Under section 115BAC of the Income-tax Act, 1961, the concessional/New Tax Regime (NTR), which was introduced in the Union Budget 2020, gives individuals and HUF taxpayers the opportunity to pay income tax at reduced rates in exchange for giving up some exemptions and deductions. The NTR was developed to streamline the filing of income tax returns and to decrease the amount of supporting evidence needed to claim exemptions and deductions.

Salary people under the NTR are required to give up exemptions such as the House Rent Allowance, Leave Travel Allowance, and deductions for specified investments and costs that would otherwise be available under the current or previous tax regime (OTR).

Latest Updates

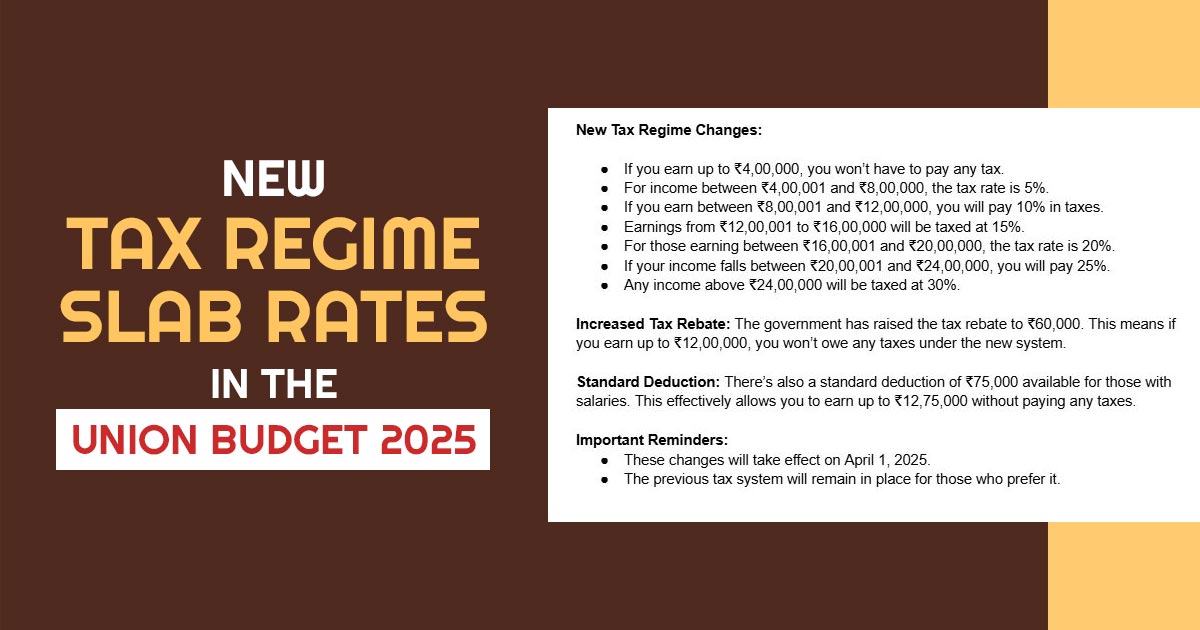

- New Tax Regime Slab Rates in the Union Budget 2025: The FM announced the Budget 2025 with changes to some slab rates in the new tax regime. Let’s look at these changes

New Income Tax Regime (NTR) vs Old Tax Regime (OTR)

Even if the NTR offers lower tax rates with a variety of income slabs, the OTR appears to be more well-liked, especially among taxpayers who earn a salary. The NTR is less desirable than the OTR for the following reasons:

- Under both the OTR and NTR, taxable income over Rs 15,00,000 is subject to a 30% tax rate.

- Unlike the OTR, the NTR does not allow deductions for contributions to long-term investments and retirement savings plans (such as provident fund contributions, insurance premiums, etc.). In general, these investments yield higher returns.

- The NTR does not allow for a deduction for the repayment of the interest and principal components of a housing loan when the property is self-occupied.

- Salaried taxpayers may feel the pain harder because the following exemptions and deductions are not permitted under the NTR:

- Rental expenses are not deducted from the House Rent Allowance

- Exemption from the Leave Travel Allowance/Assistance for travel expenses

- Standard deduction up to a maximum of Rs 50,000

- A deduction for employment taxes or professional taxes up to a maximum of 2,500

- The following example will help you understand.

| Particulars | Case A | Case B | ||

|---|---|---|---|---|

| OTR | NTR | OTR | NTR | |

| Salary Income | 8,00,000 | 8,00,000 | 12,00,000 | 12,00,000 |

| Less: Standard deduction | (50,000) | -75000 | (50,000) | -75000 |

| Taxable salary income | 7,50,000 | 7,25,000 | 11,50,000 | 11,25,000 |

| Less: Interest on housing loan self-occupied property (being set off) | (200,000) | – | (200,000) | – |

| Gross taxable income | 5,50,000 | 7,25,000 | 9,50,000 | 11,25,000 |

| Less: Deduction u/s 80C (for provident Fund, Insurance premiums etc.) | (1,50,000) | – | (1,50,000) | – |

| Net taxable income | 4,00,000 | 7,25,000 | 8,00,000 | 11,25,000 |

| Income-tax (Before health and education cess) | 7,500 | 22,500 | 72,500 | 68,750 |

| Less: Rebate u/s 87A | 7,500 | – | – | – |

| Net Income-tax (Before health and education cess) | – | 22,500 | 72,500 | 68,750 |

| Additional tax outgo if opted for NTR | 22,500 | Benefit of Rs 3,750 in NTR | ||

For salaried taxpayers with income from a business or profession, the choice is only accessible once and cannot be changed again. Taxpayers without such income can choose the NTR each year.

NTR may be advantageous for taxpayers who have little investment or fall into a low-income category. This may also be advantageous for people who want a straightforward tax filing procedure without having to worry about remembering the deductions and exemptions they need to claim.

However, despite reduced tax rates, the NTR seems to have a greater comparative tax outlay, which makes it appear less advantageous for taxpayers.

Given the rise in personal spending, a fair and tax-effective single tax system is the call of the day. These issues should be addressed in the next Union Budget 2024, which should also overhaul the New Tax Regime (NTR) or institute a more straightforward single tax system.

Important FAQs About the New Income Tax Regime for Salaried

Here are some of the leading and important FAQs based on the topic by Sudhakar Sethuraman, Deloitte India and as per his tax expertise we will go through these 4 questions based on the income tax new regime.

Q1. What income level would you suppose if the income level is favourable to choose the new tax regime over the old, based on a few appropriate deductions?

- At first glance, it appears that the new tax regime will be preferable to the previous one if someone expects to earn a salary of up to Rs 7,75,000. Any amount above this may require further investigation into the individual’s income structure and any other possible deductions or exemptions.

- An examination of costs and benefits could be necessary. This Budget has proposed to increase the threshold for tax triggers for persons selecting for new tax regimes and prolong standard deduction for those opting for new tax regimes in the form of a refund of up to 7,00,000. This is the reason for the nod up to Rs 7,75,000.

- One can claim a refund for up to Rs 7,00,000 if they earn Rs 7,75,000, of which Rs 75,000 would be excluded through the standard deduction. So, there won’t be any tax burden up to that point, and the new tax system will undoubtedly have a big benefit over the previous one. If income rises over this threshold, as I previously stated, it may be necessary to examine how the income is structured and how total deductions are claimed by a person at that level of income to determine whether the new or the old regime will be more advantageous.

Q2. Convenience is the main justification for switching from the old tax system to the new tax system. So, in your opinion, is this mostly a convenience, or is there some resistance because those who wish to invest and save in these programs suffer as a result? They’re being talked out of making those investments, right?

- Change is never easy. When you look at history and how these tax incentives have changed, you can see that they were first implemented when our economy’s per capita income, GDP, and needs were all very different. There was a considerable disparity.

- People were encouraged to invest and create bank accounts. There was a period when there were incentives for making investments and subsequently receiving a tax break. Now, we have reached a point where income levels have fairly grown, as has per capita income. This is reflected in the Gross Domestic Product (GDP) and the employment aspect.

- What is needed now is to figure out how to make it easier. The amount of time employers must commit to validating an HRA claim filed by an individual is significant. Document verification takes a long time for business procedures, especially in the latter one or two months of the fiscal year, such as February and March.

- Given all of this, it is best to accept the shift and then look at it more favourably from an investing standpoint. Taxation should not be used to encourage investment. Taxation can only follow the company. Furthermore, if the business is about investment, the tax will inevitably follow. It cannot operate before the funding. That should be the intention here. That could take a few years. The government is looking into ways to reduce the compliance load on companies. When you remove all of these documentation-based deductions and exemptions, it will undoubtedly simplify tax compliance. That is a beneficial shift that we may have to accept.

Q3. You said that it would simplify things for the common assessee. Do you anticipate a very immediate increase in the tax base as a result of this? How big of an impact will it have on the exchequer?

- The exchequer, in my opinion, did a good job of balancing things out. The Honourable Finance Minister made mention of a loss to the exchequer in his Budget address due to the modification of the slab rates up to Rs 7 lakh. The exchequer has suffered a revenue loss as a result of expanding the standard deduction and the refund up to Rs 7 lakh. Nevertheless, they have also included a counterbalance by limiting the exemptions provided by Sections 54 and 54F to Rs 10 crore.

- The second option is insurance contracts signed after April 1, 2023. There would be a tax impact if the total premium paid for such insurance exceeds Rs. 5 lakhs. The government has already provided a tax advantage for the new individual tax system, and it will make up for it by eliminating some of these already granted exemptions. An illustration would be advantages relating to insurance that exceed Rs 5 lakh by capping 54 and 54F deductions. So, the government is attempting to recover it using these methods.

- In the minister’s statement on finances, it is mentioned that the government will suffer a loss of Rs 37,000 crore as a result of the new tax system and the extension of tax advantages. But, if you take into account the tax recoupment that the government would carry out about the other channels, it may be a win-win situation for all parties. That’s how I’d look at it.

Q4. When the new tax system is completely implemented, is it possible that some deductions will be allowed? Is there any truth to the claim? How strongly do you think the evidence is for it?

- Nowadays, the government may find a middle ground between some of the conventional deductions, the new tax system, and doing away with paperwork by using the media, which is a middle path in this overall strategy. That is finished. There is a chance.

- Using technology to your advantage will be a key facilitator for this. Technology will play a significant enabling role in this. Presently, Form 26 AS is available for viewing. To obtain Form 16 and certificates to determine the interest and taxes, we do not need to visit the bank. You can only determine how much tax the banker has discovered by sitting at your home and looking at Form 26AS. The government may consider extending some advantages, such as insurance or some benefits, such as provident fund contributions or 80C-related deductions towards PPF, if the UAN keeps track of the PAN number becoming required on transactions.

- KYC is a requirement for all banks. Because of this, these items may be monitored with the help of the person’s PAN number, and they can be reported in the 26 AS. These advantages may appear when the department uploads the online tax return to the tax portal. There is no requirement to provide a copy of the PPF statement or the insurance receipt to make this claim. The PAN number of the person may be used to trace all of these items as soon as the transaction occurs. So that they may at least consider addressing the population’s expectations or requirements to some level throughout the transitional phase, perhaps they might look into it via a medium like this.

- Yet one essential idea must be kept in mind: should tax incentives drive investments, or should it be the other way around? That needs to be absolutely obvious. In my opinion, the economy today has advanced significantly from its previous state.

- Given this, in an ideal world, investments should be the ones driving the show rather than accents, and you want a specific investment to enable or permit individuals to claim the discounts. Hence, the quick answer to your query is that, yes, it is technically conceivable. The PAN number may be used to track a person’s PPF or insurance contributions, which can then be deducted directly from taxes owed by the individual using Form 26AS. It is certainly conceivable as well. They might need to consider how the media can be used in this situation.