The applicant, Bangalore Thulaseedas Srinath contested several notices and orders issued to the applicant, including those u/s 148A(b), 148A(d), 148, 147 r/w 144 and 144B and pertinent penalty notices u/s 274 read with Sections 272A(1)(d), 270A and 271B.

It was furnished by the applicant that the income tax notice issued u/s 148A(b) of the Act was issued dated 11.03.2024 and was asked to respond on 15.03.2023, which period is less than the time stipulated u/s 148A(b).

It was claimed that such a due date does not follow the legal need of furnishing at least 7 days for a reply as cited in Section 148A(b) of the Act. The same section obligated that the taxpayer should be furnished a minimum of 7 days to answer to notice before the issuance of a notice under section 148.

The Section 148A(b) of the Income Tax Act reads as follows:-

148A. The Assessing Officer shall, before issuing any notice under section 148.-

(A) xxx

(B) Furnishes a chance of being heard to the taxpayer via serving on him a notice to show cause within that time, as might be cited in the notice, being not less than 7 days and however not more than 30 days from the date on which this notice is issued or such time, as might get extended by him based on the applicant in this regard, as to why a notice u/s 148 must not get furnished on the grounds of the data which recommends that the income levied to tax has not undergone assessment for the pertinent assessment year and consequences of the inquiry performed, if any, as per the clause, (a);

With the contention of the applicant Justice S. Suni Dutt Yadav agreed showing that the insufficient answer breaches the norms of natural justice and caused prejudice. The court has declared the notices issued Under Section 148A(b) and the forthcoming orders and the penalty notices to be not valid.

Subsequently, the notices along with the orders in question were being set aside, with the court allowing the Revenue the freedom to issue the new notices and take precise measures within the law.

Read Also:- Steps to Verify an Income Tax Notice Using DIN with Benefits

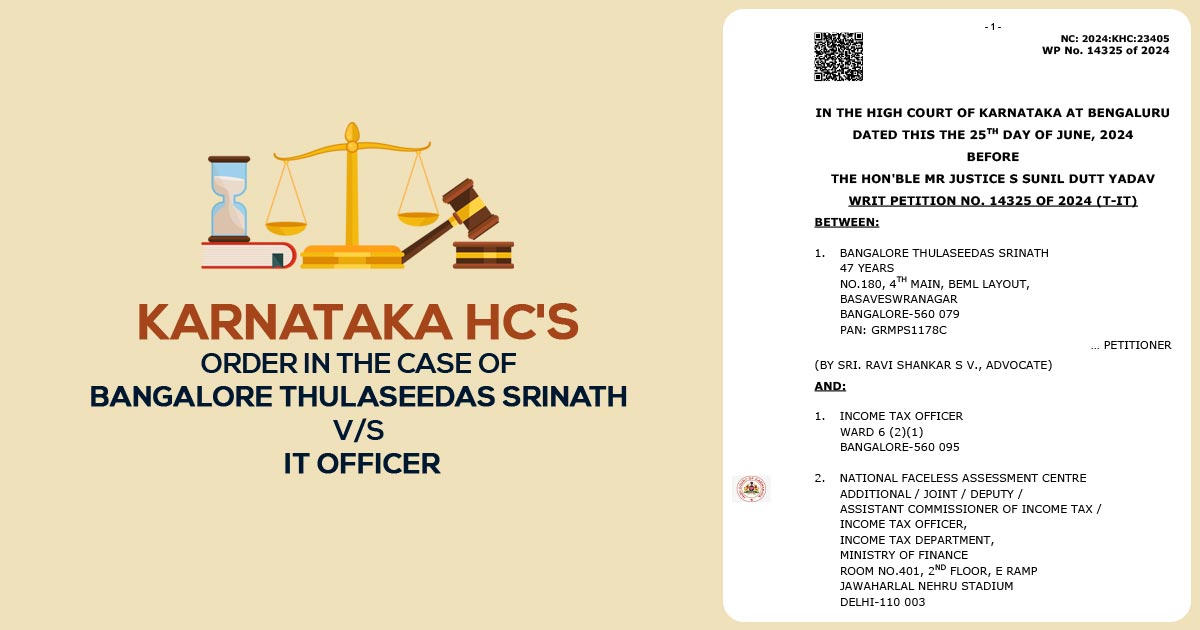

| Case Title | Bangalore Thulaseedas Srinath V/S IT Officer |

| Citation | WP No. 14325 of 2024 |

| Date | 25. June.2024 |

| Counsel For Appellant | SRI. RAVI SHANKAR S V., ADVOCATE |

| Counsel For Respondent | SRI. M. DILIP., JUNIOR STANDING COUNSEL |

| Karnataka High Court | Read Order |