The Madhya Pradesh High Court has stated that the non-operation of the Income Tax Department’s TRACES Portal cannot justify refusing an assessee the benefits provided under the Income Tax Act of 1961.

A division bench of Justices Vivek Rusia and Anuradha Shukla carried that an assessee’ TDS refund cannot be rejected only on the ground that functionality of ‘adjustment of refund’ against outstanding demand made by the Department is not available at TRACES Portal.

It noted that the Portal (TDS Reconciliation Analysis and Correction Enabling System) has been formed to streamline the enforcement of rights and discharge of duties of stakeholders, not to create hindrances.

“The rights which have been given to the assessee under the Income Tax Act cannot be withheld due to the non-functionality of the TRACES. If the Portal does not function in accordance with the Act and Rules then it requires to be suitably modified to achieve the aims and objects of the Act and Rules, therefore, there is a provision in the Income Tax Act about the refund of the amount with interest as well as set off of refund against the tax payable.”

The petitioner received a notification regarding a default for not deducting TDS from payments related to various remittances for purchase, installation, and supervision fees. But CIT carried this demand ITAT quashed the assessment orders. The applicant has deposited the due TDS amount therefore asserting a refund with interest.

For the refund, the request of the income tax officer was denied on the foundation that it can be raised when the taxpayer furnishes its application on the TRACES portal. The ITO cited the non-functionality of the demand adjustment feature on TRACES.

Initially, the High Court cited Section 240 of the Income Tax Act, which requires the Assessing Officer to issue a refund to the taxpayer automatically, without requiring a claim, if a refund is warranted following an appellate order.

Read Also: Online Correction of TDS/TCS Statement at TRACES

Court concerning the interest directed to section 243 which furnishes that payment of interest on late refunds will start accruing post lapse of 3 months from the order date granting refund.

“…in view of the above, after the order passed by ITAT, the respondents are bound to refund the amount to the petitioner with interest without there being any formalities to be completed by the petitioner,” the Court said.

It went on to reference Section 245, which allows for the offset of refunds owed to any individual against taxes that person still needs to pay.

As per that, the High Court asked the Department to either refund the amount with interest or set off of the same against tax liable to be paid via Petitioner, within 30 days.

Advocate Sapan Usrethe appeared for the petitioner; Advocate Siddharth Sharma appeared for the respondent.

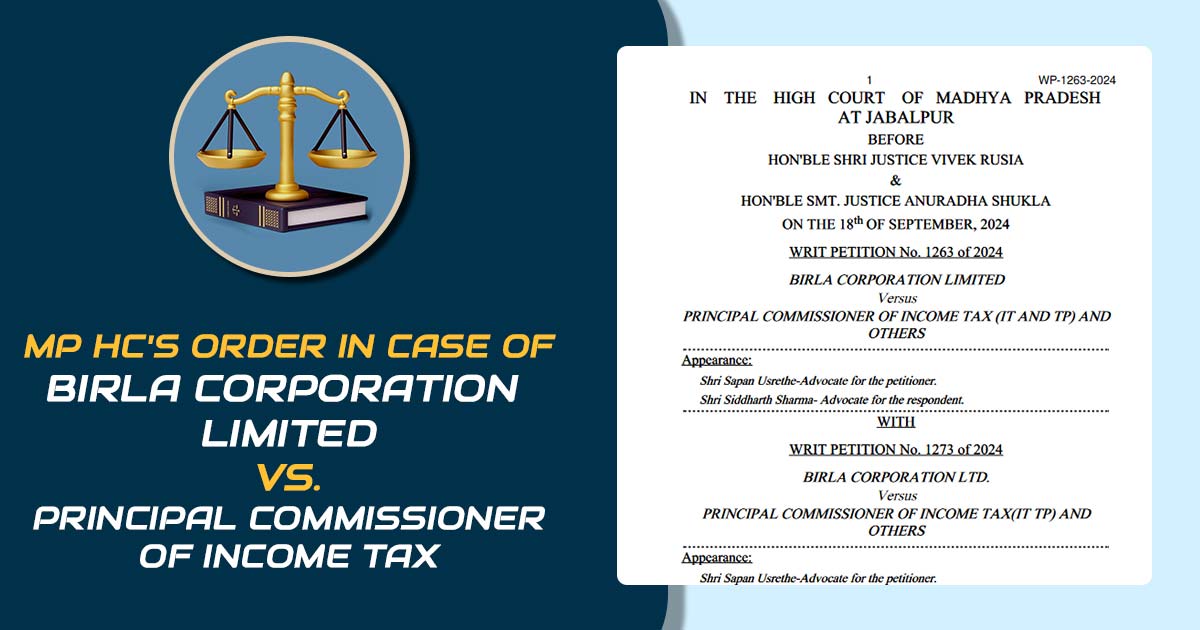

| Case Title | Birla Corporation Limited Vs Principal Commissioner of Income Tax |

| Citation | Writ Petition No. 1273 of 2024 |

| Date | 18.09.2024 |

| For Petitioner | Shri Sapan Usrethe |

| For Respondents | Shri Siddharth Sharma |

| MP High Court | Read Order |