Kerala High Court ruled that employees cannot claim income tax exemption without government notification fixing the income limit for earned leave salary.

Balan Panicker Ramesh Kumar, an applicant asked for the guidance of the respondent department to examine the income limit for tax purposes on earned leave salary u/s 10AA(ii) of the Income Tax Act, 1961, with retrospective effect. After 2002, no revision of the income limit for exemption on encashment of earned leave salary under Section 10 (10AA)(ii) of the Income Tax Act is there.

The applicants are retired employees of different public sector undertakings and scheduled banks. Before April 1, 2023, all the applicants retired from service.

The same was mentioned for the cases the court posted referring to section (10AA)(ii) of the Income Tax held that “4. It is the prerogative of the Government to fix the limit of income of encashment of earned leave salary for exemption from payment of income tax. Unless the Government issues the notification fixing the limit of income for earned leave salary, an employee cannot claim exemption from payment of income tax on encashment of earned leave up to 300 days.

The last notification was issued on 31.05.2002, and the Government did not thereafter issue a notification despite there having been three pay revisions. The latest notification is only in 2023, wherein the upper limit has been fixed as Rs.25 lakhs, taking the highest salary of the cabinet secretary, i.e., Rs.2.5 lakhs per month.”

The last notification was issued on May 31, 2002, and the government did not issue a notification after that despite there having been three pay revisions. The updated notification is only in 2023, after which the upper limit has been fixed at Rs. 25 lakhs, taking the highest salary of the cabinet secretary, i.e., Rs. 2.5 lakhs per month, a single bench of Justice Murali Purushothaman noted.

Read Also: Patna HC: Govt & Private Employees Can’t Entitled Same Rules for Leave Encashment Exemption

The writ petition has been disposed of by the court with liberty to the applicants to approach the government for the reliefs asked and the government may decide upon their representations.

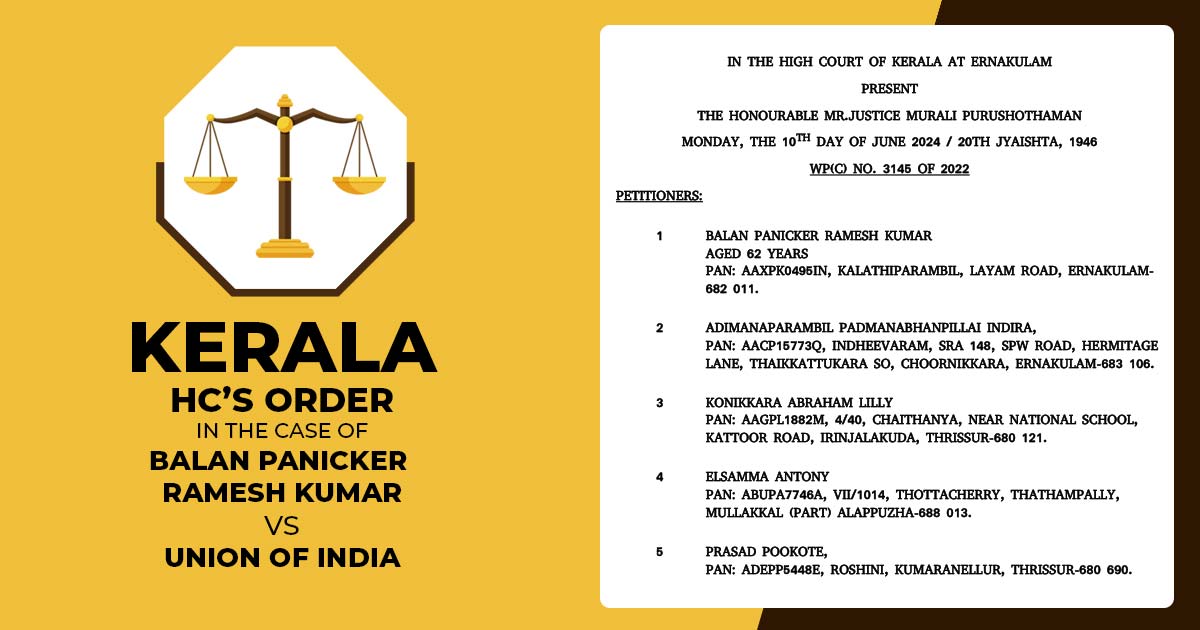

| Case Title | Balan Panicker Ramesh Kumar Vs. Union of India |

| Case No. | WP(C) NO. 3145 OF 2022 |

| Date | 10.06.2024 |

| Petitioners by | Kevin Varghese Jacob |

| Respondents by | Premsankar R, T.C. Krishna |

| Kerala High Court | Read Order |