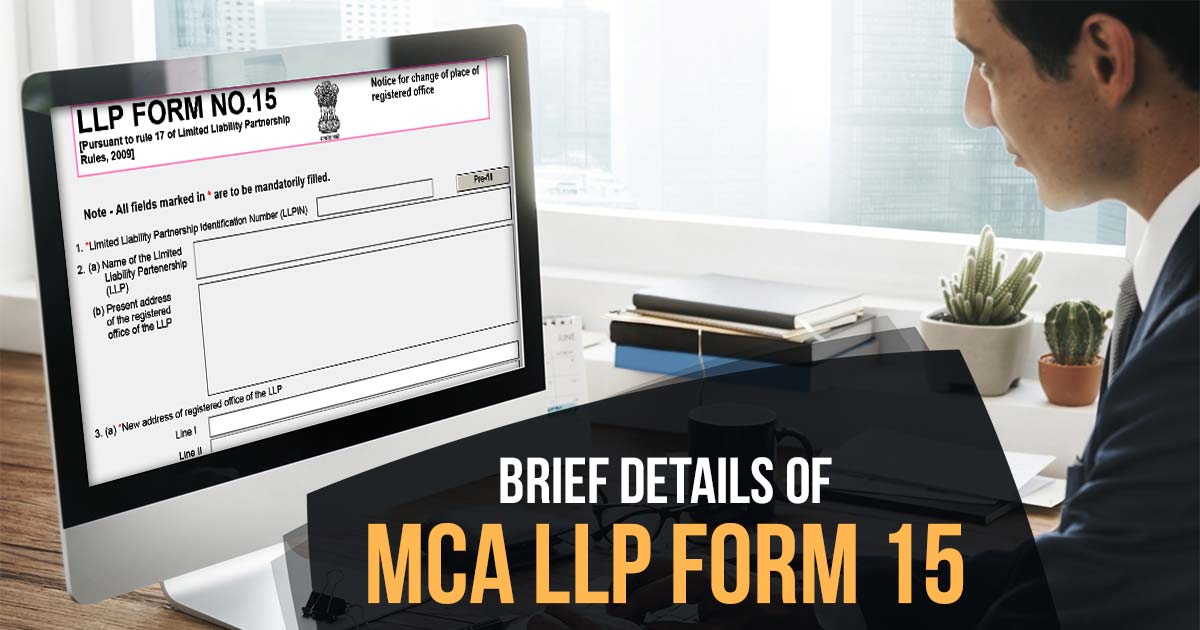

LLP may change the place of registered office by Section 13 of the Limited Liability Partnership Act, 2008, read with Rule 17 of Limited Liability Partnership Rules, 2009, by filing LLP Form No. 15 with the Registrar of Companies within 30 days of complying with the requirements of:

- Rule 17(1) of the Limited Liability Partnership Act, 2008: in case of a change of registered office within the same state.

- Rule 17(4) of the Limited Liability Partnership Act, 2008: in case of a change of registered office from one state to another state.

MCA LLP 15 Form Additional Fee Guidelines

| Contribution Amount (INR) | Normal Fee applicable (INR) |

|---|---|

| Up to 1,00,000 | 50 |

| More than 1,00,000 up to 5,00,000 | 100 |

| More than 5,00,000 up to 10,00,000 | 150 |

| More than 10,00,000 up to 2,500,000 | 200 |

| More than 2,500,000 up to 100,00,000 | 400 |

| More than 100,00,000 | 600 |

| Period of Delay | Additional Fee Payable for Small LLPs (INR) | Additional Fee Payable for Additional Small LLPs (INR) |

|---|---|---|

| Up to 15 days fees | 1 time of the normal filing fee | 1 time of normal filing |

| Exceeds than 15 days and up to 30 days fees | 2 times of normal filing fee | 4 times of normal filing |

| Exceeds than 30 days and up to 60 days | 4 times of normal filing fee | 8 times of normal filing |

| Exceeds than 60 days and up to 90 days | 6 times of normal filing fees | 12 times of normal filing |

| Exceeds than 90 days and up to 180 days | 10 times of normal filing fees | 20 times of normal filing |

| Exceeds than 180 days and up to 360 days | 15 times of normal filing fees | 30 times of normal filing |

| Above 360 days of furnishing the fees | 25 times of the normal filing fees | 50 times of the normal filing |

Online Process to File LLP 15 Form on V3 Portal

Initial Submission

Step 1: Open the MCA V3 homepage => Login to the MCA portal with registered user ID & password => Click “MCA services” and then choose “LLP (Limited Liability Partnership) E-Filing” => Select “Form 15 – Notice for change of place of registered office”

Step 2: LLPIN, and after that, select the purpose of change based on the new location. The purpose can be P1 (within the same city/town/village), P2 (outside the current city but within the same Registrar and State), P3 (change in Registrar within same State), P4 (change in State within same Registrar and jurisdiction), or P5 (change in State outside existing Registrar’s jurisdiction).

Read Also: Simple Tips to File LLP Form 11 Annual Return with Due Date

Step 3: Further enter the new address of the registered office of the LLP, and other details regarding any prosecution pending against the LLP.

Step 4: Further proceed with the details of publication of advertisement in case of Change of address of the registered office resulting in a change in State outside the jurisdiction of the existing Registrar (P5)

Step 5: Enter if any objections were received in response to the advertisement and other details, such as creditor consent in case of a change of address of the registered office resulting in a change in State outside the jurisdiction of the existing Registrar (P5)

Step 6: Attach mandatory attachments as well as optional attachments if the user wants to provide additional information.

Step 7: The Form should be digitally signed by the designated partner of the LLP, and the web form shall be certified by a professional, and clicks on the submit button after successful save.

Step 8: SRN (Service Request Number) is generated upon submitting the form. (The SRN can be operated by the user for any forthcoming resemblance with MCA.)

Step 9: Download the web form and affix DSC.

Step 10: Upload the DSC affixed PDF document to the MCA V3 portal

Resubmission:

Step 1: Go to the MCA homepage

Step 2: Log in to the MCA portal with valid credentials

Step 3: Proceed with the application history via the My Application user dashboard

Step 4: Choose Form 15 application with the status as ‘Resubmission required’

Step 5: Fill up the application

Step 6: Save the web form as a draft (optional)

Step 7: Submit the web form

Step 8: SRN is updated

Step 9: Affix the DSC

Step 10: Upload the DSC affixed PDF document on the MCA portal

Step 11: Resubmission of webform (towards the case when the user does not finish the re-submission of the form and upload the DSC affixed PDF document within 24 hours of the SRN update, an SMS and email reminder would be sent to the user daily for 30 days OR till the submission of this)

Step 12: Acknowledgement would be generated

Similar: Simple Guide to MCA LLP Form 5 with Name Change Process

Attachments for MCA LLP 15 Form

It is mandatory to attach the following attachments:

- Proof of the changed address of the registered office (Conveyance/Lease deed/Rent Agreement, etc., along with the rent receipts).

- Copy of the minutes of the decision/ resolution/ consent of partners in case option 1, based on procedures laid out in the LLP agreement, is selected.

- Copy of public notice, if applicable

- The extracts related to the law of the limited liability partnership agreement are to be given as an essential attachment.

- Additional information could be given as an optional attachment

In the case when a change of the place of the enrolled office from one state to another, it is essential to enclose copies of the public notice and approval of the secured creditors.

Digital Signature for the Partner

The e-Form must be digitally signed through the designated partner of the LLP. Insert the Designated Partner identification number (DPIN) of the DP.

LLP Form 15 Certificate

The e-form must be certified by a CA (in whole-time practice), or a cost accountant (in whole-time practice), or a company secretary (in whole-time practice) by digitally signing the e-form. Choose the related category of the professional. For the case, the professional is a CA (in whole-time practice) or a cost accountant (in whole-time practice), insert the membership number. Insert the certificate of practice number when the practising professional is a company secretary (in whole-time practice).