taxpayer did not satisfy the requirements specified u/s 115BAC of the Income Tax Act.

The revenue counsel claimed that section 115BAC does not furnish for the withdrawal of practice option in the identical year though it furnishes merely in the forthcoming years. Hence the counsel asked to dismiss the plea.

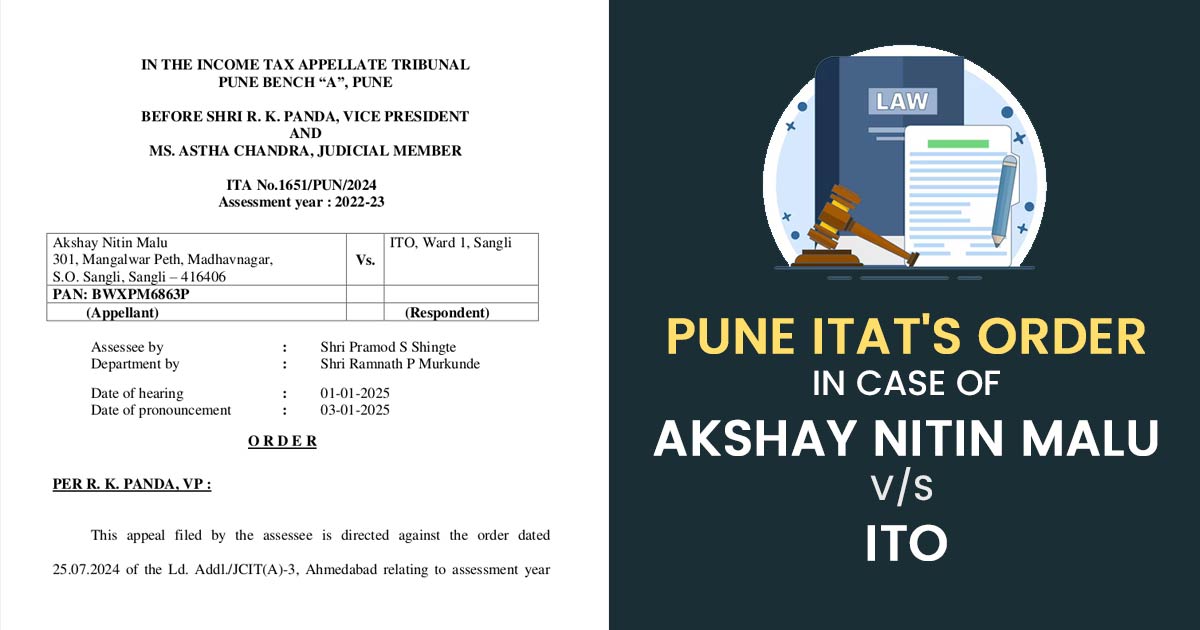

It was noted by the two-member bench comprising Astha Chandra (Judicial Member) and R.K. Panda (Vice President) that the taxpayer submitted a return under the old regime of taxation. Also, the tribunal noted that the taxpayer does not satisfy the pre-requisites cited in section 115BAC of the Income Tax Act.

Hence the tribunal considered the taxpayer’s counsel’s contention and noted that the CIT(A) was not explained in keeping the CPC order. The order of CIT(A) has been set aside by the tribunal. Thereby the taxpayer’s plea was permitted.

| Case Title | Akshay Nitin Malu Vs. ITO |

| Citation | ITA No.1651/PUN/2024 |

| Date | 03.01.2025 |

| Assessee by | Shri Pramod S Shingte |

| Department by | Shri Ramnath P Murkunde |

| Pune ITAT | Read Order |