The penalty u/s 271(1) (c) of the Income Tax Act, 1961 is deleted by the Delhi bench of the Income Tax Appellate Tribunal ( ITAT ) concluding there was no providing of incorrect particulars of income or a deliberate attempt to conceal the income.

The present appeal has emerged on the fact that the assessee- revenue Deputy Commissioner of Income Tax had e-filed its income tax return on 30.11.2016, declaring a total income of Rs. 14,22,64,180.

For scrutiny assessment, the matter was chosen and the assessment u/s 143(3) of the Income Tax Act was framed dated 22.12.2018 at Rs. 16,14,72,606 by making disallowance of Rs. 15,21,372/- by invoking the provision of section 40(a)(i) of the Act; disallowance u/s 35(2) of the Act at Rs. 1,76,87,054/- and relief claimed u/s 90 of the Act of Rs. 24,37,344/- was confined to NIL.

A penalty proceeding has been initiated by the Assessing Officer (AO) under section 271(1)(c) of the Act and vide order on 28.06.2019, levied a penalty for the disallowance of Rs. 1,76,87,054/- for furnishing inaccurate income particulars. Therefore, a Rs. 60,11,830 penalty has been levied by AO.

The same was a revenue appeal filed against the order passed by CIT(A) on 21.11.2019, whereby CIT(A) deleted the penalty of Rs. 60,11,830 charged by A.O. u/s 271(1)(c) of the Income Tax Act, 1961. On the disallowance of deduction claimed by the taxpayer u/s 35(2AB) of the Income Tax Act, the penalty was levied.

Therefore under Section 143(3) of the Income Tax Act, AO vide order 22.12.2018 has permitted the total research and development expenditure of Rs. 4.41 crores. But, because of DSIR approval, he restricted the additional deduction u/s 35(2AB) concerning the expenditure to Rs. 2,64,52,000.

Bench revealed that all the information provided via the taxpayer in its return is determined to be correct and no question was there of inviting the penalty u/s 271(1)(c). Just because of making a claim that was not sustainable in law, by itself, shall not be liable for providing the wrong facts for the taxpayer income. The same claim made in the return could not be liable for providing the wrong particulars.

The two-member bench of the tribunal M. Balaganesh (Accountant member) and Kul Bharat (Judicial member) remarked that the appellant had explained, that there was no providing of incorrect income particulars or a deliberate attempt to conceal income. The stringencies of the provisions of section 271(1)(c) are not attracted in this matter.

For the same the opinion that u/s 271(1)(c) of the Income Tax Act the penalty charged of Rs.60,11,830/- was deleted. The petition grounds are in the favour of the appellant. The petition for the revenue was dismissed, consequently.

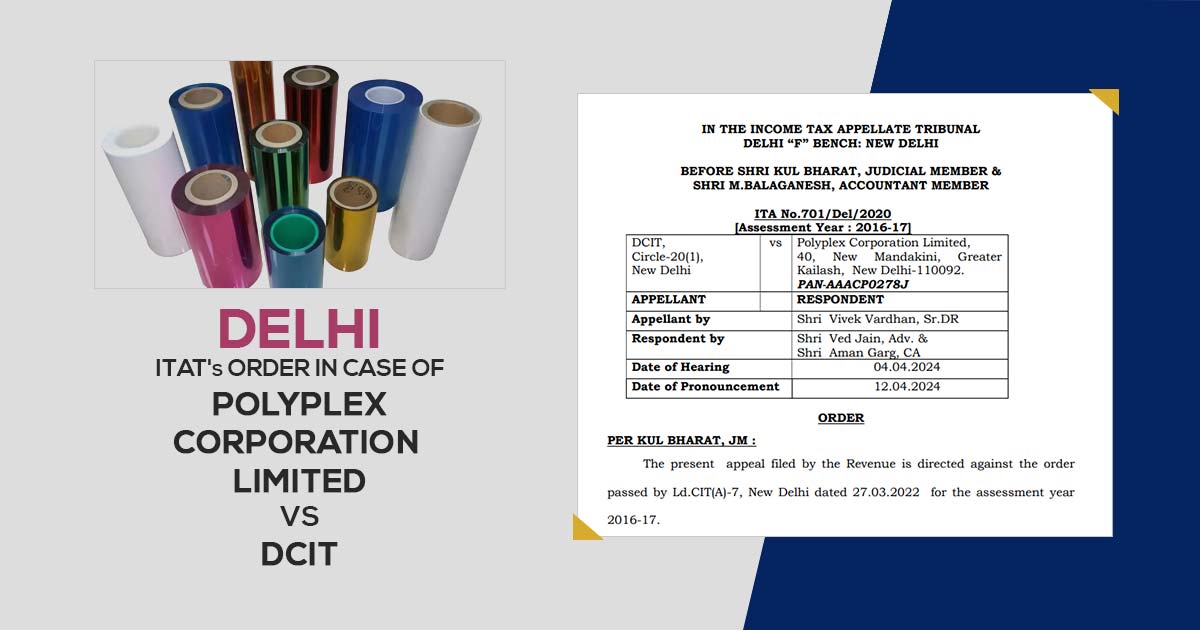

| Case Title | Polyplex Corporation Limited Vs DCIT |

| Case No | ITA No.701/Del/2020 |

| Date | 12.04.2024 |

| Appellant by | Shri Vivek Vardhan, Sr.DR |

| Respondent by | Shri Ved Jain, Adv. & Shri Aman Garg, CA |

| Delhi ITAT | Read Order |