On Friday (May 17) the Supreme Court kept a rule issued by the Institute of Chartered Accountants Of India (ICAA) restricting Chartered Accountants from accepting more than the “specified number of tax audit assignments” (at present, the upper limit is set at 60) in a fiscal year.

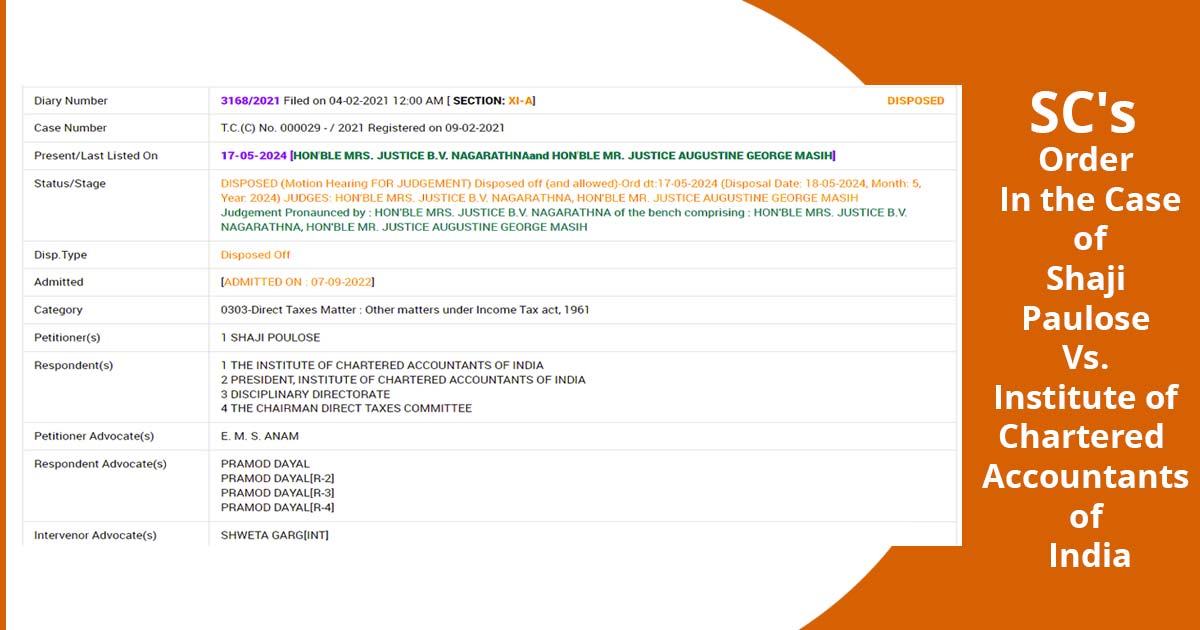

A bench of Justices BV Nagarathna and Augustine George Masih ruled that the rule (para 6.0 of Chapter VI of the Council Guidelines No. 1-CA(7)/02/2008 dt. 08/08/2008 and the subsequent amendments) are not in breach of the fundamental right to practise profession guaranteed under Article 19(1)(g) of the Constitution.

The court ruled that the clause shall be regarded to come into force from 01.04.2024 and quashed the disciplinary proceedings initiated against the members for violation of the clause.

The bench stated that we quashed the disciplinary proceedings begun against the petitioners based on the doctrine of legal uncertainty.

The court ruled that ICAI shall be free to increase the number of audits that a CA could perform.

The bench in a ruling makes specific remarkable observations for the ICAI role-

“ICAI has, over time, received recognition as a premier accounting body domestically and globally for maintaining the highest standards…the ICAI has also played a significant role in ensuring the dynamism of the CA course and the credibility of the examination. We commend that the ICAI must be committed towards the convergence of accounting and ethical standards with international standards…the true test, however, lies in enforcing these standards” the Court remarked.

Read Also: ICAI Notifies CAs for Withdrawing Facility of 15CB Form on Portal

The bench quoted the conclusions of the judgment that are:

- Clause 6 of Chapter 6 and the following amendment does not breach Article 19 (1)(g) and is a reasonable restriction.

- The same clause is considered to be effective from 1.04.2024. Therefore, all proceedings initiated stand quashed.

- Privilege is reserved for the respondent institute to increase the number of audits that a CA can perform

Background

In 1984 the obligatory tax audit regime was introduced by the insertion of Section 44AB in the Income-tax Act, 1961, which came into force from 1st April 1985. The same section for a person made it mandatory who operates a business or a profession with total sales, turnover, or gross receipts surpassing a certain threshold stated in the Act in any previous year, to get their accounts of such previous year audited via a Chartered Accountant. Under this section, the condition stated is satisfied merely when these taxpayers receive an audit report in the specified form duly signed and verified by the Chartered Accountant before a specified date.

Merely the accounts maintained by companies and cooperative societies needed to be audited under the Companies Act, 1956 and the Co-operative Societies Act, 1912 respectively, before 1985. Taxpayers under the other categories were waived from this liability to get their accounts audited. Section 44AB was legislated to oppose tax evasion and check fraudulent practices.

In 1988, in the practice of the administrations granted under Clause (ii) of Part II of the Second Schedule to the Chartered Accountants Act, 1949, a notification was issued by the Council of the Institute of Chartered Accountants of India restricting members from accepting more than the defined number of tax audit assignments u/s 44AB of the Income-tax Act in a fiscal year.

Concerning the case of a Chartered Accountant firm, this limitation would be applicable to each partner. In the notification categorically it cited that non-compliance with the stated provision shall result in the delinquent member being held guilty of ‘professional misconduct’. The Parliament, in 2006 revised the Chartered Accountants Act, 1949 after which the impugned notification was replaced by Guidelines issued dated August 8, 2008.

In numerous writ petitions, such guidelines were contested that have been filed in different High Courts across India. In certain petitions, disciplinary proceedings initiated based on the impugned guidelines have also been contested. Since conflicting decisions have been rendered on the matter, in 2020, the Supreme Court accepted an application driven by the Institute to transfer all the petitions to itself for a final and conclusive determination of the issues involved.

Arguments Summary

The major basis for questioning the validity of the impugned stipulation was that the same violated the fundamental right of citizens to practice any profession or to bring on any occupation, trade, or business as consecrated in Article 19(1)(g), apart from also being violative of the right to equality under Article 14. To issue the same guidelines the competence of the institute was in doubt. Among the counsel who represented the applicants was Senior Advocate Paramjit Singh Patwalia.

Senior Advocate Arvind P. Datar represented the institute who prefaced his submissions by proposing a historical summary on the origin of compulsory audit of accounts for a bigger class of taxpayers under the Income-tax Act, 1961.