The Hyderabad bench of the Income Tax Appellate Tribunal ( ITAT ) remanded the case to the Assessing Officer ( AO ) post remarking that the Income Tax Authorities were unable to discuss the difference in sundry creditors before confirming the addition u/s 41(1) Income Tax Act, 1961.

The taxpayer Jonna Iron Mart is a partnership firm that is in the business of trading in iron and steel, furnished its income tax return for the A.Y 2017-18 declaring a total income of Rs.31,98,300. The matter was selected for investigation and during assessment proceedings, the Assessing Officer witnessed that under the balance sheet as of 31.3.2017, the taxpayer has shown sundry creditors at Rs.24,58,14,826. The Assessing Officer called the taxpayer to furnish the account copies in the books of accounts of sundry creditors.

The taxpayer provided the account copies in the books of sundry creditors. Post verification, it is observed that in some cases, there is a difference in closing balances in the books of account of the creditors and in the books of account of the taxpayer and hence, the Assessing Officer made the addition of Rs.6,29,194 under section 41(1) of the Income Tax Act as cessation of liabilities.

Taxpayers filed an appeal to the first appellate authority and contested the addition that the Assessing Officer made for the difference in sundry creditors’ balance u/s 41(1) of the Income Tax Act. The first appellate authority posted the appeal for hearing on 5 dates and on some dates, the taxpayer did not respond and on some occasions, the taxpayer has asked for an adjournment.

On 29.1.2024 appeal was posted for a hearing for which the taxpayer filed a letter on 28.1.2024 and asked for the adjournment on the foundation that the Accountant is undergoing treatment. Without acknowledging the taxpayer’s asked adjournment CIT(A) wishes the petition and kept the addition made for the difference in the sundry creditors balance u/s 41(1) of the Income Tax Act.

The taxpayer representative CA, K.A. Sai Prasad, furnished that the related CIT(A) has erred in maintaining the addition incurred for the difference in the sundry creditors balance u/s 41(1) of the Income Tax Act without appreciating that the taxpayer has filed critical attributes of sundry creditors with reconciliation exemplifying the difference.

All the information has been furnished via the taxpayer however the assessing officer incurred the addition u/s 41(1) of the income tax act without appreciating the fact that the provisions of section 41(1) apply exclusively when there is cessation of liabilities for write off of creditors by any one party.

Mr. V.M. Mahidhar, representing the revenue sustained the CIT (A) orders and stated that the taxpayer can not explain the difference in the parties’ accounts with the essential details. However, the taxpayer claimed to have filed the reconciliation explaining the difference, but no proof has been filed that proves that the stated difference is concerned with trade discounts etc. The Assessing Officer (AO) and the CIT (A) after considering the relevant facts have incurred the addition for the difference in sundry creditor’s balances u/s 41(1) of the Income Tax Act.

CIT(A) has disposed of the petition that the taxpayer filed for the non-prosecution via rejecting the petition furnished via the taxpayer for the adjournment, while problems in the appeal were not discussed on merit on the grounds of the material that is available on records.

The council has not been able to regard the problems under the pertinent provisions of the act and opposite to the principles of natural justice, moreover the acknowledged opinion, for fresh consideration, the problems required to proceed back to the file of the assessing officer.

Read Also: Delhi ITAT Deletes Penalty U/S 271C If Not Deducting TDS On Account of Belief U/S 194J

Single member bench of the tribunal Manjunatha G (Accountant member) set aside the order of the CIT (A) restored the issue to the file of the Assessing Officer and asked the Assessing Officer to ascertain the taxpayer claim concerning the evidence that may be filed to explain the difference in certain parties account.

The taxpayer was asked to provide the proof to the assessing officer and explain the difference calculated for the sundry creditors‘ balances in certain accounts with details. Consequently, the taxpayers filed petition was permitted.

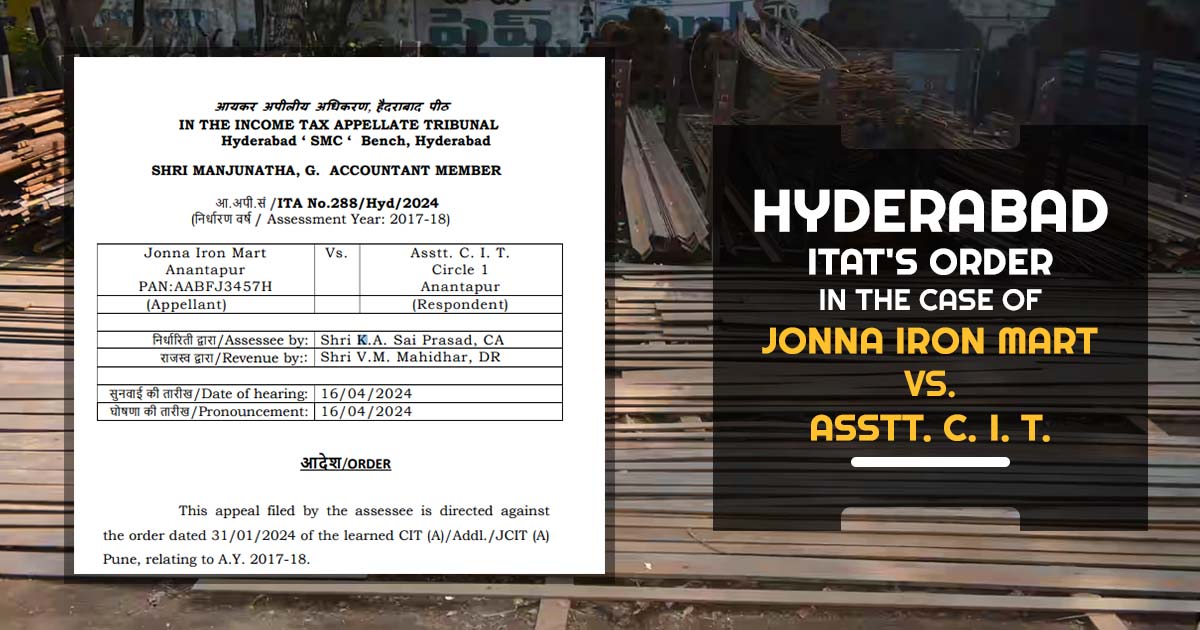

| Case Title | Jonna Iron Mart Vs. Asstt. C. I. T |

| Citation | ITA No.288/Hyd/2024 |

| Date | 16.04.2024 |

| Assessee by | Shri K.A. Sai Prasad, CA |

| Revenue by | Shri V.M. Mahidhar, DR |

| Hyderabad ITAT | Read Order |