An order passed under Section 144 of the Income Tax Act, 1961 (ITA), noting that income tax notices were not sent to the actual address of the assessee has been set aside by the Ahmedabad “A” Bench of Income Tax Appellate Tribunal (ITAT).

A notice on 08.03.2018 under section 142(1) of ITA was issued to Radha Mohan Education, the assessee/appellant, asking for the submission of a true and correct return of income for AY 2017-18.

The taxpayer as per section 142(1) of ITA, was asked to provide the income return as per the set conditions and way cited in Rule 12 of the Income Tax Rules, 1962, by 07.04.2018.

The taxpayer was not able to file the income tax return u/s 139 (by 31.03.2018) and also failed to reply to the notice issued u/s 142(1) of the tax legislature.

It was remarked by the assessing officer that the taxpayer had deposited Rs 4,90,000 in cash in its bank account during the demonetization period (9th November 2016 to 30th December 2016) in old currency.

As of the non-compliance of the taxpayer with the legal notice and failure to file the income return the AO proceeded u/s 144(1)(b) of the statute, resulting in an addition of Rs. 1,34,87,426 as unexplained money under section 69A of ITA.

The taxpayer dissatisfied with the assessment order appealed to the Commissioner of Income Tax (Appeals), who dismissed the appeal. The taxpayer aggrieved again and appealed before ITAT.

The taxpayer’s counsel claimed that the notice was sent to the wrong address in Village Moyad, District Mehsana, instead of the correct address in Village Moyad – 383 120, Tal: Prantij, District Sabarkantha.

Read Also: IT Section 254(2) Only Allows Rectification of Mistakes, Not Recalling or Reviewing Orders

The online notices were not obtained as they were sent to an old email ID which is of a former Trustee, who does not share them. Consequently, the taxpayer cannot adhere to the assessment notices.

The taxpayer trust filed a physical plea to the CIT(A), but it was not able to do so online because of the absence of a password and login ID.

Also Read: Cuttack ITAT Remands Case to CIT(A) for Reassessment of Non-Compliance and Evaluation of Evidence

The notices were obtained on the email of one of the sons of the trustee, however, he was accidentally unable to notify his father, who is the trustee of the taxpayer trust.

Afterwards, the taxpayer urged that the case be remanded back to the AO, as additional proof has been furnished that is required to be regarded on its merit. Contrary to that the counsel for the revenue sustained the assessment order and the decision of the CIT(A).

Post acknowledging the submissions and analyzing the available records the bench of Ms Suchitra Kamble and Mr Narendra Prasad Sinha remarked that it was proof that the reasons furnished via the taxpayer trust via its Chairman for not appearing before the Assessing Officer and CIT(A) and for not submitting the mandated documents, are genuine.

The tribunal discovered it suitable to remand the case back to the Assessing Officer (AO) for a thorough adjudication, and verification of the documents submitted by the taxpayer as additional evidence.

It was concluded that the taxpayer must be granted a chance for a hearing following the principles of natural justice. Therefore the grand raised via the taxpayer was permitted.

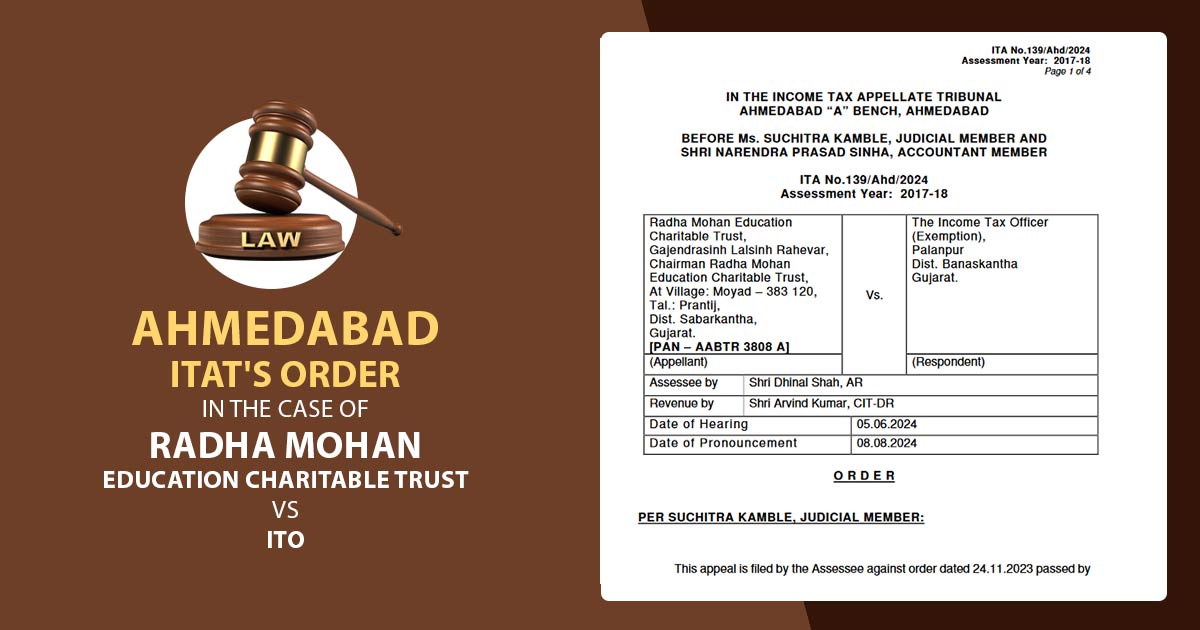

| Case Title | Radha Mohan Education Charitable Trust Vs ITO |

| Citation | ITA No.139/Ahd/2024 |

| Date | 08.08.2024 |

| Assessee by | Shri Dhinal Shah, AR |

| Respondent by | Shri Arvind Kumar, CIT-DR |

| Ahmedabad ITAT | Read Order |