In this post, we have summed up all the methods to both blocking as well as unblocking of the GST e-way bill generation for the taxpayers and assessees who have been out of the track in the fulfillment of government compliance. Also, we have attached all the rules and the screenshots of the complete process in this post. A GST e-way bill is important to document to be taken when a good is transported and to block or unblock is done to restrict certain parties in generating them as per the requirements of the compliance.

Latest Update In GST E-way Bill

05th October 2021

The CBIC has temporarily suspended the blocking of the E-way bill generation facility for the taxpayers who fail to file the basis of their returns on monthly or quarterly due to the Covid pandemic. View More

05th August 2021

The government has disclosed a new advisory related to blocking e waybill creation facility. The CBIC department has removed this facility till 15th August 2021 for the taxpayers. View More

22nd December 2020

- Taxpayers can, in the case, request to reinstate/unblock the EWB generation facility by filing an online application before the tax officer. The application for unblocking the EWB generation feature is completely online now.

- Taxpayers who wish to understand the procedure for filing an application to request their EWB generation facility to be unblocked can join the webinars scheduled on the following dates. The live webinars are being organized by GSTN on its office YouTube channel, the link for which is mentioned below.

Main Reasons for Blocking GST E-Way Bills

As according to the latest notification by the Central Board of Indirect Taxes and Customs (CBIC), a registration of an assessee registered under Goods & Services Tax (GST) will be cancelled if he fails to file monthly or quarterly returns for two consecutive months or quarters, so this also implies the “block of GSTIN” which is a 15-digit unique identification number assigned to every individual registered under GST.

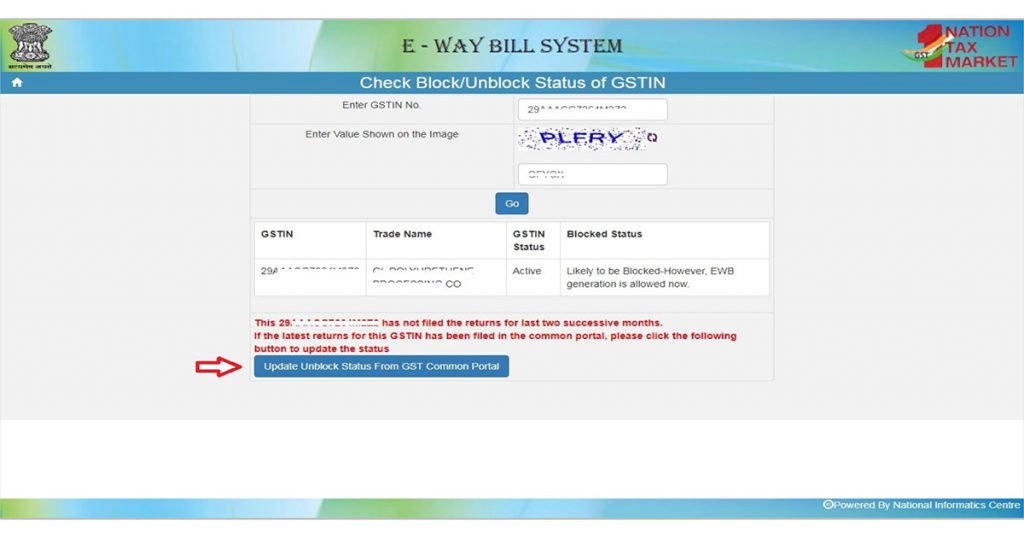

An alert will be sent to the users when he will generate e-way bills if the system, through the GSTIN entered, finds that the user has not filed returns for the last 2 successive months as non-filing of returns for 2 consecutive months blocks the GSTIN of users. Check out the below image.

The status of GSTIN gets auto-updated from blocked to unblocked in the e-waybill system when a user files GSTR 3B Return in the GST Common Portal. This happens within a day when Return-3B is filed in the GST common portal.

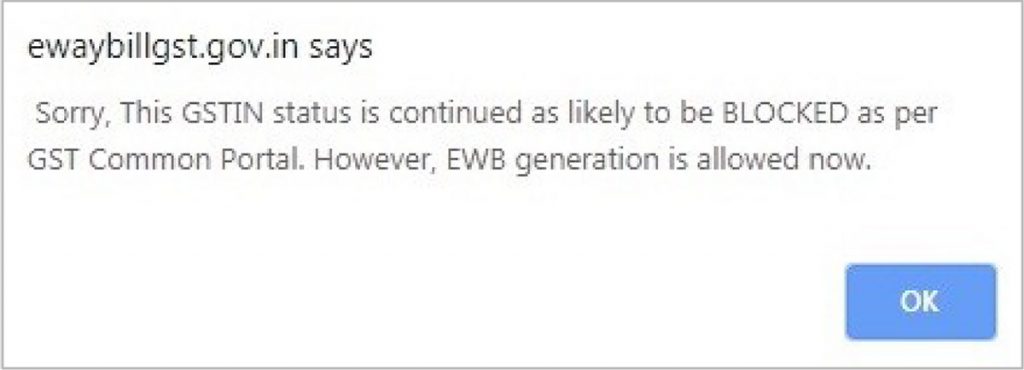

If the taxpayers did not file the GST returns for the last 2 successive months and click on the update button, a message will be displayed.

Read Also: GST E Way Bill Registration Quick Guide with Full Procedure

In case the status does not get auto-updated in the e-way bill system, the taxpayer can also update the same by going to the e-waybill portal and then to the option Search Update Block Status. After entering the GSTIN, users can update their status by clicking on ‘Update GSTIN from Common Portal’.

In this way, the status of filing from GST Common Portal can be accessed and the same gets finally updated also when the returns are filed by the assessee.

User Manual Guide to Unblocking of GST E-Way Bill Generation Facility

CBIC has recently announced that an assessee registered under Goods & Services Tax (GST) will be made ineligible to register after failing to submit monthly or quarterly returns twice in a row, as this also implies the “block of GSTIN,” a unique 15-digit number assigned to each individual registered under GST.

What is the method to furnish the application to unblock the e-way bill generation facility?

To furnish the application towards unblocking of the e-way bill generation facility on the GST portal do the mentioned steps:

Steps to File the Application to Unblock the E-way Bill Generation Facility

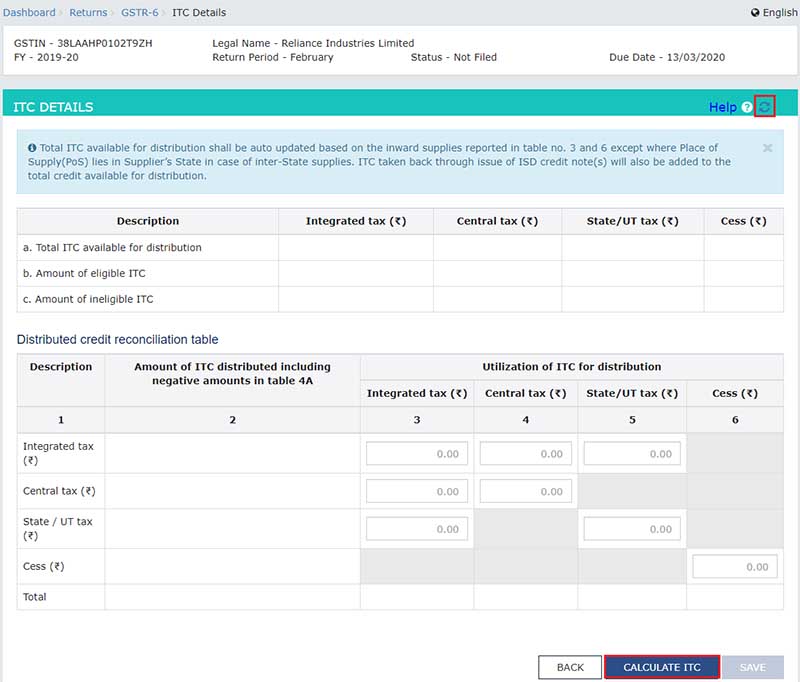

Step:1 Go to the www.gst.gov.in URL. the GST home page will be shown. Login to the portal through the valid credentials. A dashboard page would be shown. Tap services>user services> My applications option.

Step:2 My application page would be shown. Choose the application to unblock the e-way bill in the application type field. Tap on the new application button.

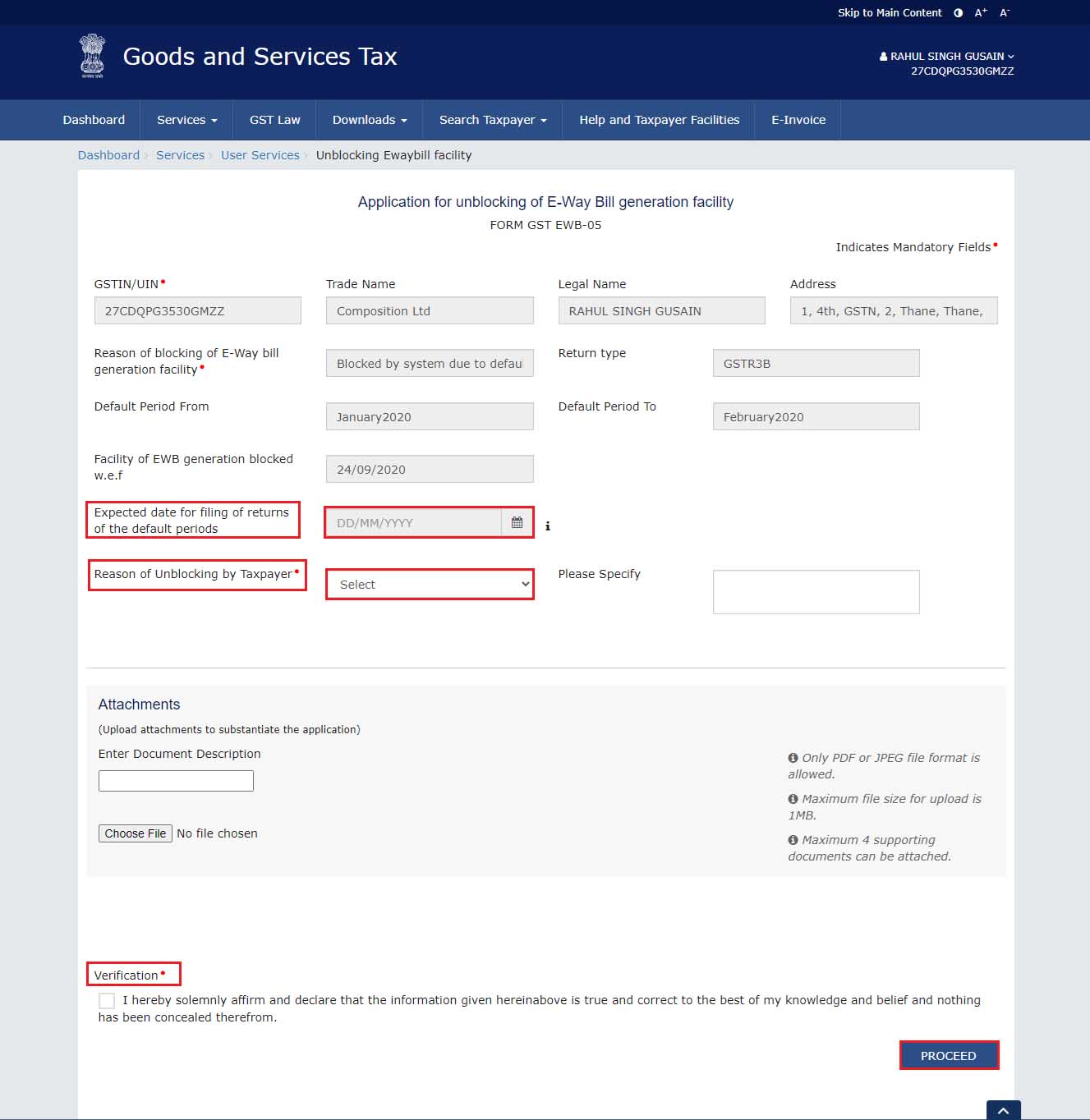

Step:3 The application to unblock the e-way bill page would be shown.

Step:4 Choose the expected date to furnish the returns of the default duration through the calendar.

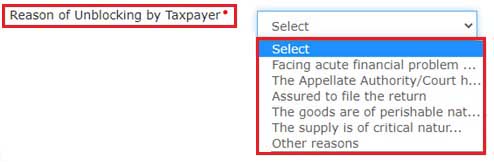

Step:5 Choose the reason for unblocking through the assessee from the drop-down list.

Note: When the other cause is chosen as the reason for unblocking, mentioned the cause in the box given subsequent to it.

Step:6 Tap on the file to upload the documents concerned to this application.

Note:

- Only PDF OR JPEG file format is permitted to upload.

- The maximum file size for upload is 1MB.

- Maximum 4 supporting documents can be attached.

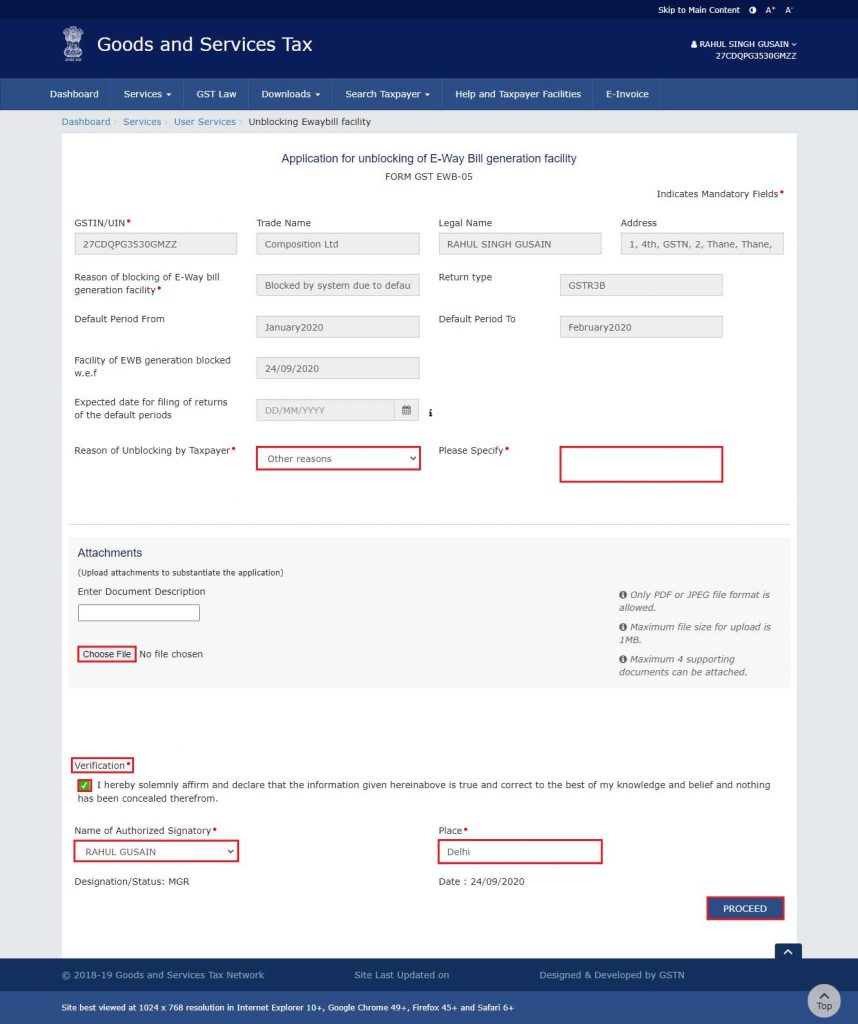

Step:7 Choose the verification check box and name the authorized signatory from the drop-down list. Insert the name of the place in which you are furnishing the same application. Tap on the Procced button application.

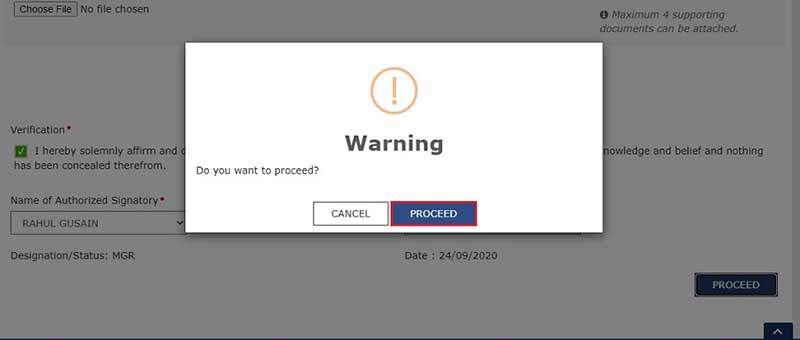

Step:8 Tap the Procced button.

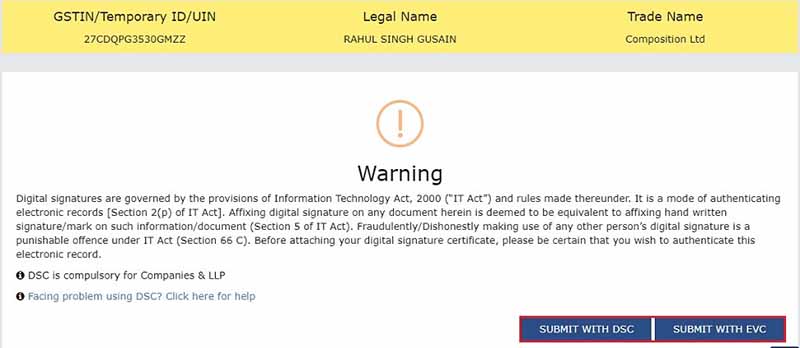

Step:9 The page of submitting an application is shown. Tap on the submit with DSC or submit with EVC.

Step:10 (a) 10(a). Submit with DSC: Click the Procced button choose the certificate and click the SIGN button.

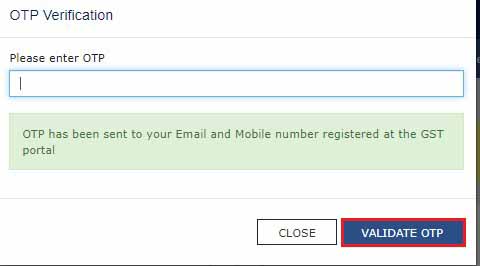

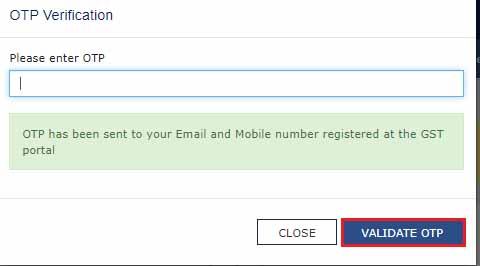

Step:10 (b) 10(b) Submit with EVC: Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the Validate OTP button.

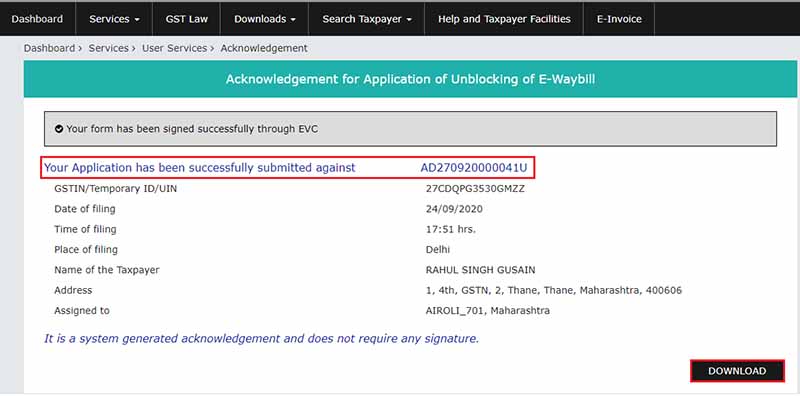

Step:11 The page of acknowledgment is shown with the generated ARN. you would indeed obtain the SMS and email on your enrolled mobile number and email id respectively, telling you about the generated ARN and successful filing of the application.

Note: After the filing of the application the status of the application gets updated to the pending with tax officer.

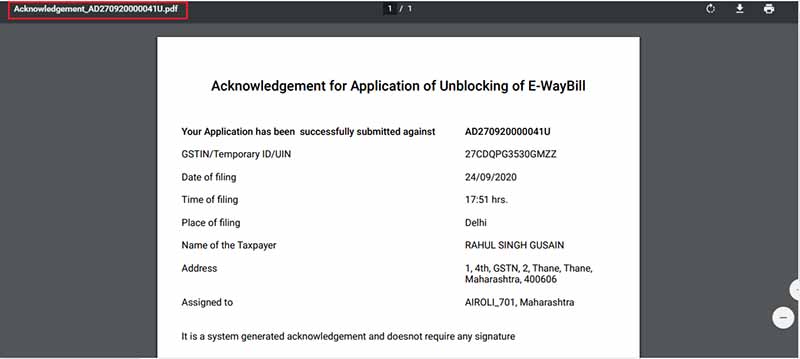

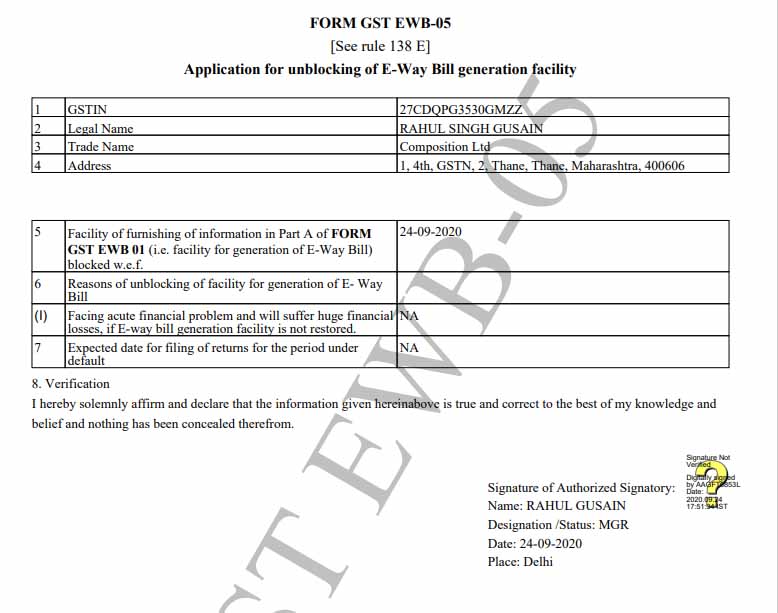

Step:11.1 For downloading the furnished application, tap the download button.

Step:11.2 The filed application is to be shown in PDF format.

Choose action through the Applications tab of the case details screen: See your filed application

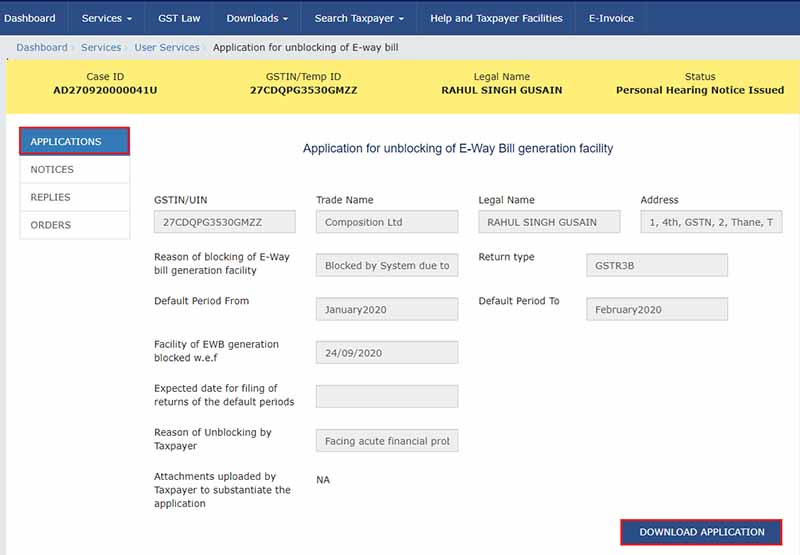

To see the information of unblocking application filed do the mentioned steps written below:

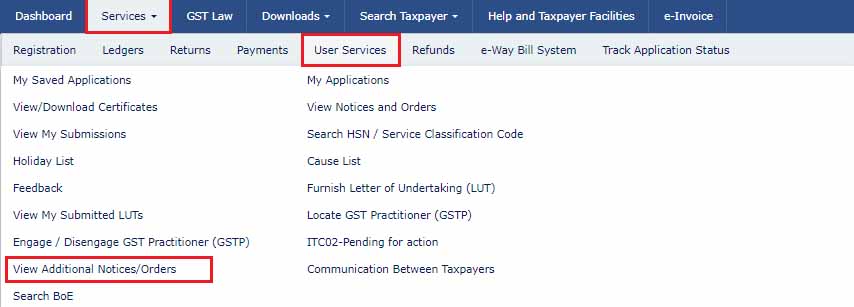

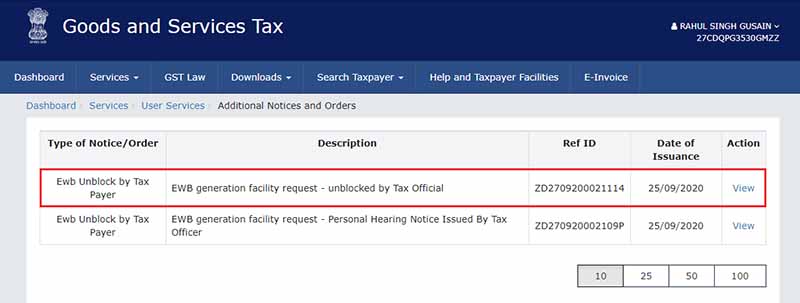

Step:12 Navigate to Services > User Services > View Additional Notices/Orders option.

Step:12.1 Click View

Step:13 On the case information page of that specific application, choose the application tab when it is not being on default. This tab is used to furnish an option to see the furnished application in PDF format. Tap on the download application button to download and see the application inside the PDF mode.

Step 13.1: The file application is shown in PDF format.

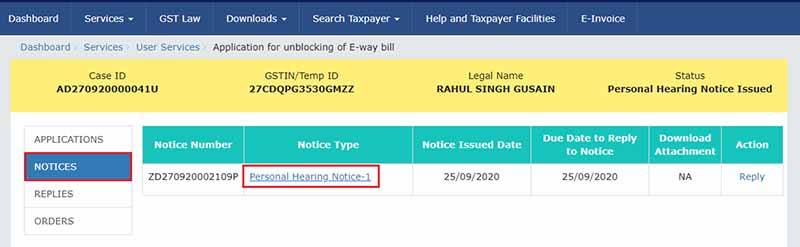

Choose an action through the Notice tab of the case details screen: See the provided notice concerned to that application and then furnish your reply.

To see the notices provided by the tax administrator to you concerned to your application and to furnish your answer to it, follow the mentioned procedure:

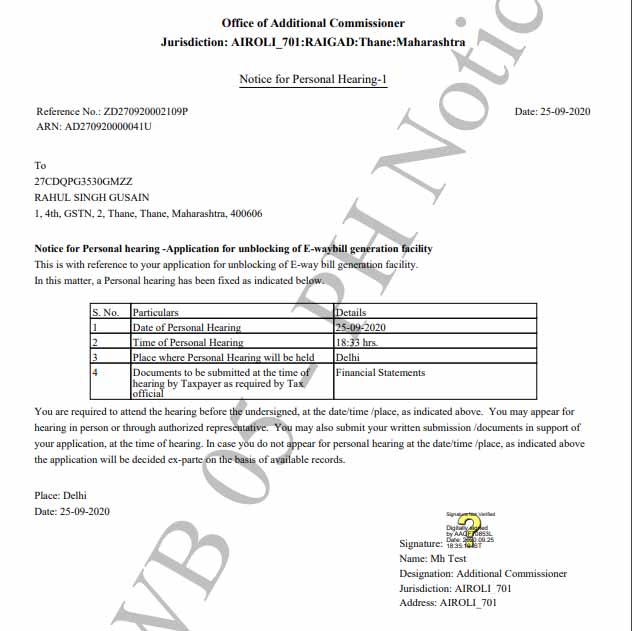

Step:14 On the case details page of that specific application, choose the notices tab. The same tab shows all the notices provided by the tax official. Tap on the notice type to download the personal hearing notice in PDF format.

Step 14.1 the personal hearing notice is shown in PDF format.

Note: the download attachment column displays the link to see or download the supporting documents attached through the tax official, if any, during providing the mentioned notice.

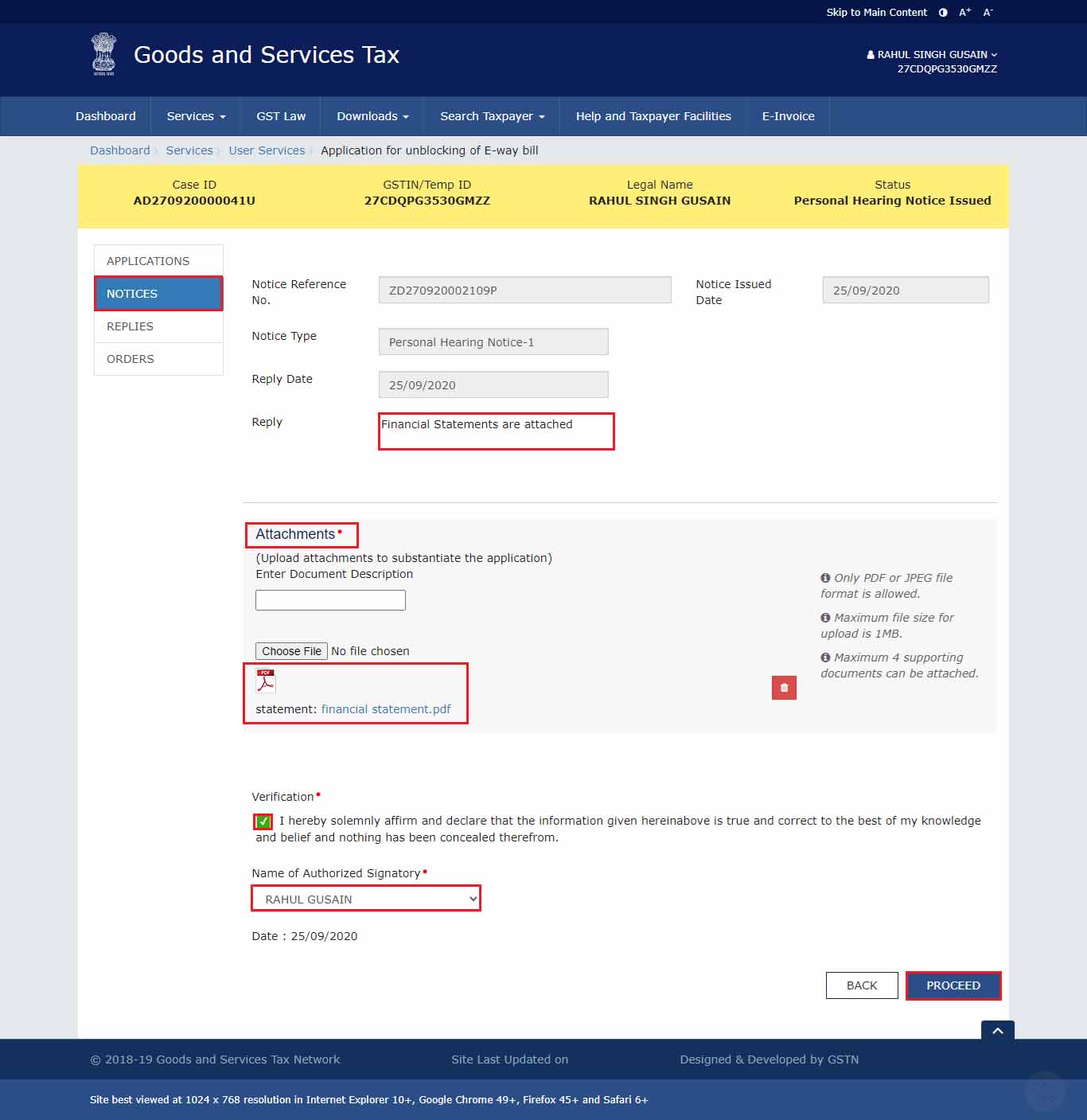

Step:15 To answer the issued notice, tap on the reply hyperlink.

Step:16 The Notice Reference Number, Notice Issued Date, Notice Type, and Replay Date fields are auto-populated. In the Reply field, insert the information of your reply to the given notice. Tap on Choose File to upload the document(s) related to your reply. Select the Verification check box and select the Name of Authorized Signatory from the drop-down list. Click Proceed.

Note:

- Only PDF or JPEG file format is allowed.

- The maximum file size for upload is 1MB.

- Maximum 4 supporting documents could be attached.

Step:17 Tap on the Proceed button.

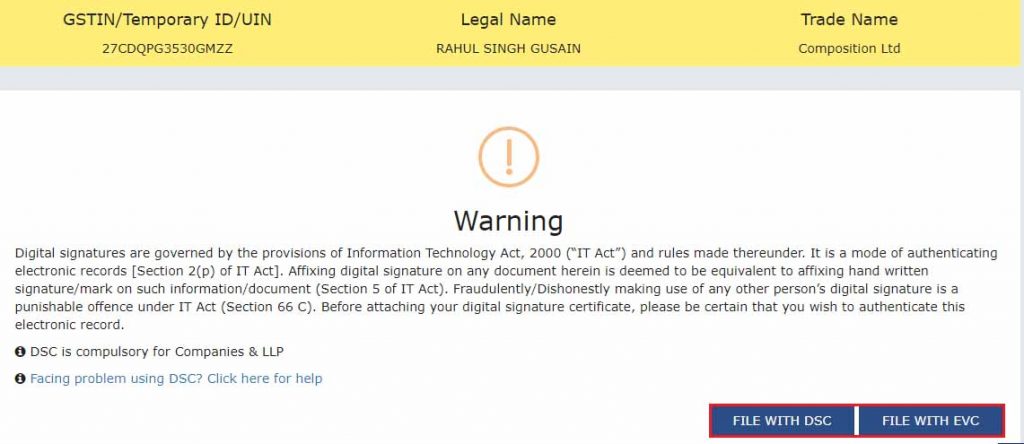

Step:18 The Submit Application page is shown. Tap file with Digital Signature Certificate (DSC) or file with EVC.

- File with DSC: Tap on the proceed button. Choose the certificate and tap the SIGN button.

- File with EVC: Insert the OTP provided on the email and mobile number of the authorized signatory enrolled at the GST portal and tap on the validate OTP button.

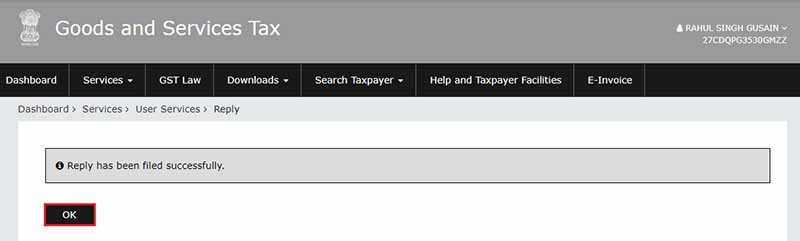

Step:19 A confirmation message is shown where it prompts that the reply has been furnished successfully. Tap ok.

Step:20 The updated Replies tab is shown with the record of the furnished answer in the table and with the status updated to reply to the personal hearing filed. You would indeed tap on the documents in the reply furnished section of the table for downloading it.

Choose an action through the Orders tab of the case details screen: See the given orders concerned to that application.

To download orders given by the tax official concerned to the acceptance or rejection of unblocking of the e-way bill generation facility, execute the provided steps:

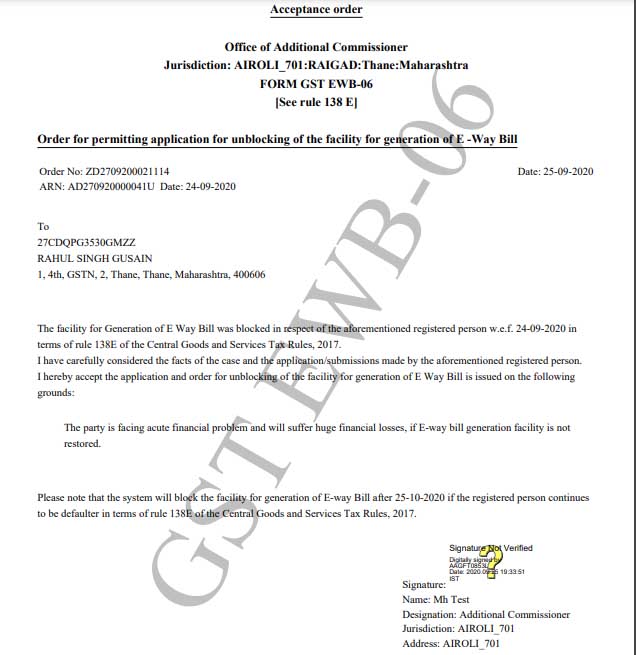

Step:21 On the case information page of that specific assessee, tap on the orders tab. The same tab is used to give you a choice to see the issued order in the mode of PDF. tap the order in the order type section of the table to download them in PDF format.

Step:21.1 The same PDF is prompt as shown below:

Note: Unblocking of the e-way bill generation facility is valid up to the duration shown by the tax office in his or her order.

After the expiry of the validity period, the assessee shall carry on to unblocked in the e-way bill system for the generation of the EWB, when the assessee is not in the defaulter list, post to the expiry of the validity duration.

After the expiry of the validity duration, the assessee would be automatically restricted in the system of the e-way bill, when the assessee is still in the defaulter list, post to the expiry of the validity duration. The same would occur when the assessee losses to file the form GSTR-3B return or statement in form CMP-08 for the former two or exceeding consecutive tax periods, post to the expiry of the validity period.

Here are the Relaxations Granted by the Govt to Taxpayers in India:

- “As you might be aware that the facility of blocking E way bill generation had been temporarily suspended due to pandemic, in terms of Rule 138 E (a) and (b) of the CGST Rules, 2017, the E Way Bill generation facility of a person is liable to be restricted, in case the person fails to file their return in Form GSTR-3B / statement in CMP-08, for a consecutive period of two months / Quarters or more.”

- “The government has now decided to resume the blocking of EWB generation facility on the EWB portal, for all the taxpayers in terms of Rule 138 E (a) and (b) of the CGST Rules, 2017, from 15th August onwards.”

- “Thus, after 15th August 2021, the System will check the status of returns filed in Form GSTR-3B or the statements filed in Form GST CMP-08, and restrict the generation of EWB in case of:

- Non-filing of two or more returns in Form GSTR-3B for the months up to June, 2021.

- Non-filing of 02 or more statements in Form GST CMP-08 for the quarters up to April to June, 2021″

- “To avail continuous EWB generation facility on EWB Portal, you are therefore advised to file your pending GSTR 3B returns/ CMP-08 Statement immediately.”

Note: “Please ignore this update if you are not registered on the EWB portal.”

Finally, the Kerala high court has cleared that the GST e-way bills will only be unlocked when the full tax payments have been done to the government. In the petition filed by contractors, the high court has stated that the government is bound to take all the tax payments firsthand before clearing ways for GST e-way bills.

Solved! Queries on Unblocking E-Way Bill Generation on GSTIN

Q.1 – How Payment on Voluntary Basis can be done?

Check whether your GSTIN is blocked for the E-Way Bill generation facility. This generally happens when you haven’t filed your GSTR 3B consistently in line for two or more tax periods

Q.2 – What should I do to unblock the E-Way Bill generation facility against my GSTIN?

E-Way bill generation facility gets unblocked automatically as soon as you file GSTR 3B and the default becomes less than two consecutive tax periods. Once you are done with your GSTR 3B compliance and still the service is blocked then you can write to your area tax officer requesting him to unblock the E-Way Bil generation service against your GSTIN.

Q.3 – What is the procedure of furnishing the request application for unblocking E-Way bill generation services?

One can submit the manual request or offline request to the concerned tax officer (under whose jurisdiction the area comes) stating that E way bill generation facility against your GSTIN is blocked and that you have rectified the flaws and want the services to be operative again. You need to submit the copies of certain documents to justify your statement in the application. After the request is received by the tax officer he will extend the same through the Back Office GST portal and issue order online

Q.4 – Is it possible to find out the status of order issued against the application that is submitted to the tax officer?

The order issued by the tax official against the application can be an acceptance or a rejection notice. The applicant gets the intimation of the order status via Email and SMS on the ID and number registered under his name

Q.5 – Is there a way to track the order status (accepted or rejected) online via the GST portal?

- Yes, the status of the order is visible on GST Portal as well.

- The applicant needs to login to the portal > on the Dashboard > Select Services > User Services > Click on ‘View Additional Notice/Orders.

- Here the applicant can find whether the request submitted by him is rejected or accepted by the tax authorities.

Q.6 – Once the application is accepted by the tax official, for how much time the taxpayer is able to access the facility?

Time period is mentioned in the order issued by the tax officer until when the facility of E-Will Bill Generation can be availed by that particular taxpayer against his/her GSTIN

Q.7 – How will I be able to know that my E-Way Bill generation facility has been blocked by the tax officials?

Taxpayer will receive email or SMS from GST Portal stating that the E-Way Bill Generation Facility against his/her GSTIN has been blocked. Until such services are blocked, the taxpayer will not be able to generate even a single E-Way Bill against his/her blocked GSTIN

Q.8 – Will I be informed by the tax department if there is any progress regarding my application?

Once the online order is issued by the tax officer against the taxpayer’s application, whether the application is accepted or rejected he will get a copy of that online order on his GST login ID. Apart from that, the Email and SMS will be sent by the tax department on the registered mail ID and number notifying the same

Q.9 – How will I come to know my E-Way Bill generation services are getting expired?

The validity period of the services is mentioned in the acceptance order issued for unblocking E-Way Bill generation facility. Apart from that, the taxpayer will get the mail and SMS from GST Portal stating that the validity of the respective services is getting expired against his/her GSTIN. Taxpayer gets the notification 7 days before the date of service expiry

Q.10 – The unblocked E-Way Bill generation facility against my GSTIN is been blocked again by the authorities. What is the reason?

The reasons for re-blocking the E-Way bill generation facility is either the validity period mentioned in the order (by tax officer) has expired or the taxpayer has not filed GSTR 3B continuously for two tax periods

Q.11 – Is there any way by which my E-Way bill generation facility gets blocked before the expiry of the said validity period?

There is no way by which your E-Way Bill generation facility can be blocked before the expiry of the validity period. Once the said validity period is over or you haven’t filed GSTR 3B for two consecutive tax periods then the E-Way bill system will automatically block the services against your GSTIN

Q.12 – What are the possible statuses of application for which the tax officer issues an online order (acceptance or rejection)?

Mentioned below are the possible statuses of application for which the tax officer issues an online order (acceptance or rejection):

- A. Order Generation Enqueue – When the order is not yet generated by the Tax Official i.e. the status of the application is pending.

- B. Order of Acceptance Issued – When the order is issued by the Tax Officer accepting the request for unblocking the E-Way Bill generation facility against the respective GSTIN.

- C. Order of Rejection Issued – The order is issued by the Tax Official after rejecting the request for unblocking the E-Way Bill generation facility against the respective GSTIN.