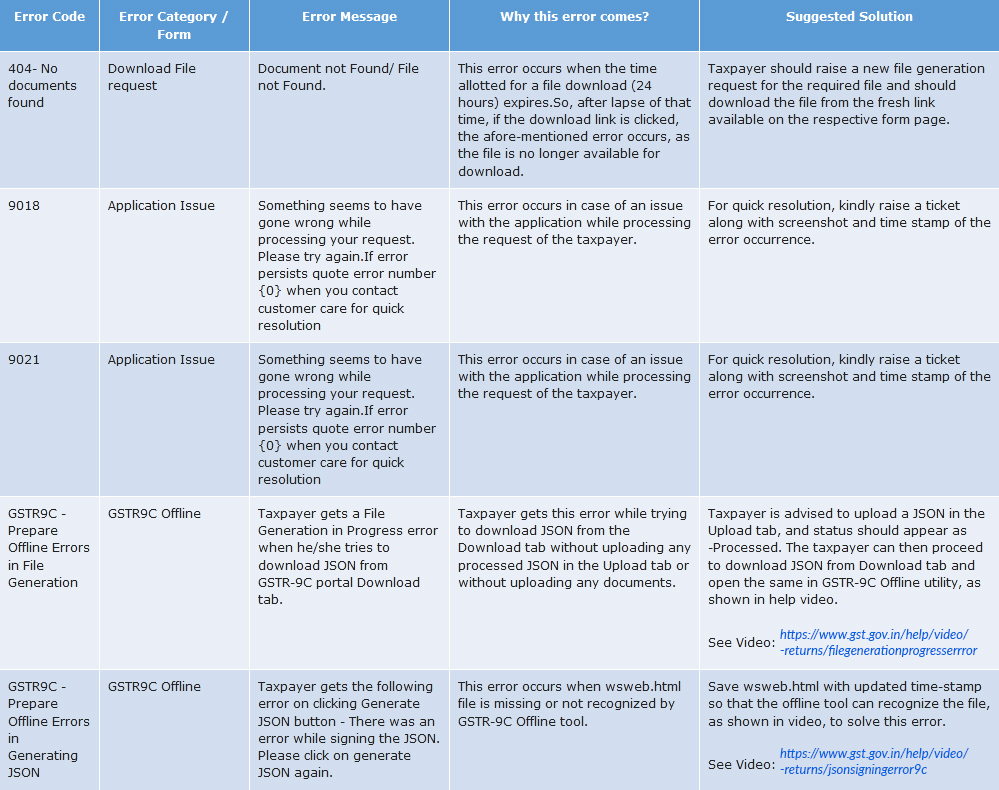

There are several errors in the GST portal which can be noticed while working these are error in downloading the file it occurs when the time allotted of 24 hrs gets expired, application issue which occurs while processing the application by the taxpayer, some other application related issues is to be seen is the invalid order number, etc these can be removed such as for file downloading error the solution is to raise an appeal for new file generation which is download from fresh link, for the application issue raise a ticket with a screenshot, timestamp of the error occurrence.

Solutions for GST Refund Common Errors

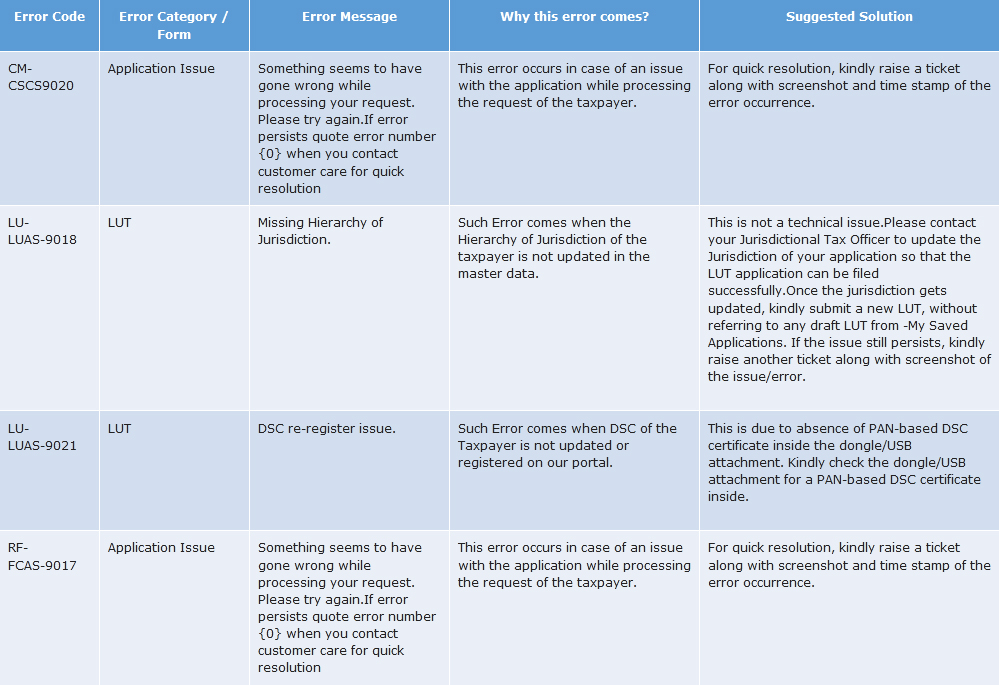

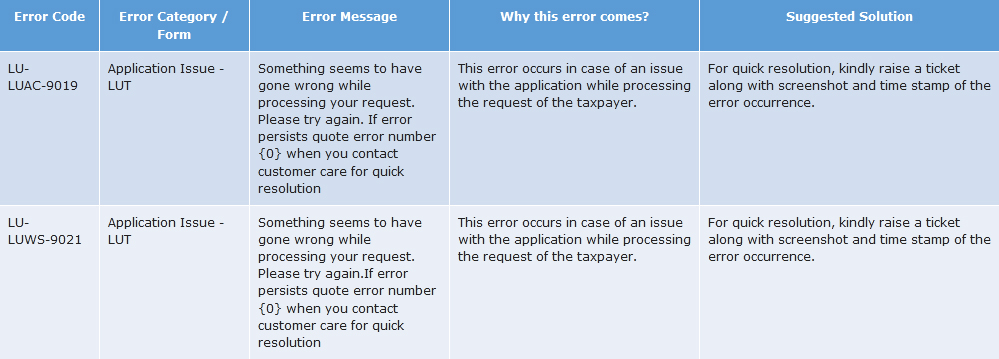

In the refund section, there are several errors and solutions to it. One of the errors is the application issue which shows that something is wrong during the process of GST refund application, it arises on issuing the application in the process of the request of the taxpayers. For this, the solution is to raise a ticket and a screenshot along with the timestamp of the error. Another one is LUT error which gives a message of the missing hierarchy of jurisdiction, this comes when the taxpayer is not updated with the hierarchy of Jurisdiction

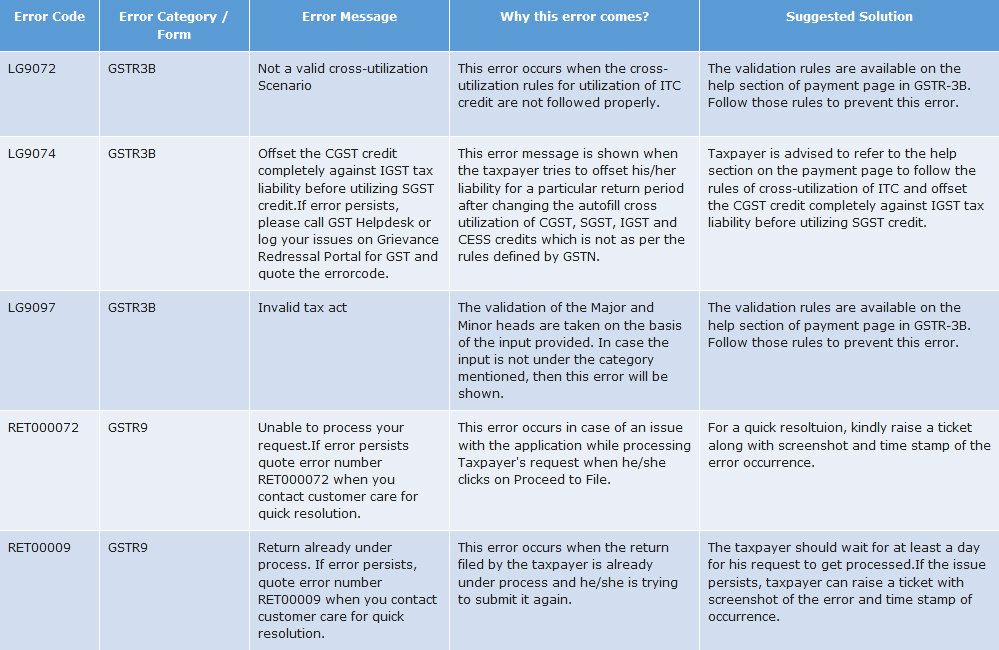

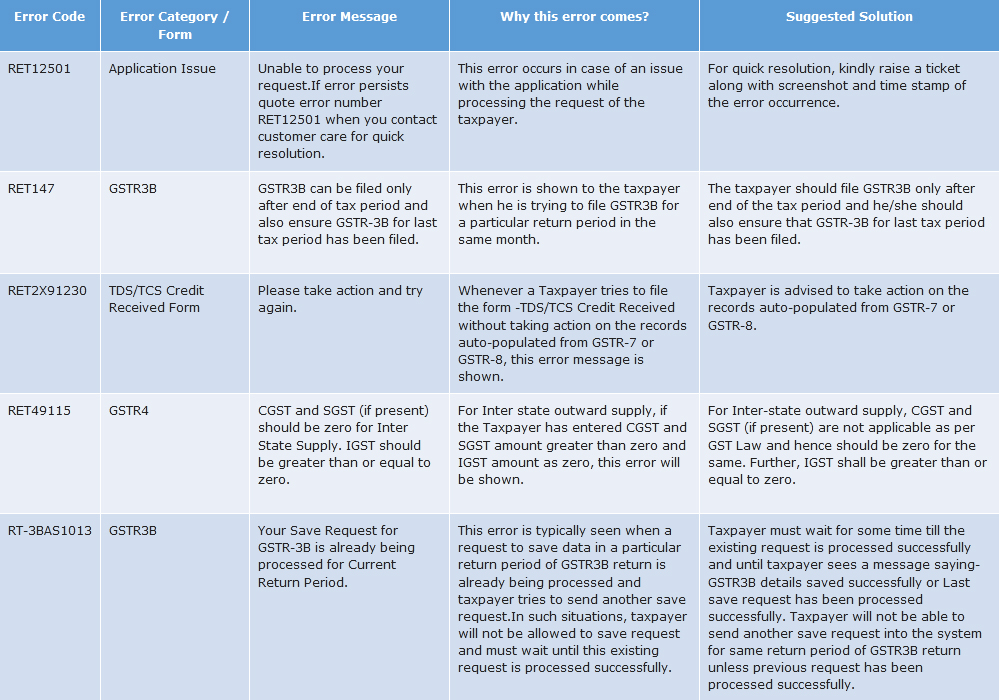

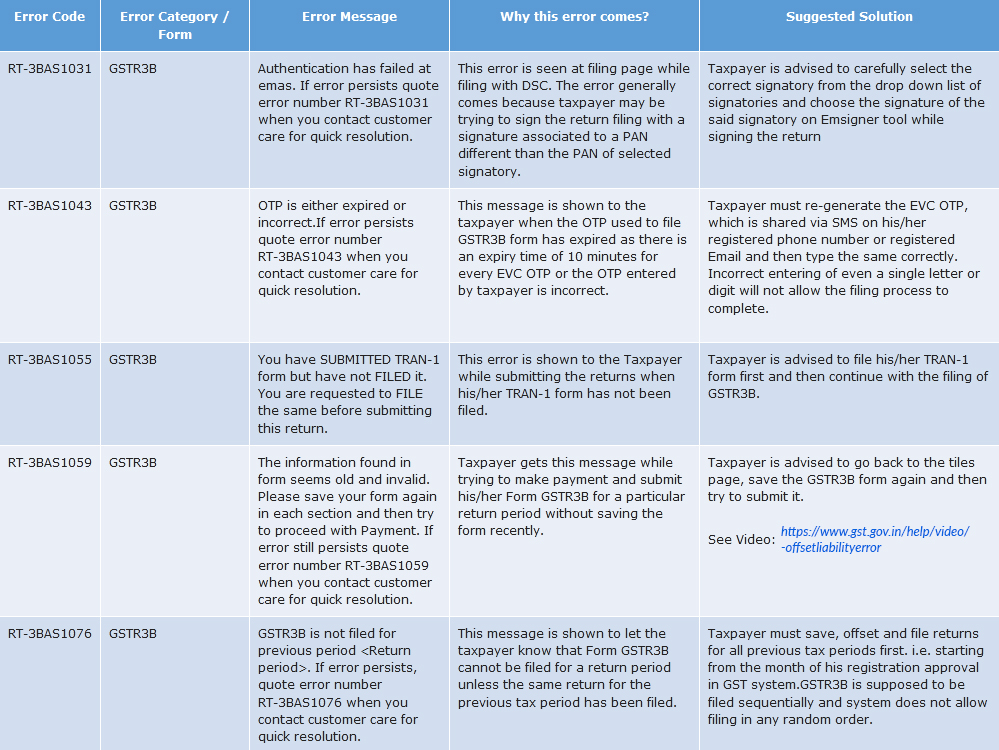

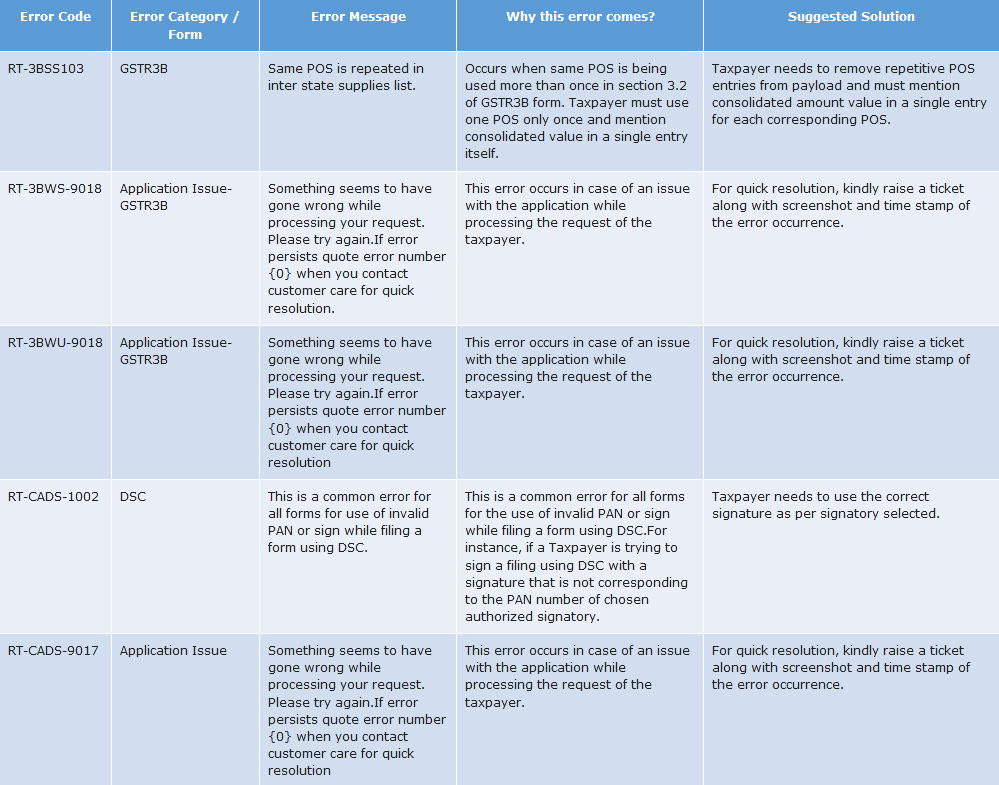

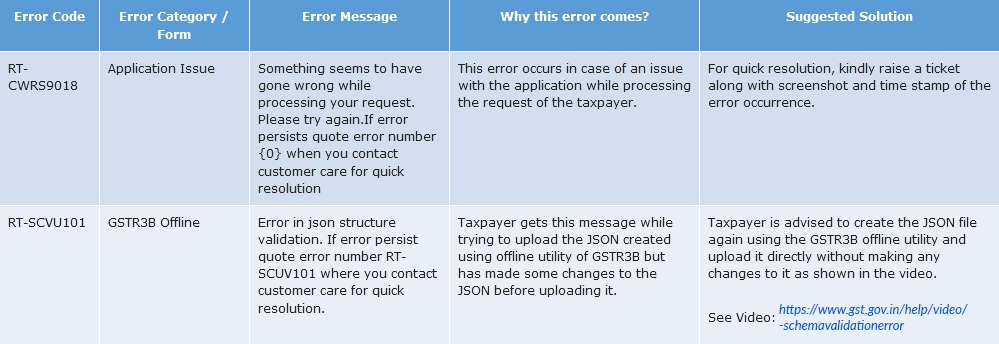

Common Errors & Solutions Related to GST Returns

In this division, the error can be stated as a download file request by showing the message document not found, this message comes because the time expired to download a file is 24 hours. To solve it the assessee needs to raise the new file generation request from the fresh link. Another error found is in the Progress error when he/she tries to download JSON from the GSTR-9C portal Download tab this arises due to JSON from the Download tab without uploading any processed JSON in the Upload tab or without uploading any documents. The solution to it is to upload a JSON in the Upload tab, and status appears as in process. The assessee can then proceed to download JSON from the Download tab and open it in the GSTR-9C Offline service.

GST Registration Common Errors with Solutions

In this section the application issue LUT error occurs, it is due to the case of the issue within the application during the process of request applied by the assessee. The solution to this is to raise the ticket with a screenshot and the timestamp of the error occurred. Another error is of the same type which has a similar solution as explained for the LUT error. The only difference is the error code which is distinct to the first one.

Read Also: Solved! GSTR 9C Technical Errors While Uploading on Portal

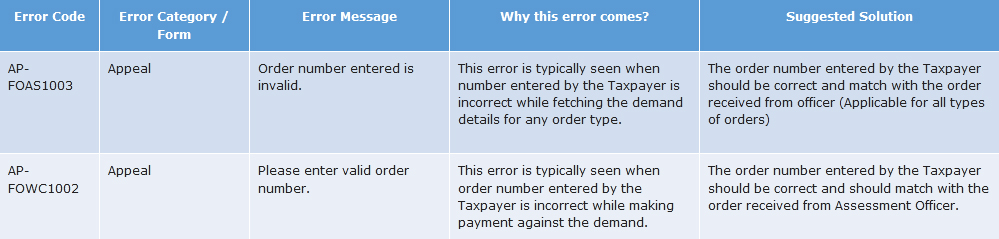

Solutions of Errors for GST Appeal

In the appeal section, the error states that the entered order number is invalid this is due to the number entered by the Taxpayer is incorrect while fetching the demand details for any order type. The solution to this problem is the amount subscribed by the Taxpayer should be correct and suit with the order obtained by the officer. Another type of error is the message that shows please enter a valid order quantity, this is usually seen when an incorrect order number is entered. The solution to the problem is the order number entered by the taxpayer must be correct and should be relevant to the order which is received by the assistant officer.

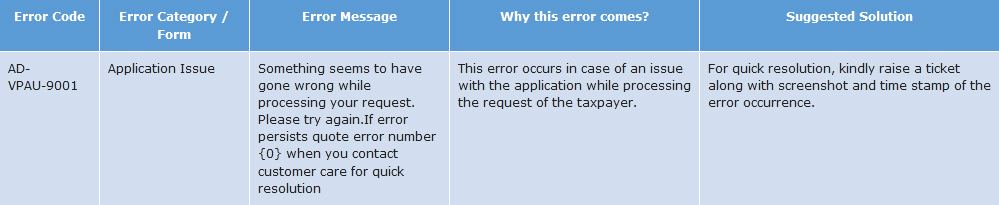

Solutions for GST Advance Ruling Common Errors

The advance ruling consists of only one type of error which shows on the GST portal. The error of application issue, the screen shows the message something seems to have gone wrong while processing your request. Please try again. If the error continuously shows error number when you contact customer care for quick resolution, this error comes due to the application facing the problem during the process of the request by the assessee. The solution to the problem is the taxpayer needs to raise the ticket along with the screenshot, also the timestamp of the error occurred.

I am unlade the GSRT REFUND : GST RFD-01

Exports of Goods/Services – without Payment of Tax (accumulated ITC) (Excluding Electricity), Now after the all attachment etc, : Error shows : Error : The sum of IGST, CGST and SGST entered should be lesser than or equal to ₹0.

error undefined in gst refund application

Error : The return period in uploaded JSON file does not match the return period for which Refund application is created..

This msg has been shown on the portal at the time of filing RFD 01 FOR THE REFUND OF ITC ON EXPORT OF GOODS

Please check the return period, as the error is related to Return period itself

Any solution of RED-01 gst error “The return period in uploaded JSON file does not match the return period for which Refund application is created”

Is this resolved?

We are also facing this issue / error since starting of june month, we had raised complaint / ticket in gst portal but till today couldn’t resolved this issue by the GST Grievance cell.

if you find any resolution reagrding this than please intimate me also.

the same error, even though the period is correct

GST REFUND APPLICATION …

Error : The return period in uploaded JSON file does not match the return period for which Refund application is created..

I am getting the same error, even though the period is correct

Is this query resolved ??

GST RETURN EXTED DUE Date for Jun 20, July 20, & August 20 inform immediately

Please specify the GST Return Form First