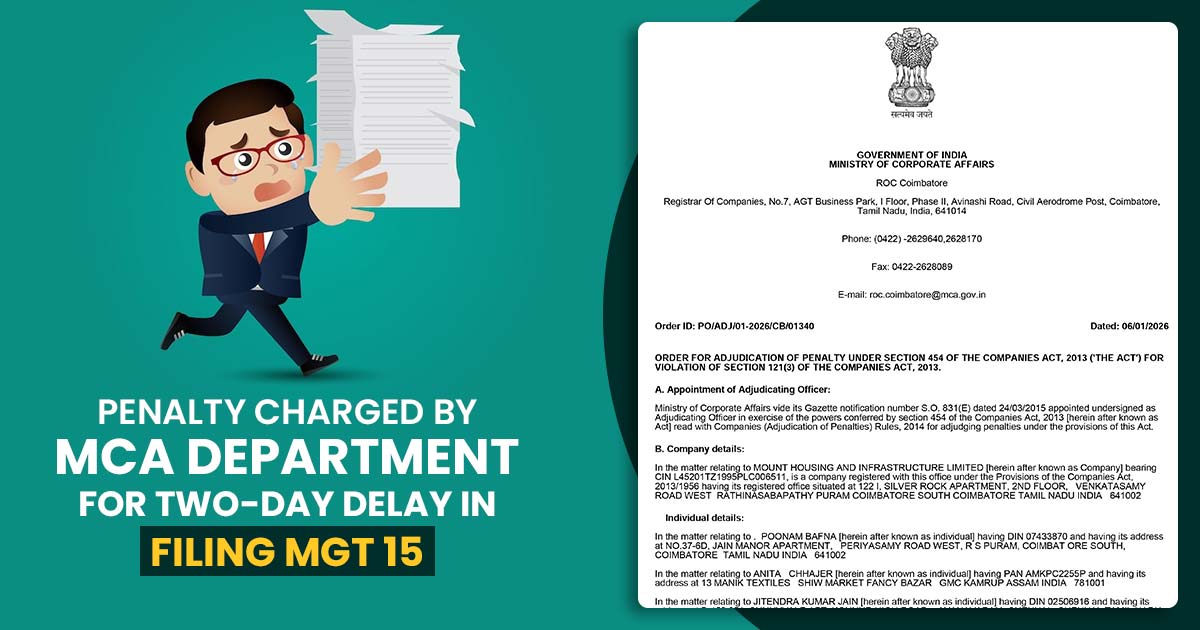

The Registrar of Companies (ROC) in Coimbatore has imposed a tax penalty of INR 1,02,000 on Ambika Cotton Mills Limited. Additionally, an aggregate liability of INR 78,000 has been levied on three of its Key Managerial Personnel (KMPs), with each person paying a penalty of INR 26,000. This action was taken under Section 454 of the Companies Act, 2013, due to a two-day delay in the e-filing of Form MGT-15.

The company provided a representation to the ROC, stating that the delay was due to technical issues on the MCA portal. The company cited that some technical issues frequently occurred on the portal during that period.

When the portal permitted submission, the form was submitted immediately along with the additional fees. Sunday was one of the delayed days, the company noted. Even after such submissions, the order of the ROC does not acknowledge the legal claims of the company.

But the company intends to submit an appeal against the order of the Registrar of Companies (ROC) before the Regional Director, RD Chennai, within the statutory timeframe.

What is Form MGT 15?

MGT 15 Form is a formal statement presented to the Registrar of Companies (ROC) that confirms the valid behaviour of the Annual General Meeting (AGM) of a corporation in compliance with the requirements of the Companies Act, 2013. This statement also ensures that the AGM information has been duly qualified.

The e-filing of Form MGT 15 is the duty of the AGM Chairman. In the absence of the chairman, it should be submitted by two or one director jointly with the Company Secretary (CS). This submission must happen within 30 days following the close of the AGM.

Read Order